America is on the cusp of the most power-hungry decade in a generation. Federal forecasters expect record electricity demand in 2025–26, even as oil producers are carefully managing output. Yet the main reason your bill is climbing isn’t just regional differences, it’s rules. A thicket of tariffs on essential hardware, marathon permitting timelines, and clogged grid interconnection queues layer a “policy premium” onto every kilowatt-hour. In a textbook supply-and-demand sense, demand is racing ahead, driven by AI data centers and electrification, while policy squeezes supply. Worse, Washington keeps “choosing” technologies, inviting regulatory capture and raising costs for everyone. If we want the AI era to benefit households instead of draining their wallets, we need neutral, pro-entry rules that let the cheapest reliable electrons win.

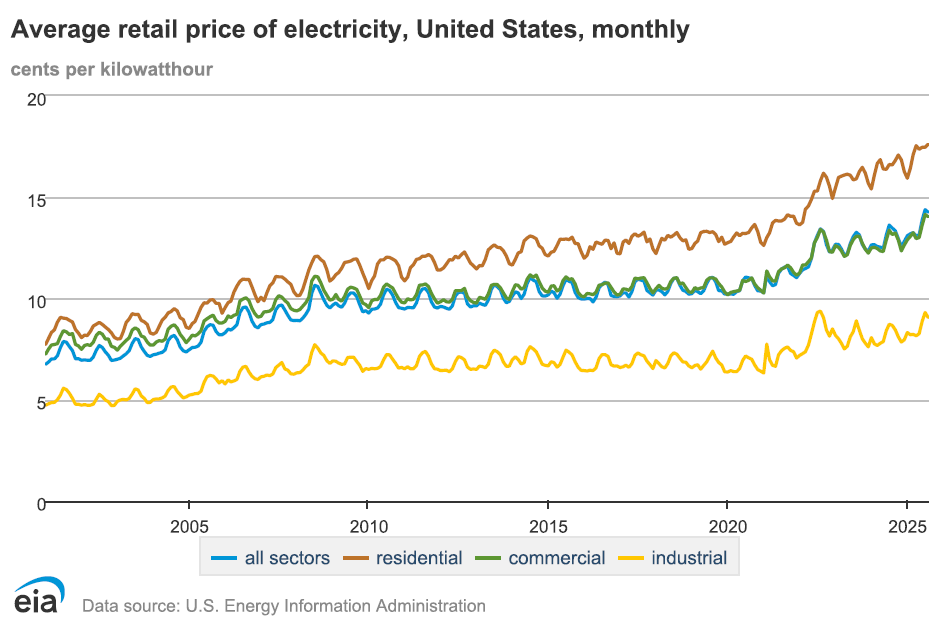

Energy inflation tells the tale. Headline prices are running hotter than the 2 percent target, and the pressure points are concentrated in utilities. Electricity alone is up roughly 5 percent, and utility gas is up close to 12 percent versus a year ago. Average retail electricity prices have jumped nearly 9 percent already this year. The burden isn’t uniform. North Dakotans pay the lower energy costs, around 11.7¢ per kWh with a typical bill near $112, while Hawaiians pay roughly 42.3¢ and a $203 monthly tab. That gulf largely reflects system design and policy. North Dakota sits on abundant generation with strong ties to the Midcontinent grid; Hawaii is an islanded system importing fuel and equipment with layers of costs. When transmission is constrained and hardware is expensive, consumers pay.

Energy demand is taking off, mainly driven by data centers powering AI. Data-center electricity use tripled over the last decade to roughly 176 terawatt-hours, and federal analysts expect it to double, or even triple, again by 2028. That would take data centers from roughly 4.4 percent of US electricity consumption to something like 10–12 percent in just a few years. In markets with heavy data-center clustering, wholesale prices near key nodes have surged, reportedly doubling or tripling compared with five years ago, and those spikes bleed into retail rates. The largest campuses are now measured in hundreds of acres; Meta’s complex in Prineville, Oregon, covers well over a hundred. None of this is a problem if supply can scale. But supply is boxed in.

