Silver has dramatically outperformed gold this year, with prices surging by nearly 100% as of early December.

The rally has been marked by sharp swings, driven by shifting economic signals and evolving trade tariff policies, and with high uncertainty persisting, ING Group anticipates further market volatility.

The recent strength of silver is attributable to several key factors: a continued supply deficit, robust industrial demand driven by its essential role in solar technology, EVs, and electronics, ING said in its outlook report.

Additionally, there has been a resurgence of investment interest in silver as a more accessible alternative to gold.

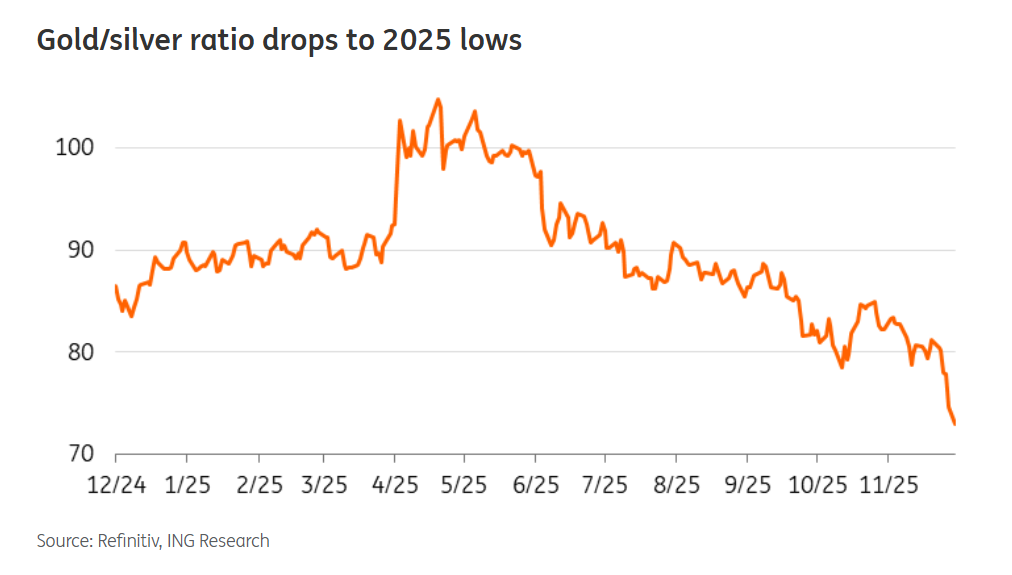

The gold/silver ratio has dropped significantly from its Liberation Day peak of 105, now sitting at a year-to-date low of below 70.

This reduction suggests a growing confidence in silver among institutional investors, according to Ewa Manthey, commodities strategist at ING Group.

Great silver squeeze

US tariff uncertainty caused a historic squeeze by diverting metal from London to the US, resulting in COMEX futures consistently trading higher than London prices throughout much of the year.

This shift led to a sharp reduction in available silver stocks in London, the main trading center.

The silver market is still grappling with the effects of a historic short squeeze, despite a record inflow of silver into London.

Lease rates, which represent the annual cost of borrowing silver in London, remain elevated at about 6%.

The situation has put pressure on other regions, as evidenced by Chinese silver exports surging to a record high of over 660 tonnes in October.

As a result, stockpiles in warehouses linked to the Shanghai Futures Exchange recently reached their lowest level in nearly a decade, prompting a significant amount of silver to be shipped to London to alleviate the strain there.

Manthey said in the ING report:

There is still a risk of a tariff on silver, with the recent inclusion of the precious metal on the US Geological Survey list of critical minerals increasing the likelihood of US import tariffs.

Tailwinds in 2026

“Looking ahead into 2026, silver will continue to be supported by improving investor sentiment towards precious metals and tightening physical balances,” Manthey added.

Silver is poised to benefit from macro factors similar to those supporting gold, including a weaker US dollar, interest rate cuts by the Fed, and increased demand for safe-haven assets due to ongoing geopolitical instability.

Historically, silver has demonstrated superior performance to gold during periods of monetary easing, as a decline in real yields typically boosts both investor interest and industrial usage.

But silver’s outlook is also shaped by fundamentals that differ from gold, according to Manthey.

Industrial applications consume over half of the total silver supply.

A slowdown in solar demand is anticipated, particularly in China, following several robust years, with installations projected to reach their highest point in 2025.

Further increasing demand for silver are trends like electrification, necessary power grid enhancements, and the rising incorporation of silver in automotive components, particularly within hybrid and battery electric vehicles.

Volatility to continue

Manthey said:

Silver is often nicknamed “gold on steroids” – it tends to move much more than gold in percentage terms.

Silver’s market size is smaller than gold’s, and its demand is split between industrial and investment uses, making it highly susceptible to economic fluctuations.

Consequently, while silver can significantly outperform gold during bull markets, it is also prone to steeper declines in economic downturns, according to the ING report.

This high level of volatility is expected to persist for silver next year.

“While we don’t believe that the pace of gains seen this year is sustainable, overall, we expect silver prices to remain well-supported amid the combination of resilient industrial demand, constrained supply growth, and a more favourable macro environment,” Manthey said.

We see prices averaging $55/oz in 2026.

The post Silver volatility to continue in 2026; ING Group sees prices averaging $55/oz appeared first on Invezz