India’s retail demand for gold jewelry has been significantly impacted by the surge in gold prices to new all-time highs since the beginning of the year, the World Gold Council said.

Despite record-high prices putting pressure on jewelry demand, interest in gold investment is expected to stay strong, the council said.

“The financial year-end dynamics, which include statutory payments and tax-saving investments, may curtail discretionary spending, further weighing down demand,” said Kavita Chacko, research head, India, WGC.

So far in 2025, gold prices on COMEX have surged by more than 10%, and have hit a series of record highs.

On Thursday, the gold price on COMEX had hit a fresh record high of $2,973.40 per ounce.

“Domestic (India) prices have been rising in parallel with international prices, rising by 14% to a record INR86,831/10g,2 with the higher gains attributed to the weakness in the INR against the USD (1.1% depreciation y-t-d),” Chacko said.

Our analysis indicates that the upward climb in gold prices can be attributed to a combination of geopolitical risks, growing concerns about inflation, and increased investment flows.

Jewellery demand subdued

India’s retail demand for gold jewelry has been significantly impacted by the surge in gold prices to new all-time highs since the beginning of the year.

The uncertainty surrounding the Union Budget announcements has also affected buying activity.

Demand fell sharply in January and continued to be weak in February, despite the end of the inauspicious period in the Hindu calendar on January 15 and the typical post-Union Budget increase in demand, according to WGC.

Consumers’ front-loaded purchases in November when prices were lower have resulted in subdued wedding-related purchases.

“Rather than making fresh purchases, many buyers are opting to exchange old gold for new jewelry,” Chacko said.

“Additionally, as gold prices surged past previous thresholds, many consumers are also taking the opportunity to sell old gold and lock in profits.”

The widening gap between domestic and international gold prices, which has grown from an average of $3 per ounce in December to $23 per ounce currently, reflects the subdued demand environment.

This has been further exacerbated by a slowdown in jewelry demand, causing retailers to be reluctant to restock due to challenges in meeting manufacturer payment terms.

This reluctance has created a liquidity crunch within the industry, leaving domestic gold prices trading at a discount to international prices since December.

“Notwithstanding the depressed jewelry demand, investment demand interest (for bars and coins) has stayed the course with investors anticipating further price increases,” Chacko added.

However, price stability could be a mitigating factor for jewelery demand, which could see an improvement in the new fiscal year starting in April.

Record ETF inflows

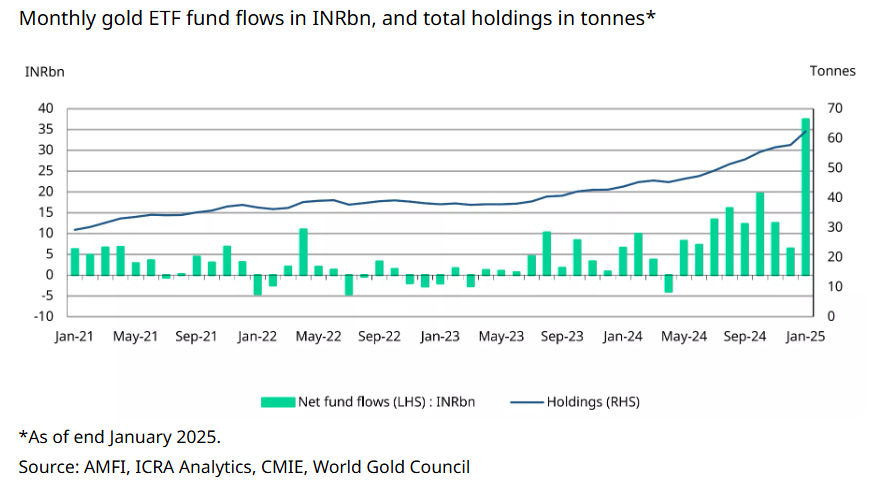

The Association of Mutual Funds in India (AMFI) reported that January 2025 saw unprecedented net inflows of 37.5 billion rupees ($435 million) into Indian gold ETFs, indicating a strong start to the year for this investment.

This figure is significantly higher than the average monthly net inflow of 9.4 billion rupees ($112 million) over the preceding 12 months.

The total holdings of gold ETFs increased by 4.6 tons to 62.4 tons, with assets under management (AUM) growing 15% month-over-month to 51.8 billion rupees ($6 billion).

These results closely align with our initial estimates, which were based on the data that was available at the time, WGC said.