Start with trade policy. The grid is steel, copper, aluminum, power electronics, batteries, transformers, inverters, and miles of conductor, exactly the things Washington keeps taxing. Many power-sector inputs now carry duties in the 25–50 percent range. The administration has announced additional tariffs on medium and heavy trucks, which will raise logistics costs across energy supply chains. For oil and gas, the exemption record is mixed: while crude itself may avoid new levies, drillers and midstream firms still buy tariffed inputs — steel casing, line pipe, valves — magnifying project costs. Steel and aluminum duties, recently doubled to 50 percent in some cases, raise the price of everything from rigs to transmission towers. On the “green” side, tariff policy is even more tangled. Grid-scale batteries face total duty stacks approaching the mid-sixties percent; aluminum and derivative products also pay 25 percent. Solar modules and cells still sit under safeguard tariffs near the mid-teens, layered atop other levies. The result is not a level playing field but a politicized one where lobbyists fight to be a “protected” winner and consumers lose either way.

Then there’s the permitting time tax. Big energy projects routinely wait six or more years for approvals; some major transmission lines have been in limbo for more than a decade. Meanwhile, the grid clogs and aging infrastructure strains. Transmission congestion alone added roughly $11.5 billion to customer bills last year. Lengthy reviews no longer deliver meaningfully cleaner or safer outcomes; they mostly deliver uncertainty, which raises financing costs and deters entrants. In economics, that’s classic deadweight loss.

Interconnection is the third vice. You can’t sell power until a grid operator studies how your plant will affect the system. For years, independent system operators and regional transmission organizations have been drowning in applications, many of them speculative. Backlogs keep new capacity — renewables, nuclear uprates, even industrial cogeneration — from plugging in. Regulators have introduced helpful reforms: “cluster studies” that analyze groups of projects at once and “readiness screens” to ensure entrants have site control and basic financing before staff spends months modeling them. But adoption is uneven. Markets like the California Independent System Operator are making headway with annual intake cycles and clearer milestones; others are still stuck, creating a patchwork of rules that adds friction and encourages forum shopping. Even good projects die on the vine if siting processes collide with wildlife, historic-preservation, and local zoning rules that were never designed for 21st-century energy density.

Why do we tolerate all this? Because we keep trying to direct outcomes, favoring particular fuels, geographies, or industrial constituencies, rather than setting simple, technology-neutral rules. That invites regulatory capture. When agencies tilt toward the loudest incumbent or the trendiest technology, they’re not discovering the lowest-cost path to reliability; they’re rationing permits and tax credits. Households and factories pay the markup.

What would a pro-consumer pro-technology agenda look like?

First, stop playing favorites. Drop the tariff thicket on intermediate goods central to generation, storage, and transmission. Don’t carve out oil-and-gas inputs but punish solar or vice versa; end the game entirely. Let firms source the cheapest safe equipment globally and let market competition decide the mix of resources. When inputs get cheaper, so do bills.

Second, rebuild permitting around shot-clocks, not calendars. Establish firm timelines and a single lead agency for major projects; if the clock runs out, move to a decision on the record. Focus intensive reviews on genuinely high-impact projects and allow routine, low-impact work, like reconductoring existing lines or swapping transformers, to proceed quickly under programmatic approvals. Provide judicial review, but time-limit it to curb endless litigation.

Third, finish the interconnection fix. Make cluster studies and readiness requirements universal, but tune them so they screen out pure speculation without blocking smaller independent power producers. Publish transparent cost-allocation rules so developers can plan. Align interconnection with long-range transmission planning so we’re not endlessly studying plants for a grid that doesn’t exist yet.

Fourth, open the door to firm, zero-carbon baseload. Small modular reactors and advanced designs, including molten-salt and thorium-based concepts, should compete on their merits. That means modern licensing that evaluates designs by efficiency and productivity, not lineage; standardized approvals for repeat builds; and clarity on waste handling. Clear the obstacles so private capital can try thorium-powered nuclear. If it can deliver reliable power at scale, the market will adopt it. If not, resources will flow elsewhere. Either way, consumers win.

Finally, remember why we’re doing this. AI is a once-in-a-century general-purpose technology. It can raise productivity and living standards, but only if the power system scales without crippling costs.

We don’t need another round of picking winners and losers on the energy front. We need to remove the artificial barriers that make supplying power slow and expensive. Cut the policy premium, tariffs that pad equipment costs, permits that drag on for years, interconnection rules that reward queue gaming, and America’s engineers, utilities, and entrepreneurs will do the rest. The cheapest reliable kilowatt-hour is the one that’s allowed to be built.