For decades, economists and journalists have discussed the “Pink Tax”: the idea that products marketed to women price higher than identical ones for men. In 1992, the New York City Department of Consumer Affairs released a study asserting that women were routinely charged higher prices for haircuts, dry cleaning, and other services. Then-Mayor Bill de Blasio commissioned a second study in 2015, which found that women’s products were more expensive for 43 percent of a representative sample (this figure is slightly misleading: of 800 products with distinct male-female versions, fewer than 350 had higher prices for women). These studies influenced legislation in New York and California, aiming to ban gender-based price differences for similar goods and services.

But lawmakers and economists have missed a key question: why don’t women switch to the same products men use? If we assume they don’t switch and are worse off because of it, we’re also assuming women can’t make the best choices for themselves.

On the contrary, any sound economic explanation must assume that women are no less capable than men of making decisions that maximize their well-being. The so-called Pink Tax (to the exclusion of explicit taxes on feminine products) can be understood as a difference of cost, even for identical products. As I’ll show below, this approach also correctly predicts which types of products are likely to cost more for women. Legislation to “fix” this issue, as I’ll show, may actually harm female consumers more than help them.

Some Price Theory

Imagine a product that varies in certain features — it could be more or less “X,” very “X,” or not very “X” at all. A potato could have a lot of bruises, or not a lot of bruises; it could be very brown, or barely brown. John approaches the potatoes and selects at random, not caring about these traits. As he continues picking, the average potato in his bag starts to look like the typical one: mid-brown, lightly bruised. But John doesn’t care about these characteristics. He cares only about one thing: is it a potato or not?

Jane, however, wants a more specific potato: mid-brown, and lightly bruised. She’s willing to spend time searching for her preferred potato. But as economics teaches us, costs are shared between buyers and sellers. A six-percent sales tax does not mean buyers pay exactly six percent more, and a $100,000 fine on pollution does not fall entirely on the producer. Even if all potatoes are identical, and every potato in the bin meets Jane’s specifications, John and Jane are effectively searching for different things. Jane’s potato must have certain characteristics. John’s potato must simply be a potato.

