The US Federal Reserve could be on course for several interest rate cuts in 2026, even if a pause is more likely in January, Commerzbank AG said.

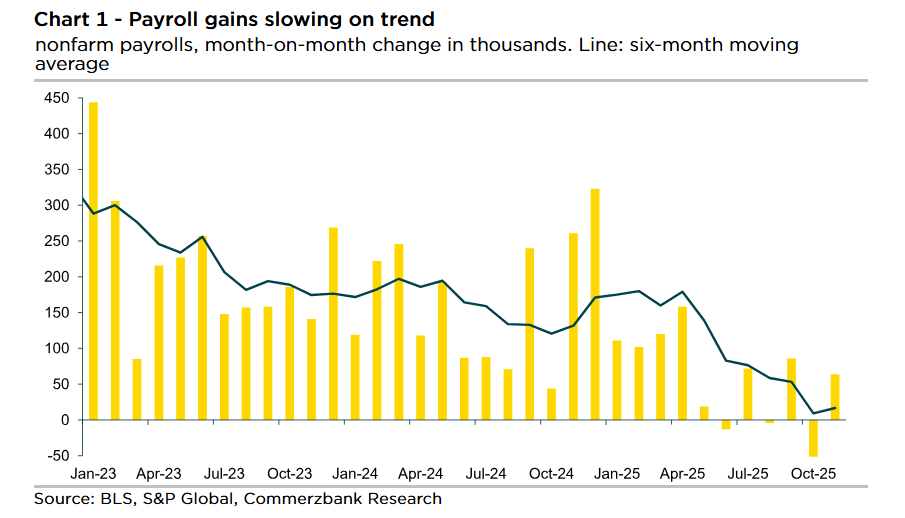

The US labour market’s momentum has significantly stalled, with minimal job creation observed in recent months.

The US labour market showed surprisingly weak growth in November, with the economy adding a mere 64,000 jobs.

This figure represents a notable deceleration in employment gains, raising concerns about the overall health and momentum of the economic recovery.

Further dampening optimism, Federal Reserve Chairman Jerome Powell recently voiced his assessment that this reported employment figure of 64,000 may actually overstate the true underlying trend in job creation.

US job growth

Powell’s cautious perspective suggests that when factoring in various nuances and potential statistical distortions, the actual pace of employment growth is likely even slower and less robust than the official report indicates, pointing to a more sluggish recovery in the labour sector than previously hoped.

“This is because the contribution of newly founded or closed companies must first be estimated,” analysts at Commerzbank AG said in a report.

A subsequent comparison of these estimates with comprehensive social security data has shown for some time that the assumptions were significantly too optimistic.

Powell suggests that the reported job growth might be overstated by 60,000 positions monthly, potentially indicating no actual increase in employment.

Job growth is anticipated to be slightly higher in December compared to November’s reported figures.

This expectation is largely due to the probable negative impact that the partial federal government closure (the “shutdown”) had on November’s business activity, particularly affecting public sector subcontractors, according to the analysts.

Thus, a certain rebound is likely. We expect next month’s report to show that 80,000 new jobs to have been created in December.

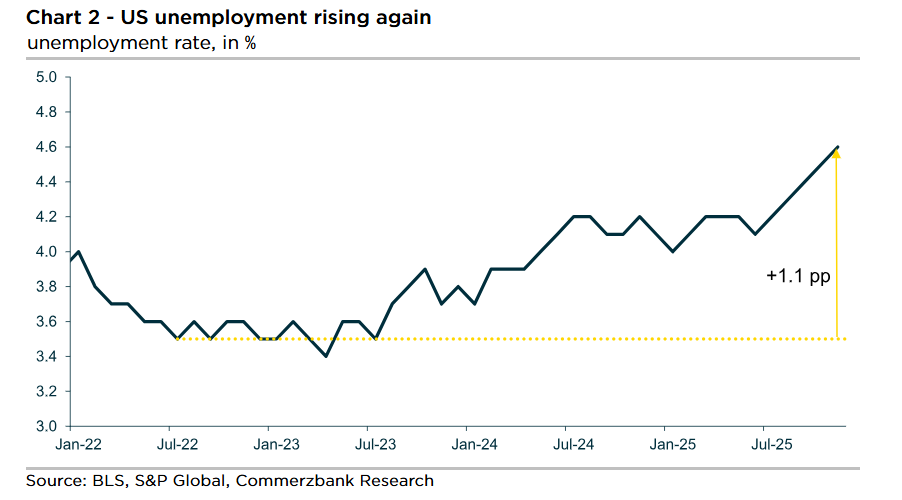

Focus on the unemployment rate

From the Fed’s perspective, the focus is likely to be on the unemployment rate in particular.

“This is because part of the weakness in employment is related to the fact that fewer people are entering the labour market due to more restrictive immigration policies,” Commerzbank analysts said.

Consequently, Fed Chair Powell currently views the unemployment rate as a more accurate reflection of the labour market’s condition.

The unemployment rate has increased by a full percentage point since its very low level in 2022-23.

“We expect it to remain at 4.6% in December. The Fed would then probably continue to be more concerned about the labour market than about inflation risks,” the German bank said.

It would thus remain on course for several interest rate cuts in 2026, even if a pause is more likely in January after three consecutive steps.

US GDP growth

The release of the US GDP growth report for the third quarter is anticipated.

This publication was postponed by approximately two months due to the shutdown.

Commerzbank expects strong growth, with forecasts predicting a 3.2% increase (quarter-on-quarter, annualised rate).

The US economy experienced broad growth, according to the source data, with the only contraction observed in the residential and commercial construction sectors.

The economy’s momentum slowed in the third quarter, and this decline in activity is likely to have been further exacerbated by the shutdown.

Consequently, growth in the US economy is anticipated to have slowed significantly during the fourth quarter.

“However, we do not see the upturn as being at risk as financing conditions remain favourable,” the analysts added.

The post Weak labour market, not inflation, will drive multiple Fed rate cuts in 2026, says Commerzbank appeared first on Invezz