The simultaneous selloff across gold, silver, oil, stocks, and crypto has sparked renewed debate over the efficacy of diversification, but financial experts warn against judging long-term strategies by a short-term “chaotic freeze-frame.”

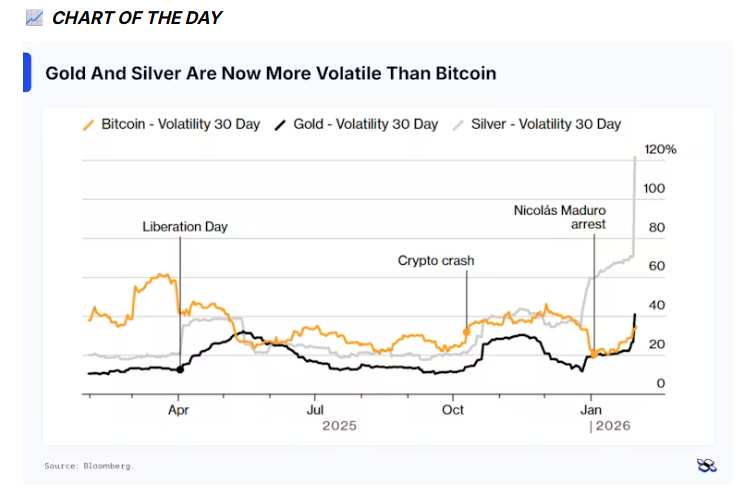

The precious metals complex is currently more volatile than Bitcoin.

Following months of record highs and investors treating them as a safe haven, investors finally began to dump both gold and silver.

“Gold is normally seen as a safety net – but lately, it’s felt more like a trampoline,” Finimize.com said in a report.

Dramatic collapse in precious metals

The precious metals market has experienced a dramatic and sudden reversal of fortune.

After reaching a record high just last week, god has suffered a significant collapse, tumbling by a striking 16% from its peak.

This sharp decline signals a major shift in market sentiment and threatens to erase recent gains.

However, the volatility has been even more acute in the silver market.

Silver prices saw a truly catastrophic performance, crashing by a third (approximately 33%) on Friday alone.

This single-day loss represents its worst performance since the year 1980, marking a historic and deeply troubling day for silver investors.

Furthermore, the pain was not confined to the weekend, as these substantial losses continued to spill over into trading on Monday, suggesting a sustained and powerful wave of selling pressure that has gripped the entire metals complex.

The current selloff follows a remarkable three-month rally.

During this period, gold’s price soared from $4,000 per ounce to over $5,500 per ounce, and silver more than doubled, leaping from approximately $50 an ounce to nearly $120 an ounce.

This widespread retreat suggested that investors were rapidly shedding their exposure to precious metals amidst broader market anxieties or shifts in monetary policy expectations.

The US dollar is likely to be further strengthened as investors anticipate the new Federal Reserve chairman, Kevin Warsh, will adopt an aggressive stance on inflation, leading to prolonged higher interest rates.

A strengthening dollar makes gold and silver more costly for international buyers.

Diversifying with long-term perspective

This effect, combined with the decreased appeal of precious metals compared to interest-bearing assets when rates rise, creates a strong downward pressure on prices.

“To make matters worse, the fact that so many investors had piled into precious metals in recent months made the exit very crowded,” Finimize said.

That means a lot of sellers and very few buyers, pushing prices even further down.

The simultaneous crash of gold, oil, stocks, and crypto in this selloff could lead one to conclude that diversification is pointless, as Finimize pointed out in its latest report.

But that’s like judging a whole movie from a single chaotic freeze-frame.

See, in a rush for cash, investors don’t carefully prune based on long-term logic – they offload whatever they can sell quickly to plug holes elsewhere.

The information platform, which helps investors understand financial markets, said that assets with different long-term paths can often fall for the same reason in the short-term.

And smart diversification is about spreading out your risk over the long haul, rather than guaranteeing that nothing ever drops at the same time in a full-blown stampede.

The post Great selloff in precious metals markets: Is diversification dead? appeared first on Invezz