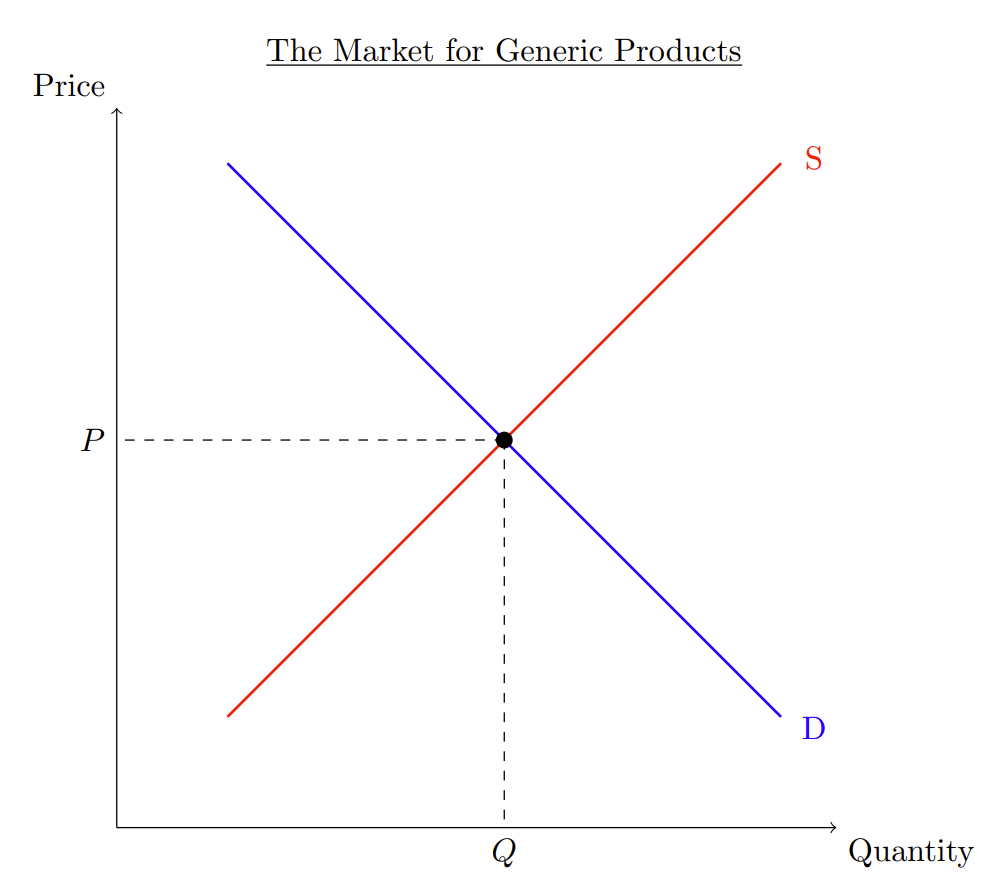

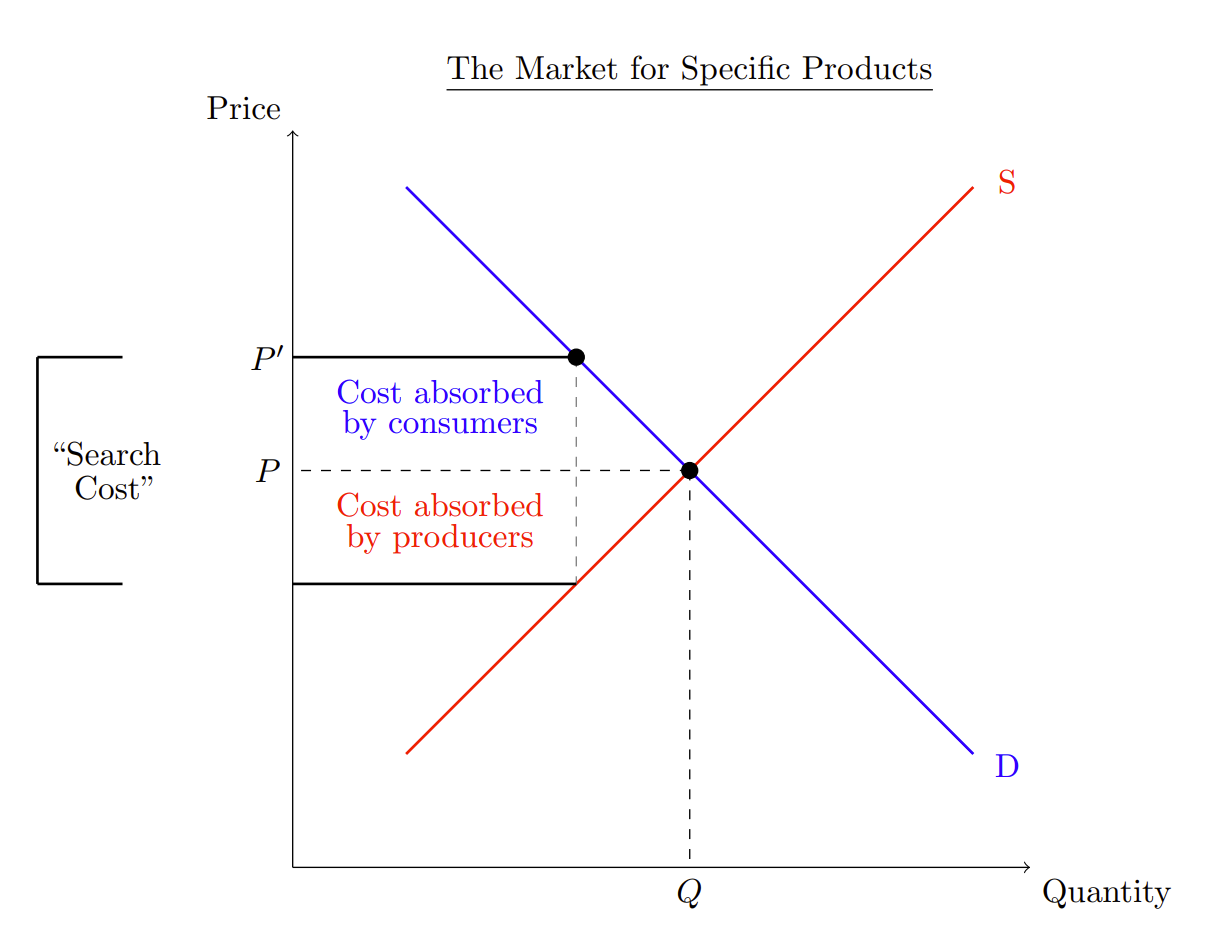

We can therefore model these two distinct markets, and evaluate what happens when a “generic” good is replaced with a more “specific” good. Put another way, we shift from a consumer with John’s preferences to one with Jane’s, all else held equal. See below:

In the example above, an introduced “search cost” is shared by both consumers and producers, raising the equilibrium price compared to markets with lower search intensity. Producers absorb part of this cost by investing in or renting assets that mitigate the “search” burden; for example, a potato producer may build a brand for a specific type of potato, or may package potatoes in ways that help consumers recognize the right potatoes sooner. Consumers absorb some of the search cost by increasing the reward to suppliers for providing a more correct product, paying a premium for a more suitable product.

As economists Klein, Crawford, and Alchian have described, consumers are willing to pay a premium to suppliers who fulfill expectations. Without the price premium, sellers are more induced to “cheat,” misidentifying their products to consumers.

Prices rise when they include added search costs. We should expect, then, slightly higher prices for products that women search for characteristics, while men do not. The aforementioned studies explicitly mention three products with the largest gender disparity: cosmetics (shampoo, etc.), haircuts, and dry cleaning. These are all products where men clearly search for more generic goods than women. It would be no rash generalization to describe men’s haircuts as “make it shorter,” and men’s shampoo choices as utterly indiscriminate of ingredients, specific use, or even scent. Two shampoos may have the same ingredients, but women’s shampoo might be branded more specifically (‘sulfate free,’ or ‘color protecting,’ or ‘all natural ingredients’) because they search relatively more.

But we needn’t rely only on the most obvious cases. Why, as one study shows, does a girl’s bicycle helmet have an equilibrium price higher than a nearly identical helmet for boys? One explanation is market segmentation — charging different groups according to their (presumably different) willingness to pay. But there’s another possibility: women face, and are willing to pay, higher search costs.

Why women might have these preferences and be willing to pay a premium for them where men and boys are not — for example, to achieve a particular hair texture, to have a basket and a bell included on a bike, or because they really do enjoy using a pink product more than a black one — is not the economist’s to examine. It is enough to know women reveal the preference of being willing to search and pay slightly more for their particular, preferred potato.

