The American housing market is no stranger to boom and bust cycles, but the current slowdown in existing home sales is remarkable both for its scale and its stubbornness. With sales in 2025 on track to reach their lowest levels in more than 25 years, the market appears to be in a deep freeze. That stark reality, highlighted recently by analyst Meredith Whitney, has often been treated as a secondary detail in coverage of the economy. Yet the depth of this freeze — and the reasons behind it — are central to understanding broader economic conditions.

Whitney’s phrasing is blunt: the market is “gummed up.” Unlike past downturns, when collapsing demand or financial crises abruptly cut off activity, today’s deep freeze is rooted in a peculiar mix of policy choices, pandemic aftereffects, and household-level psychology. The forces of supply and demand still operate, but they are being distorted in ways that have left buyers sidelined and sellers locked in place.

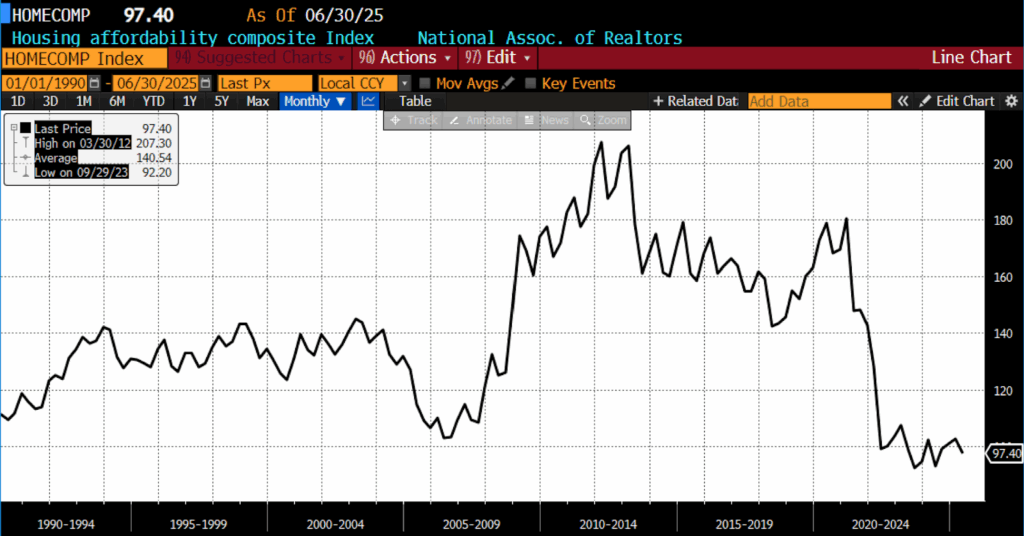

National Association of Realtors’ Housing Affordability Composite Index (1990 – present)

The most obvious factor is mortgage rates. Millions of households refinanced or bought homes in 2020 and 2021, when rates fell below 3 percent. Those “golden handcuffs” make moving far less attractive. A family that secured a $400,000 mortgage at 2.8 percent would face a payment increase of hundreds of dollars per month if forced to take out a new loan at today’s rates, which hover around 6 to 7 percent. Unsurprisingly, many simply refuse to sell, contributing to the freeze.

The stalemate can be traced to a web of overlapping dynamics. First, homeowners with ultra-low pandemic-era financing are clinging to their loans, unwilling to give up what may be the cheapest debt they will ever hold. Second, while price appreciation has slowed, home values remain historically elevated, keeping many first-time buyers on the sidelines. Third, the labor market, though stable, reveals caution through the “job hugging” phenomenon — workers staying put in their current roles rather than risking a change. If people are hesitant to change jobs, they are even more hesitant to take on new housing obligations.

During the COVID years, furthermore, stimulus checks, surging lumber prices, and waves of do-it-yourself enthusiasm fueled renovations. Many owners effectively upgraded their homes, reducing the incentive to move. Fifth, higher property taxes and soaring insurance premiums, particularly in coastal and hurricane-prone regions, add to the burden of ownership. For many, moving means not only higher mortgage rates but also higher carrying costs. Sixth, Whitney points to an overlooked trend: older Americans increasingly tapping home equity loans. By borrowing against their homes rather than selling, retirees extract liquidity while leaving housing supply tight. That subtle shift removes inventory from an already constrained market.

