For most of the past two decades, China’s economy could solve slow growth by pulling one of three levers. It could push investment, lift property, or sell more to the rest of the world.

Today, one lever is broken, another is politically constrained, and the third is provoking resistance abroad.

Though the economy is still expanding, the menu of reliable options is shrinking fast.

Investment no longer delivers the response it once did

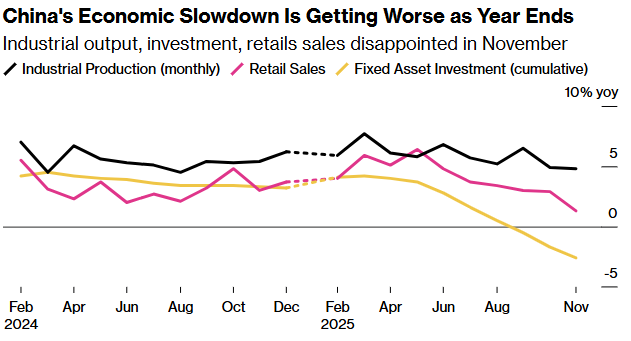

Investment used to be China’s fastest way out of trouble. Fixed asset investment fell 2.6% in the first 11 months of the year compared with the same period in 2024.

The drag is dominated by property, where investment fell nearly 16% over the same period.

Once a quarter of economic activity when related sectors were included, property has shifted from growth engine to structural restraint.

The sector once absorbed capital at scale and transmitted growth quickly. Now it does the opposite, pulling confidence down.

Infrastructure used to be the usual fallback, but now it’s also constrained.

Local governments face tighter borrowing limits and are using more funding capacity to refinance existing obligations rather than start new projects.

Investment has not disappeared, but it has become slower, more selective, and less powerful as a growth engine.

There is also intent behind the slowdown. Policymakers have become more explicit about curbing inefficient investment and excess capacity.

This has narrowed the scope for blunt stimulus. Growth is no longer something that can be accelerated simply by building more.

Consumption is weak despite targeted support

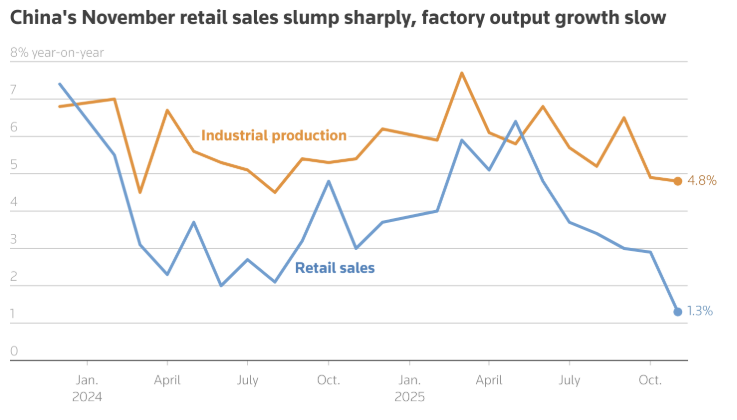

Household spending has proven stubbornly difficult to revive. Retail sales grew just 1.3% in November from a year earlier.

That was down from 2.9% in October and the weakest pace outside the pandemic period.

The worrying part, however is that retail growth has slowed for six straight months, the longest such run since 2020.

The composition of spending is telling. Auto sales fell around 8% year on year, and home appliance sales dropped close to 19%, based on industry and official data.

Both categories had been lifted earlier by trade-in subsidies. When those effects faded, demand followed.

This is not a story of liquidity shortages. Consumers are simply hesitant to spend.

Urban unemployment rate held at 5.1% in November, while youth unemployment remains elevated above 17%, limiting confidence in income growth.

More importantly, falling property prices continue to affect household behavior.

Average home prices across major cities declined again in November, extending a multi-year slide.

With the International Monetary Fund estimating that around 70% of household wealth is tied to real estate, even modest price declines have outsized effects on spending decisions.

Subsidies can shift the timing of purchases, but they cannot offset a sustained erosion of perceived wealth.

Exports are carrying growth, and attracting scrutiny

With domestic demand under pressure, exports have absorbed much of the slack.

Industrial production grew 4.8% year on year in November, outperforming consumption and investment, supported by strong overseas orders.

The result has been a record trade surplus of roughly $1.1 trillion in the first eleven months of 2025, according to customs data.

From a growth accounting perspective, exports have been decisive in keeping GDP near the government’s 5% target.

Exports also carry fewer immediate fiscal costs. They bypass household confidence, do not rely on local government balance sheets, and deliver output quickly.

In a constrained policy environment, that makes them attractive.

But the costs are accumulating. Persistent excess supply has kept producer prices in deflation for more than three years.

Externally, trade partners are responding with tariff threats and new barriers, not only in the United States but across Europe and emerging markets.

Export strength that once relieved pressure is increasingly generating it.

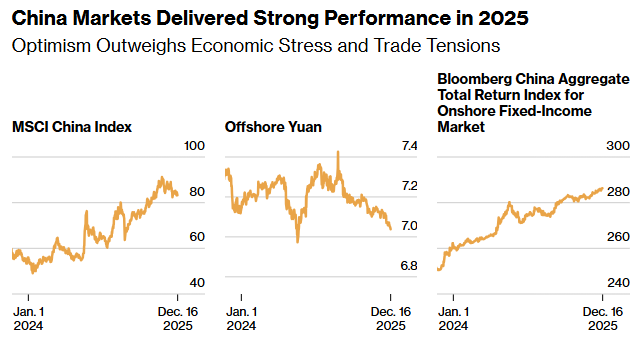

Markets are improving faster than fundamentals

While the real economy struggles to regain momentum, China’s financial markets have moved in the opposite direction.

Equities, the yuan, and onshore government bonds are all on track to post gains in 2025, a combination not seen in several years.

Foreign investors increased holdings of Chinese equities at the fastest pace since 2020 as of the third quarter, while demand for offshore sovereign bonds remained strong despite low yields.

The yuan is heading toward its first annual gain against the dollar since 2021.

Perhaps this was about policy, with authorities rolling out liquidity tools to support equities, easing regulatory pressure on parts of the private sector, and emphasizing growth stability.

Valuations also played a role, with Chinese assets still trading at a discount to global peers.

Yet the market rally has not translated into a broader economic lift.

Households have gained an estimated 4.5 trillion yuan from rising equity prices over the past two years, but that is small compared with the roughly 20 trillion yuan decline in residential property values over the same period, based on estimates cited by market analysts.

The wealth effect from stocks is simply overwhelmed by losses in housing.

Why next year looks harder than this one

Policymakers have pledged continued support through fiscal spending, ultra-long-term bonds, and moderate monetary easing.

At the same time, they are practicing restraint.

Large-scale stimulus risks reviving debt problems and undermining efforts to curb overcapacity.

Direct income transfers would boost consumption but require fiscal and institutional shifts Beijing has long avoided.

The result is a strategy focused on stabilization rather than acceleration.

Growth is supported, but not re-engineered. Markets respond to that reassurance. Households and firms remain cautious.

China is running out of low-cost ways to generate growth, as it has done in the past.

The data show an economy that still produces, still exports, and still attracts capital, but increasingly struggles to turn those strengths into confidence at home.

That gap between what China can do and what it can rely on is now the defining feature of its economic outlook.

The post Why China’s traditional growth model is breaking down appeared first on Invezz