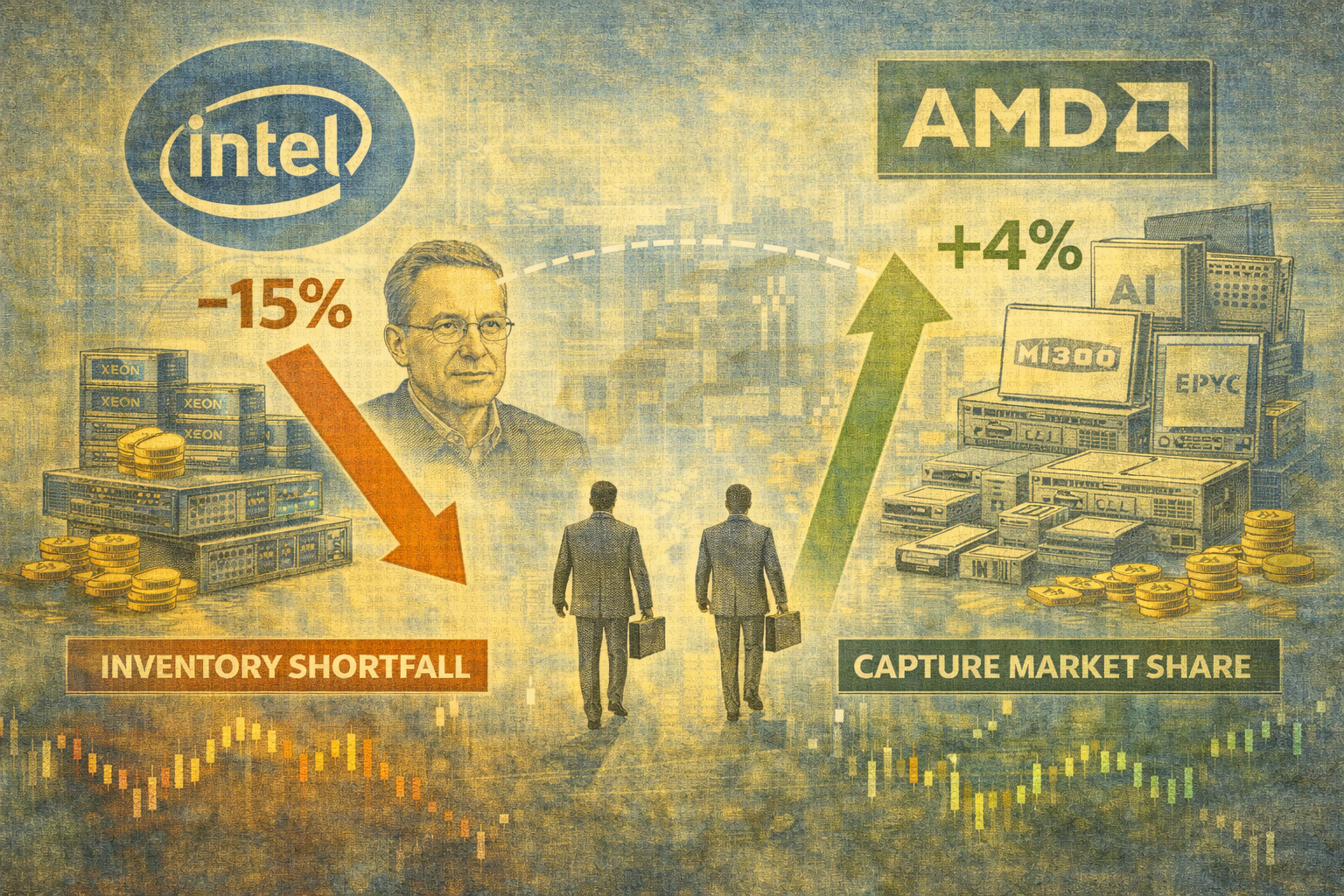

Advanced Micro Devices (NASDAQ: AMD stock) rose roughly 4% on Friday as investors repositioned into the chipmaker following Intel’s disappointing fourth-quarter guidance.

The move underscores a critical market dynamic: when Intel can’t supply the chips customers demand, AMD stands ready to capture the business.

Intel beat quarterly estimates Thursday evening, reporting $13.7 billion in revenue and adjusted earnings per share of $0.15, both above analyst expectations, but the real story lay in the forward guidance.

The company warned of a weak first quarter with revenue as low as $11.7 billion and adjusted earnings near zero, a miss that sent Intel stock plunging over 15% on Friday.

What Intel reported and why traders care

The supply-chain confession came straight from management.

CFO David Zinsner told investors that Intel’s available semiconductor supply would reach “its lowest level in Q1” before improving in subsequent quarters.

The remarks signal that the company cannot meet customer demand for server chips used in artificial intelligence data centers, even as such demand remains robust.

This wasn’t a demand problem; it was a supply problem.

Hyperscalers and enterprises want to buy Intel server processors, but Intel doesn’t have enough inventory to fulfill orders at the scale customers expect.

CEO Lip-Bu Tan acknowledged that manufacturing yields remain “still below what I want them to be.”

That admission sent a stark message: Intel’s operational challenges persist despite five consecutive quarters of beating revenue guidance.

The company is squeezing efficiency from its existing capacity but cannot expand supply fast enough to capitalize on the AI infrastructure boom gripping the industry.

AMD stock: Opening a new door

AMD shares rose approximately 3.8 to 4% intraday on Friday, reflecting investor recognition that Intel’s supply shortfall opens doors for rivals.

The chipmaker’s market capitalization climbed to approximately $413 billion, now towering over Intel’s $259 billion valuation despite Intel’s 87% year-to-date stock gain in 2025.

AMD’s over 100 percent% gain showcases sustained investor confidence in a company facing no near-term supply constraints.

The link is straightforward: when Intel can’t ship server CPUs to data center operators, those customers seek alternatives.

AMD’s MI300 AI accelerators and EPYC server processors directly address that need.

When industry supply is constrained, vendors who can deliver enjoy higher revenue per unit and margin expansion, a crucial dynamic as capital spending on AI infrastructure accelerates across the globe.

A cautious qualification is warranted, though.

AMD still trades at a relatively premium valuation by historical measures.

The move doesn’t signal a permanent structural shift in competitive dynamics, though it does reflect immediate market logic as Intel’s Q1 weakness creates a window of opportunity for better-positioned competitors.

The real story unfolds over the next six months.

If Intel’s supply constraints persist beyond Q1, AMD’s gains could prove more durable. If Intel executes its promised recovery, the AMD stock could reverse sharply.

The post AMD stock jumps 4% on Friday: is Intel’s Q4 report the catalyst? appeared first on Invezz