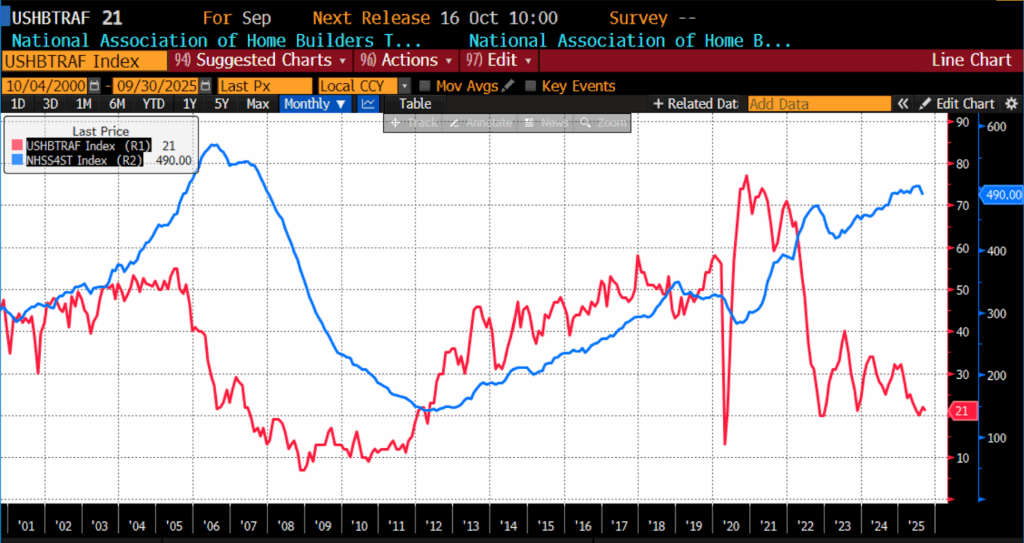

Any one of these factors alone might generate a modest slowdown. Taken together, they create a self-reinforcing freeze on transactions. Buyers hold back owing to the absence of affordable options; sellers, because moving would mean abandoning generationally cheap financing. Lenders, too, see less incentive to innovate when volumes are depressed. The result is a housing market neither collapsing nor thriving, but immobilized.

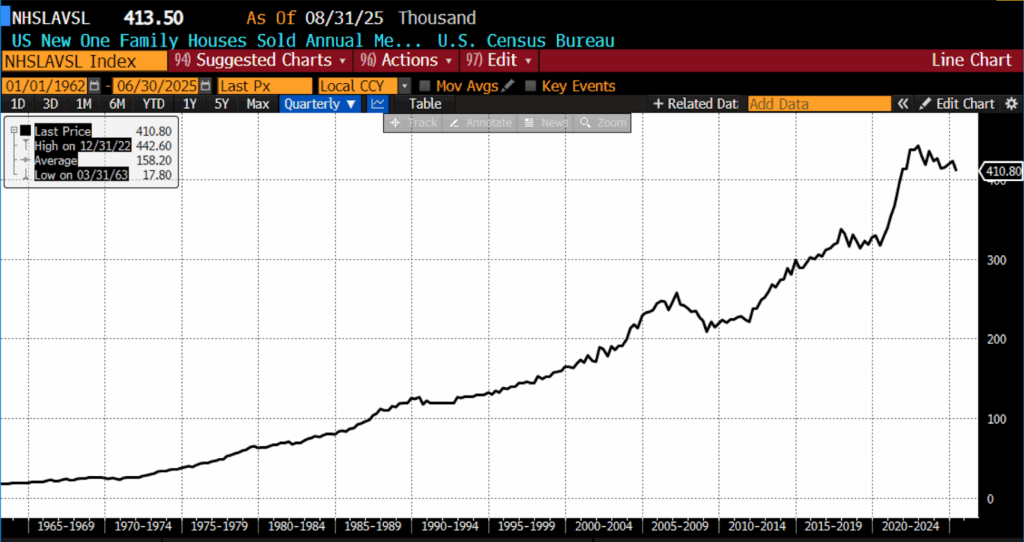

US Census Bureau US New One Family Houses Sold Annual Median Price NSA (1962 – present)

It’s an unusual state of affairs. In past housing cycles, a dropping demand eventually led to falling prices, which in time rekindled activity. Today, though, limited supply has prevented prices from correcting meaningfully. Even with sales activity at quarter-century lows, the median home price remains near record highs. That keeps affordability stretched, and thus the freeze remains intact.

The consequences extend far beyond real estate. Housing is one of the economy’s most powerful engines, driving construction employment, consumer spending on furnishings, and local tax revenues. When transactions dry up, a wide swath of related activity contracts. Realtors, appraisers, moving companies, landscapers, and retailers from Home Depot to Wayfair feel the pinch. The freeze also complicates Federal Reserve policy. Rate hikes are designed to slow demand, but the lock-in effect has amplified their impact. Instead of facilitating a natural adjustment, higher rates have created paralysis. Ironically, contractionary monetary policy could keep the shelter portion of service inflation higher for longer, since constrained supply props up rents and prices even as demand softens. (It bears mentioning that while Fed policy influences the shortest end of the US yield curve, mortgage rates track the 10-year and other, longer-term maturities.)

The freeze also reshapes household decisions in ways that are somewhere between difficult and impossible to measure directly. Younger families delay buying, renting far longer than intended. Older homeowners, instead of downsizing, remain in houses ill-suited to their stage of life. Geographic mobility suffers, which reduces the efficiency of labor markets. The decision to move across town, state, or across the country, once fairly common, has become an economic gamble. Meanwhile, creative financial behavior is emerging. Home equity loans and cash-out refinancing let older homeowners tap into their otherwise sequestered wealth, introducing risks in the process. Rising indebtedness among retirees could become a problem rising to policy levels if housing values stagnate or fall.

National Association of Home Builders’ Traffic of Prospective Buyers SA and US Census Bureau US New One Family Houses Total For Sale (1990 – present)

The key question is whether the impasse is temporary or persistent; frictional, or structural. A sharp drop in interest rates could unfreeze activity, but with inflation still elevated, such a shift seems unlikely in the near term. A major correction in prices could restore balance, but supply shortages make that outcome somewhat doubtful. The likeliest scenario is a market that muddles through: sluggish sales, elevated prices, and a large contingent of unsatisfied would-be market participants.

Whitney’s observation — that the reliance of older Americans on home equity loans may be a buried lead — underscores the complexity of the moment. The housing market is not simply a casualty of higher rates; it is the product of a confluence of pandemic-era choices, policy dynamics, and demographic realities. With sales at their lowest point in a quarter century, the US housing market is locked in a deep freeze, and understanding how — and when — it might thaw will be essential for prospective home buyers and sellers, investors, and policymakers alike.