A few centuries ago, Europe was the beating heart of global innovation. From the Enlightenment’s embrace of reason to the Industrial Revolution’s transformative power, it was a hub of bold thinkers, inventors, and entrepreneurs pushing boundaries.

Today, that spirit has faded. Europe no longer leads technological innovation — not due to a lack of talent or scientific exploration, but because of a deeper issue: an overly restrictive regulatory environment. While the US advances rapidly in AI, biotech, and space, and China heavily invests in deep tech, Europe remains tangled in bureaucracy, risk aversion, and a rigid application of the precautionary principle — prioritizing control over creativity and caution over progress.

Europe’s Innovation Crisis: How the Precautionary Principle Is Paralyzing Europe

Over the past two decades, Europe has rebranded itself—from the birthplace of industrial revolutions and scientific breakthroughs to the world’s regulatory superpower. The so-called Brussels Effect — Europe’s ability to shape global standards through its regulatory power — has given the EU influence. But at home, it has stifled the very innovation it once championed.

At the heart of this approach is the precautionary principle — the idea that new technologies must be proven completely safe before use. Though well-intentioned, it often stalls progress. Innovation becomes seen as a threat, and entrepreneurs face the near-impossible burden of proving zero risk. Instead of managing risk, European regulators demand its total elimination, halting experimentation before it even starts.

Contrast this with the United States, where a culture of permissionless innovation prevails. There, innovators are generally free to experiment unless they demonstrably cause harm. This difference in mindset explains why the US leads in AI, biotech, quantum computing, and space technology — and why Europe is falling behind.

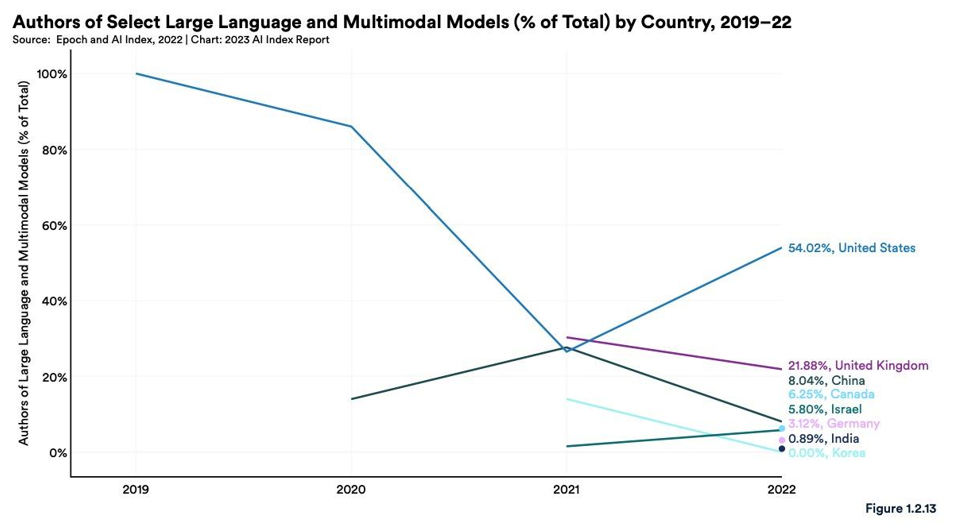

Take the EU’s 2024 AI Act. While praised for its ethical goals, the legislation imposes strict risk classifications and high compliance costs that only large corporations can navigate. Startups, lacking legal teams and capital, are left behind. As a result, Europe sees fewer AI startups, diminished innovation, and a talent exodus to the US and China, where one-third of AI experts at American universities come from Europe. And when it comes to leading the development of AI models, the gap is even wider. In 2022, 54 percent of the creators of major AI models were American, while Germany — Europe’s top performer — had just three percent.

This isn’t limited to AI. In biotechnology, Europe’s approval process for genetically modified organisms is among the slowest and most restrictive in the world. Experimental energy technologies are bogged down in red tape. Startups in high-risk, high-reward industries are routinely denied capital, not just because of investor caution, but because an overregulated financial system is conditioned to avoid anything uncertain. Rigid labor laws add further friction — hiring is inflexible, firing is expensive, and adaptation becomes difficult.

Europe’s Innovation Exodus: The High Cost of Playing It Safe

The cumulative impact of Europe’s regulatory overreach is increasingly hard to ignore: talent, capital, and innovation are steadily flowing out of the continent. Europe has become a place where ideas are born but rarely scaled. Nearly one-third of European startups that achieve unicorn status eventually relocate abroad — most often to the United States — in search of more supportive ecosystems and easier access to capital.

The numbers underscore the magnitude of the issue. The US dominates the global unicorn landscape, hosting over 55 percent of all unicorns and 75 percent of total unicorn valuation. In contrast, the EU accounts for less than 10 percent of unicorns and just 3 percent of global value. A key reason is the disparity in venture capital: European VC investment fell from $100 billion in 2021 to just $45 billion in 2023, while US startups raised $170 billion. As a share of GDP, US venture capital reached 0.21 percent in 2023, five times higher than the EU’s 0.04 percent.

In deep tech, the gap is striking. Seven of the top ten quantum computing firms are American, and none are European-headquartered. In AI, more than 80 percent of global investment flows to firms in the US and China, while Europe receives just seven percent. This investment gap is reinforced by weaker R&D spending. Europe invests only 2.2 percent of its GDP in R&D compared to 3.4 percent in the US and 5 percent in South Korea.

The warning signs are already clear.

Since 2015, Europe’s productivity growth has averaged just 0.7 percent per year — less than half the US rate and barely one-ninth of China’s. In 1995, US and EU productivity were roughly equal. Today, Europe lags by nearly 20 percent — a gap that threatens its long-term competitiveness and economic growth.

Europe is running out of time. With an aging population and shrinking workforce, it cannot afford to rest on past achievements. Without bold structural reform, the continent risks becoming a museum of past glories rather than a factory of future breakthroughs.

But decline is not destiny. Europe can still reclaim its innovative edge — if it’s willing to abandon the comfort of overregulation and embrace a new era of economic freedom and market dynamism. That means accepting risk and uncertainty, unleashing permissionless innovation, expanding access to venture capital, and reforming rigid labor and bankruptcy laws that stifle entrepreneurial ambition.

The US leads because it rewards bold ideas and tolerates failure. Europe’s culture, by contrast, punishes risk and drives talent away. The solution is not tighter control, but greater freedom.

As Milton Friedman famously explained:

The great achievements of civilization have come not from government bureaus but from individuals pursuing their own interests. Wherever masses have escaped grinding poverty, it’s been through capitalism and largely free trade. History shows clearly there’s no better way to improve the lot of ordinary people than the productive energy unleashed by the free-enterprise system.

Until Europe learns to trust its innovators and entrepreneurs, it will remain sidelined in the global innovation race.