“Anecdotal reports suggest that the strong inflows in January can be attributed to investors redirecting free cash flow towards gold ETFs for diversification amid ongoing global and domestic economic and policy uncertainty,” Chacko said.

The appeal of safe-haven assets like gold has driven investors in India away from the equity markets and into gold ETFs due to the continued weakness of the domestic equity markets.

RBI resumes gold purchases

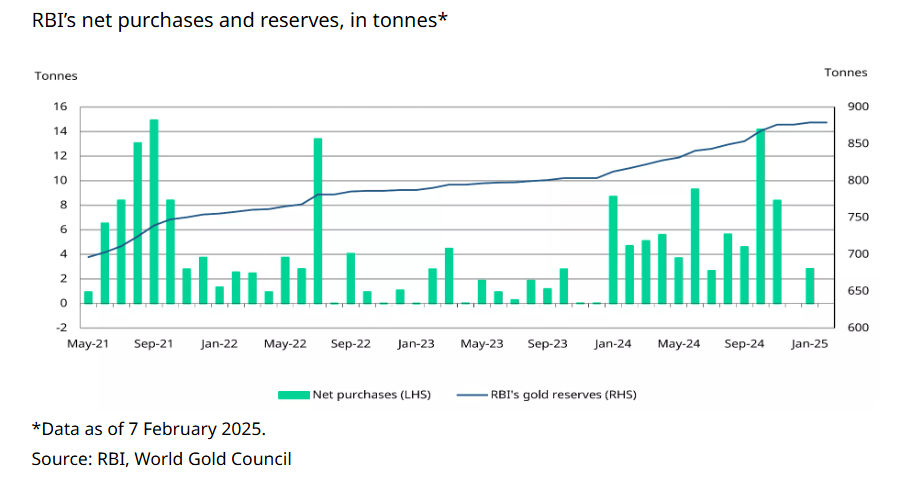

In January, the Reserve Bank of India resumed purchasing gold, following a pause in December.

The December pause ended 11 consecutive months of gold purchases by the RBI.

The central bank’s gold reserves reached a new high of 879 tons after it added 2.8 tons of gold in January.

This suggests that the RBI will likely continue accumulating gold, according to WGC.

RBI has been increasing its gold reserves, as evidenced by the growth in gold’s share of its forex reserves from 7.7% in January 2024 to 11.31% by early February 2025.

This reflects the RBI’s diversification strategy away from foreign currency assets, whose share has declined from 88.5% to 85.2% over the same period.

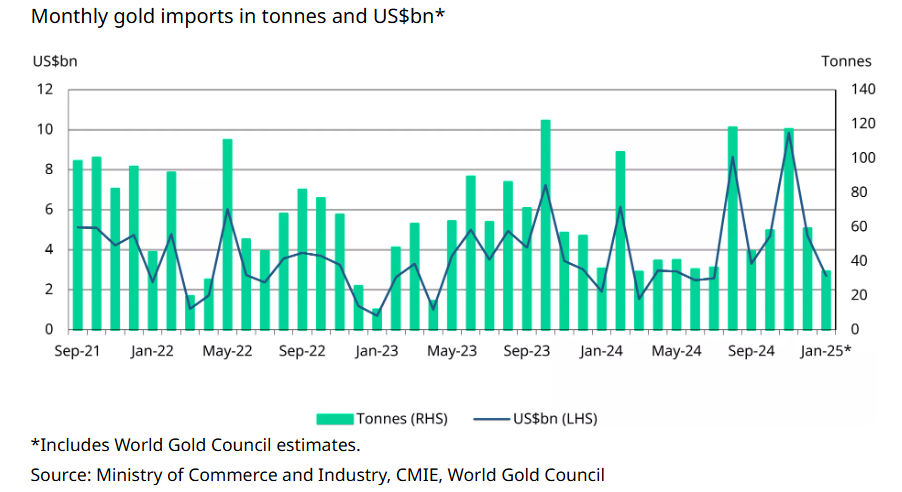

Meanwhile, India’s gold imports in January saw a noteworthy drop owing to high prices leading the pull-back in demand.

India’s Ministry of Commerce reported that January’s gold import bill was $2.68 billion.

This represents a 43% decrease from December, but a 40% increase from January of the previous year.

The estimated import volume for January was between 30 and 35 tonnes, according to the data.

The post Record-high gold prices keep Indian investors hooked—what’s next? appeared first on Invezz