Owing to the ongoing federal government shutdown, a number of key US economic data releases are currently unavailable. The Federal Reserve, the Bureau of Labor Statistics, the Bureau of Economic Analysis, and the Census Bureau have suspended or delayed various updates. Consequently, the Business Conditions Monthly indicators will be unavailable until normal data publication resumes.

Discussion, September–October 2025

Although the September 2025 CPI will be released on October 24, the exigencies of publishing deadlines require the Business Conditions Monthly to be issued before its release. Nevertheless, the following comments are germane to the ongoing macroeconomic discussion.

Amid the ongoing government shutdown, the Bureau of Labor Statistics (BLS) delayed the September CPI report from October 15 to October 24 and faces a greater challenge for October’s CPI, which will likely include fewer collected prices and lower statistical accuracy. The shutdown has halted most field operations, meaning roughly 60 percent of CPI price quotes (those gathered by in-person and telephone surveys) will be missing for much of October, while 40 percent gathered through online and corporate data can be retroactively added later. Should the government reopen during the last week of October, as much as one-third of price data could still be missing, with the housing survey — the largest CPI component, representing about one-third of total weight — especially affected, potentially losing two-thirds of its normal sampling. This will widen the 95 percent confidence interval for headline CPI, with resultant errors lingering into spring as the affected housing panel remains in the sample through May 2026.

Broader distortions could also persist across categories like airfares, hotels, and regionally staggered urban surveys, as several rely on bimonthly data collection and imputed pricing. Although alternative datasets such as Truflation and the Adobe Digital Price Index will provide interim guidance, they are methodologically inconsistent with CPI and risk adding noise. Bloomberg reports that high-frequency tracking of millions of prices indicates that tariff-sensitive goods have recently seen declines, while holiday-related categories like toys show isolated increases. Taken together, the evidence suggests that the September CPI release will be moderate enough to reinforce expectations of an October rate cut, though October’s reading is likely to be statistically noisier than usual.

With official BLS reports suspended amid the government shutdown, the national employment picture must be pieced together from state data and private sources. Estimates suggest that initial jobless claims fell to about 215,000 in the week ended October 11, indicating layoffs remain historically low despite a temporary spike in unemployment claims from furloughed federal workers under the Unemployment Compensation for Federal Employees (UCFE) program. Continued claims held near 1.9 million, pointing to steady labor-market absorption even as several states failed to report. Meanwhile, the ADP Research Institute’s September estimate of a 32,000 drop in private payrolls likely overstates weakness due to methodological quirks tied to its re-benchmarking against incomplete Quarterly Census of Employment and Wages (QCEW) data and timing differences with BLS procedures. Adjusting for those factors, true net hiring is likely near 55,000, supported by alternative data from Homebase and Revelio Labs showing private-sector job gains between 60,000 and 150,000. Taken together, available indicators portray a labor market that remains resilient but is showing mild cooling at the margins; a picture far less dire than ADP’s headline figure implies.

Although September’s data were released under the shadow of a government shutdown, the available indicators suggest a clear cooling in US economic activity across both the services and goods sectors. The vast services economy effectively stalled, with the ISM Services Index falling to a neutral 50.0 as business activity contracted for the first time since 2020 and new orders flattened. Employment continued to shrink for a fourth month, constrained by cautious hiring and persistent labor mismatches, while supplier deliveries slowed more from trade-policy disruptions than from genuine demand pressure. Inflation in services remained stubborn, with prices paid rising to near three-year highs even as demand weakened — a troubling mix for policymakers already balancing slower growth and sticky costs.

On the goods production side, factory activity remained in contraction for a seventh straight month, with the ISM Manufacturing PMI inching up to 49.1 but still signaling decline. Output and employment improved slightly, yet new orders and backlogs fell again, inventories were drawn down, and tariff-related frictions kept confidence low. Input-price growth eased for a third consecutive month, suggesting fading pipeline inflation even as trade uncertainty, high borrowing costs, and weak global demand weighed on output. Taken together, the data depict an economy losing momentum on both fronts: manufacturing continues to struggle for traction while services — the usual ballast — has slowed to a crawl, leaving growth increasingly fragile heading into the final quarter of the year.

Consumer confidence softened in September and early October as Americans grew less optimistic about inflation and the labor market. The University of Michigan sentiment index slipped to 55.0, its lowest in five months, as households reported weaker income expectations and a higher perceived risk of job loss. Nearly two-thirds of respondents expect inflation to outpace wage gains in the coming year, while about a third foresee rising unemployment — almost twice the share from a year earlier. Buying conditions for big-ticket items worsened amid tariff-related price concerns, though lower borrowing costs modestly improved views on home and vehicle purchases. Short-term inflation expectations eased slightly to 4.6%, while long-term expectations held at a still-elevated 3.7%, suggesting persistent anxiety about costs even as spending continues.

Small-business optimism also slipped, with the National Federation of Independent Businesses (NFIB) index falling to 98.8 in September, the lowest since June 2025 as owners grew more cautious about sales, inventories, and inflation. Expectations for better business conditions over the next six months dropped sharply, and concern over excess stockpiles reached a multi-decade high. Yet operational indicators were steadier: hiring and capital-spending plans ticked up, and profit trends improved modestly. Roughly a third of firms plan to raise prices to offset tariff and input costs, while the NFIB’s uncertainty index jumped to its highest since February. Together, both consumers and businesses remain fundamentally resilient but increasingly uneasy — maintaining activity for now, yet bracing for slower growth and policy-driven volatility ahead.

