Private cellular’s growth trajectory signals that IoT connectivity is shifting from best-effort public networks to deterministic, site-specific infrastructure. For vendors, the 6,500 deployments and fragmented supplier base imply an intensifying battle over ecosystems, integration capabilities and vertical specialization rather than just radio performance. Enterprises upgrading from LTE to 5G will force clearer demarcation between private 5G, Wi-Fi 7 and network slicing roles in OT/IT architectures. This momentum underscores a broader trend toward highly programmable, spectrum-aware connectivity layers underpinning industrial IoT at scale.

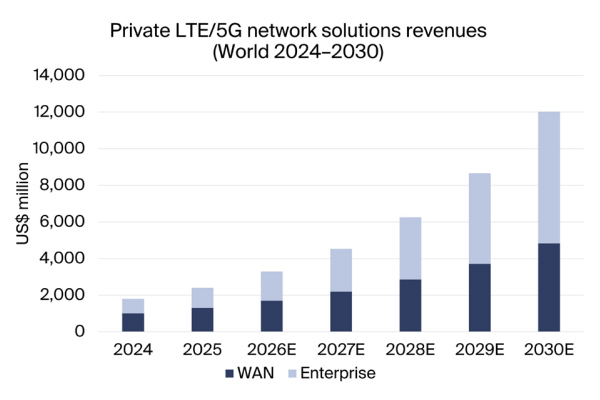

Private LTE/5G network market set to surge to US$12 billion by 2030, driven by enterprise demand and 5G upgrades

According to a new research report from the IoT analyst firm Berg Insight, there were a total of 6,500 private LTE/5G networks deployed across the world at the end of 2025, excluding proof-of-concept (PoC) projects. The market value for private LTE/5G network solutions reached an estimated US$ 2.4 billion in 2025. Berg Insight believes that the market value for private LTE/5G network solutions will grow at a steady pace over the next five years, largely driven by new network deployments. Revenue growth will also be driven by upgrades and expansions of existing networks, as enterprises add new applications and transition from LTE to 5G. Growing at a CAGR of 38 percent, the total market value for private LTE/5G network solutions is forecasted to reach US$ 12.0 billion in 2030.

“The private cellular network market is undergoing a transformation, driven by the increasing availability of dedicated spectrum, evolving device ecosystem and a growing number of latency-sensitive enterprise use cases”, said Melvin Sorum, IoT analyst at Berg Insight.

Mr. Sorum continued:

“While the market historically has been mainly supply-driven, it is today increasingly driven by organic demand from end users.”

The major RAN vendors (Ericsson, Nokia and Huawei) all play significant roles as end-to-end solution providers and are challenged by a number of smaller RAN equipment providers. Berg Insight ranks Nokia as the largest private LTE/5G network solution vendor with about 960 customers and over 2,000 private network deployments at the end of 2025. However, Nokia announced in November 2025 that it is looking to divest its flagship Nokia DAC solution in favour of focusing more on its other larger segments.

A number of small cell and other RAN equipment providers offer competitive LTE/5G radio products and in some cases complete private network offerings, including Airspan Networks, Askey, AW2S, Baicells, Benetel, BLiNQ Networks, Cablefree, Celona, Firecell, GXC, JMA Wireless, Mavenir, Microamp, Samsung Networks, Sercomm, Star Solutions, Telrad, XCOM RAN and ZTE. Important specialised core network software (EPC/5GC) vendors include AttoCore, Blue Arcus, Cisco, Cumucore, Druid Software, Expeto, Hewlett Packard Enterprise (HPE), Highway 9, IPLOOK, Onomondo, Obvios and Pente Networks. In total, RAN and EPC/5GC offerings for private networks are available from close to 60 vendors.

According to Berg Insight, the market is being shaped by trends such as the virtualisation of network functions, the implementation of O-RAN in radio products and the emergence of neutral host network solutions. Other key trends identified by the research firm that could significantly impact private LTE/5G network adoption include new regulatory changes, major divestments, new product categories and emerging technologies such as Wi-Fi 7 and network slicing, which may serve as either complements or substitutes for private cellular networks depending on the use case.

The post Private LTE/5G Market Reached US$2.4B and 6,500 Deployments in 2025 appeared first on IoT Business News.