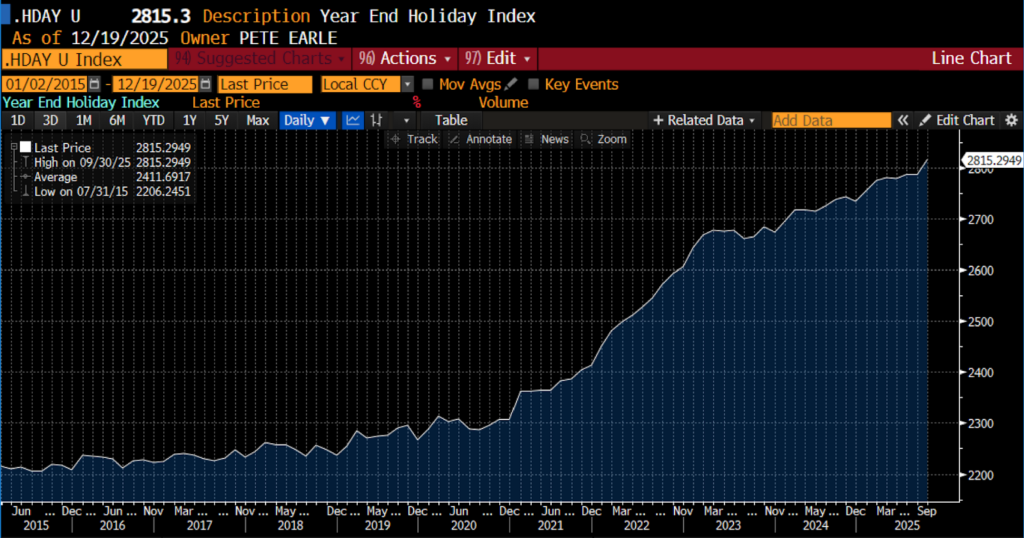

Over the five years since the COVID pandemic, the AIER Year End Holiday Index has climbed by an average of about 3.8 percent per year, resulting in a total increase of just under 21 percent. In the preceding five-year period from 2015 to 2020, the index rose only slightly — just over 2.7 percent in total — equivalent to an average annual gain of about 0.5 percent.

Our proprietary HDAY Index captures price movements across a broad basket of holiday-relevant goods and services, including apparel, toys, books, software, jewelry, pet and personal care items, gift-wrapping materials, postage and shipping, alcohol, confectionery, houseplants, and movie tickets. The table below presents both the average annual rate of change and the cumulative price increase for the five years preceding the pandemic and the five years that followed. These results are shown alongside changes in the Employment Cost Index as well as key holiday travel expenses over the same periods, including airfare and gasoline.

| Avg Annual Change | Avg Annual Change | Total Change | Total Change | |

| Category | (2015-2020) | (2020-2025) | (2015-2020) | (2020-2025) |

| HDAY Index | 0.68% | 4.17% | 3.46% | 22.64% |

| ECI Index | 2.56% | 4.10% | 13.48% | 22.28% |

| Airfare | -6.41% | 5.50% | -28.18% | 30.70% |

| Gasoline (average) | -0.87% | 7.60% | -4.28% | 44.23% |

Since the end of 2019, the HDAY Index reveals an increase of over 18 percent in the prices of selected goods and services. And as is shown below, every category other than recreational books and toys has surged in price. Notable increases over the past half-decade have occurred in categories most closely associated with Christmas, Hanukkah, and other end-of-year festivities: postage and delivery services, stationery and gift wrapping, confectionary, and indoor plants and flowers.

| Avg Annual Change | Avg Annual Change | Total Change | Total Change | |

| Category | (2015-2020) | (2020-2025) | (2015-2020) | (2020-2025) |

| Sugar and Sweets | 0.92% | 6.44% | 4.68% | 35.26% |

| Women’s and Girls Apparel | -2.35% | 2.33% | -11.23% | 12.30% |

| Men’s and Boys Apparel | -0.98% | 3.42% | -4.79% | 18.47% |

| Toys | -8.18% | -0.74% | -34.21% | -3.66% |

| Recreational Books | -0.97% | -0.01% | -4.74% | -0.05% |

| Pets, Pet Products, and Services | 1.26% | 4.71% | 6.42% | 25.85% |

| Postage and Delivery Services | 2.97% | 4.22% | 15.74% | 23.03% |

| Jewelry and Watches | 0.27% | 2.01% | 1.38% | 10.50% |

| Indoor Plants and Flowers | 0.93% | 4.97% | 4.74% | 27.51% |

| Haircuts and Other Personal Care Services | 2.83% | 4.82% | 15.03% | 26.48% |

| Cakes, Cupcakes, and Cookies | 1.05% | 5.68% | 5.39% | 31.25% |

| Alcoholic Beverages At Home | 1.48% | 2.24% | 7.64% | 11.74% |

| Stationery, Stationery Supplies, Gift Wrap | -0.20% | 6.44% | -1.02% | 36.63% |

As the 2025 holiday shopping season unfolds, several Christmas-related prices have climbed noticeably, reflecting broader inflationary pressures and lingering effects from tariffs on imported goods. One of the most visible examples is in artificial Christmas trees, where higher import costs have pushed retail prices up by roughly 10–15 percent this year, affecting a staple purchase for many American households. The tariff-driven increase represents a meaningful rise against the backdrop of generally elevated seasonal costs. In addition, a growing number of consumers and small retailers have reported higher prices on holiday decorations and gift items, including ornaments and novelty gifts, with some toys and decorative goods seeing wholesale cost increases in the range of 5 to 20 percent, which retailers in turn are passing on to shoppers. Those trends, in turn, are contributing to heightened consumer awareness of ongoing inflationary pressures as gift budgets tighten and shoppers adjust their purchases.

One hopes that consumers increasingly recognize these affordability strains as the cumulative result of the past five years of extraordinary monetary and fiscal expansion, pandemic-era interventionism, global spending largesse, and a sudden shift toward mercantilist trade policies.