Consumer Welfare Implications

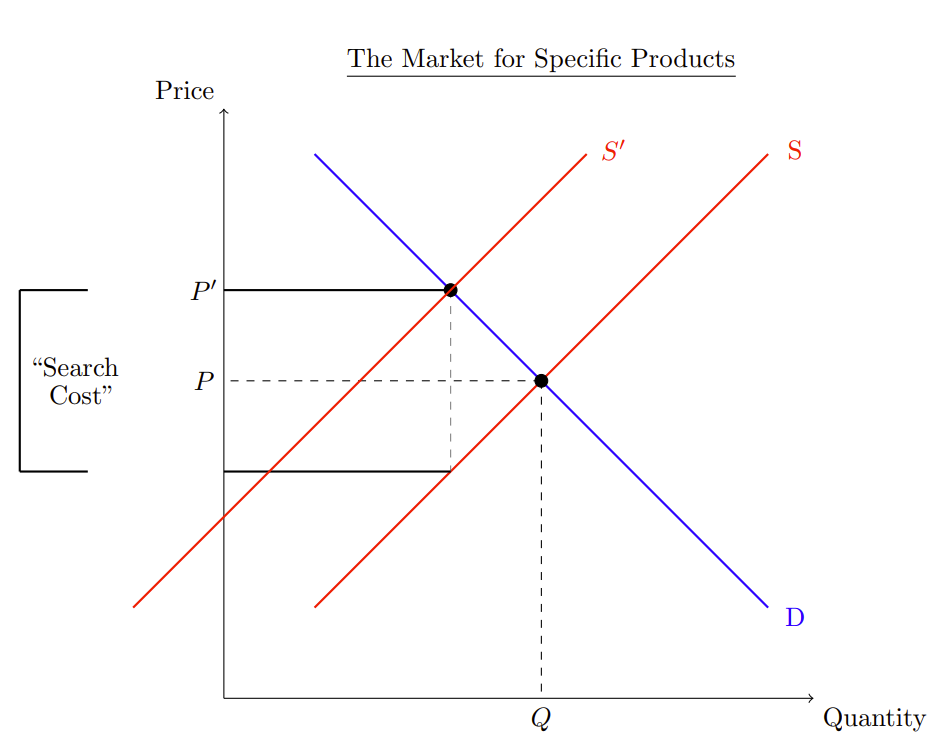

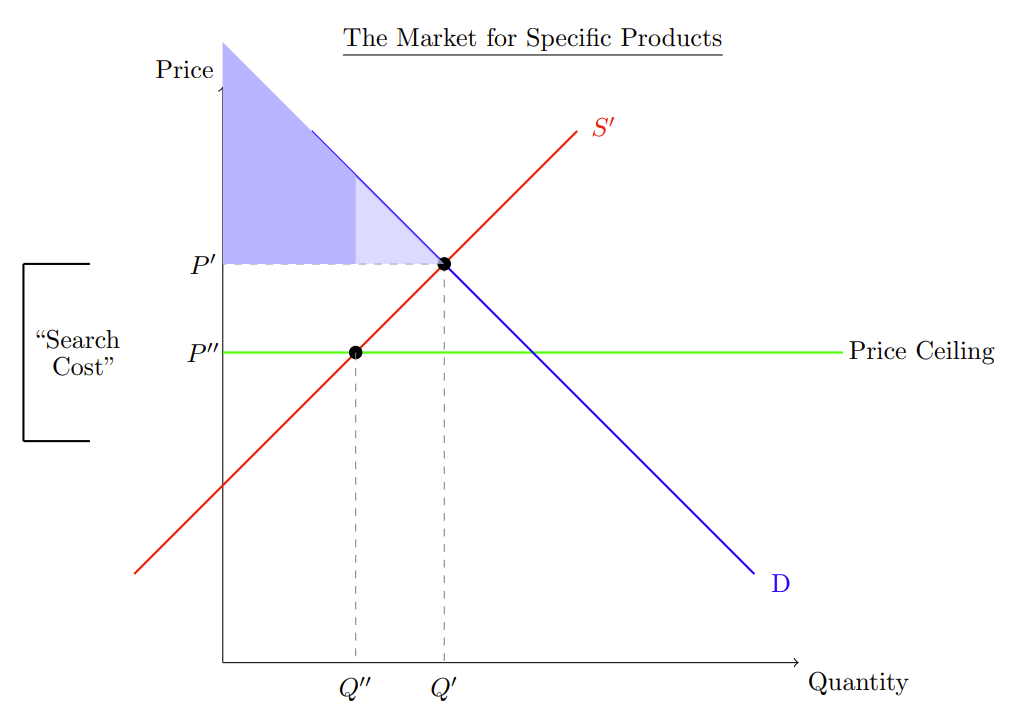

Legislation that bans price premiums for women’s products has predictable consequences. We can model the market for specific products resulting in a higher equilibrium price. I previously omitted this step for clarity, but show it below (along with a price ceiling) to illustrate the impact on consumer welfare.

Consumer surplus (a measure of how much satisfaction buyers gain from a purchase) shrinks from the blue triangle to the darkly shaded trapezoid. Producer surplus also declines. A price ceiling might improve welfare if firms were mistakenly overpricing products for women. But, as shown earlier, that doesn’t appear to be the case. Women tend to pay more for products they search for more intensively. Producers, in turn, invest in branding that reduces those search costs — like making the product pink or highlighting desirable traits more clearly. A price ceiling only creates a relative shortage, further shrinking women’s consumer surplus.

Unless we assume women consistently fail to substitute away from more-expensive products they do not actually prefer, a price ceiling is unlikely to enhance their well-being.