At present, that confidence is only marginally expressing itself in retail consumption, as a wave of high-frequency indicators points to consumers easing off the accelerator after a vigorous summer of spending. Credit- and debit-card data from Bank of America and Bloomberg Second Measure show a pullback in discretionary categories such as furniture, apparel, and home electronics, consistent with a moderation following 4.1% annualized growth in retail activity over the prior three months. While middle- and higher-income households continued to spend modestly — helped by stock market gains and lingering momentum from earlier in the year — lower-income consumers showed signs of fatigue, constrained by slower wage growth and persistently high prices. The Federal Reserve’s Beige Book characterized retail activity as having “inched down,” echoing private-sector reports that suggest shoppers are seeking more discounts and delaying large purchases. Still, Walmart and Wells Fargo reported steady spending patterns, suggesting no collapse — just a normalization. Overall, retail data portray a cooling but still durable consumer sector: steady enough to sustain growth, yet increasingly cautious as labor conditions soften and households brace for the holiday season amid economic and policy uncertainty.

Before getting to an overall assessment — so far as one is possible without the core statistical releases — a word is warranted about the government shutdown and its impact on the US economy. Now entering its fourth week, what was initially expected to be a short standoff has become a drawn-out political spectacle that could easily stretch into November. Prediction markets such as Kalshi now place its likely duration near 40 days, rivaling the 35-day record of 2018–19. The immediate effects, though real, are largely limited: hundreds of thousands of federal employees have missed paychecks, air travel has been strained by unpaid traffic controllers and TSA staff, and IRS, park, and nutrition programs have curtailed operations. A widely broadcast estimate holds that each week of closure shaves 0.1 to 0.2 percentage points from GDP, losses that will be partly recouped once back pay is issued — but potentially less so if the administration follows through on proposed federal layoffs. Opinion polls show nearly half of American respondents cite “the potential hit to the economy” as their chief concern, although there is a risk that political brinkmanship could begin to dent consumer and business sentiment if it drags deeper into the fourth quarter.

That said, the economic impact of shutdowns has historically been more theatrical than catastrophic. No US recession has ever been triggered by one, and markets have shown little panic amid the current impasse. The greater risk lies not in the lost output but in the erosion of confidence and the cumulative effect of delayed data, stalled programs, and political dysfunction. One could argue that temporary discomfort is a price worth paying if it spurs a serious reckoning with unsustainable deficits and debt — but history offers little encouragement that such episodes lead to lasting fiscal reform. More often, shutdowns end not with structural solutions but with another temporary fix, leaving the underlying budgetary pressures intact and public patience thinner.

In the broadest sense, US economic activity in September and early October was little changed, with growth uneven and sentiment subdued across regions. The Federal Reserve’s latest Beige Book describes an economy holding steady but losing momentum at the margins: consumer spending edged lower, employment levels were broadly stable, and price pressures remained persistent. Tariffs continued to push up input costs, though businesses differed in whether they absorbed or passed those increases on to customers. Several districts reported flat or modestly weaker activity, while only a few saw slight growth; most contacts described conditions as soft but not collapsing. Labor markets, though looser, showed signs of recalibration rather than deterioration — some employers trimmed headcount through attrition, while others found hiring easier as demand cooled. Persistent strains remain in hospitality, agriculture, and manufacturing, compounded by recent immigration policy shifts and tariff uncertainty. With inflation still above target and growth barely advancing, the Fed is expected to cut rates again later this month to steady conditions. The Business Conditions Monthly indicators will be updated when the constituent data is available. For now, the picture that emerges is of an economy that remains in delicate balance: not contracting, but slowing under the combined weight of trade frictions, policy uncertainty, and eroding confidence from both consumers and businesses.

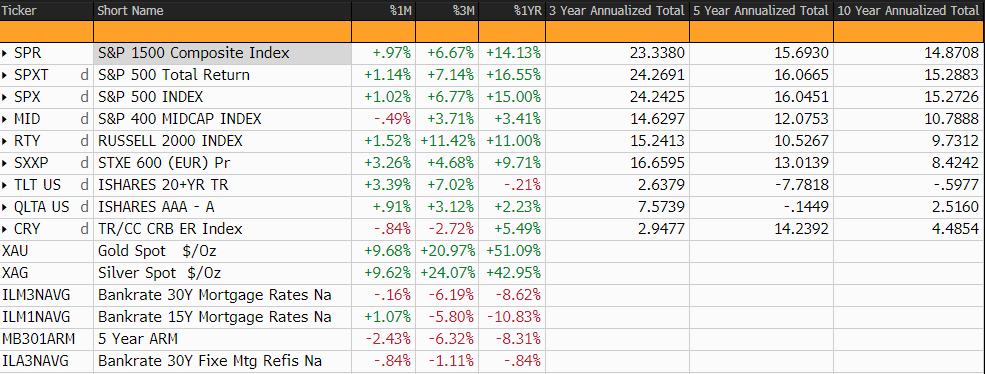

CAPITAL MARKETS PERFORMANCE