On and shortly after Liberation Day, economists warned that tariffs would raise prices, snarl supply chains, and cut into economic growth. Prices are higher, certainly, but haven’t skyrocketed. Goods are, despite early concerns, still on shelves. (Labor markets, on the other hand, are weakening swiftly.) Predictably, partisan cheerleaders are taking a victory lap, claiming the “experts” got it wrong. But the current state of affairs is not vindication: it’s misdirection. The reality is that the threatened tariff regime was never fully enacted, and where tariffs have hit, the pain has been disguised by temporary buffers.

Trade policy rarely lands as a single shock. It comes in waves of announcements, exemptions, delays, and staged rollouts. Large swaths of consumer imports remain untouched or partially shielded. It is buffoonery to suggest that forecasts built on hypothetical outcomes — i.e., what would happen if tariffs were imposed as announced — should be judged against the vastly watered-down, and moreover capriciously imposed, regime that has actually been imposed. To argue otherwise is to miss the point entirely: policymakers often retreat precisely because the dire forecasts are credible. Most individuals — and economists especially — would rather base projections on a combination of theory and historical experience.

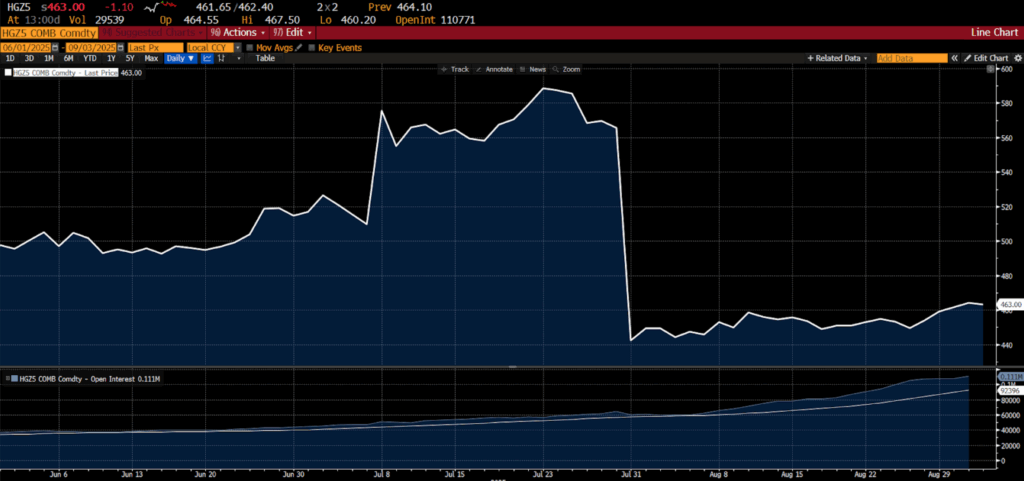

December 2025 copper futures contract (June – August 2025)

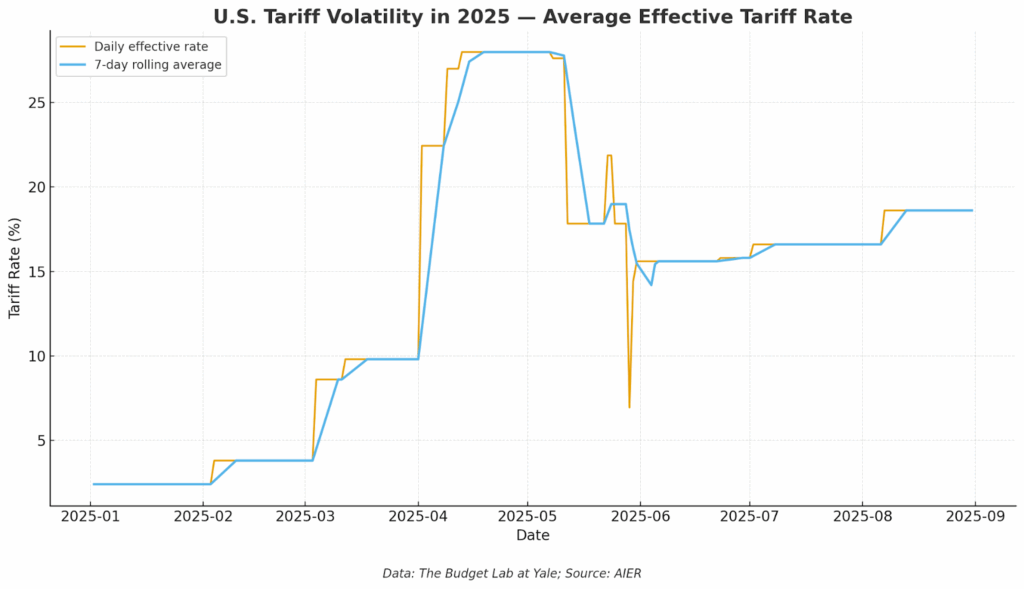

Copper alone is instructive. The administration slapped on a 50 percent tariff, sending shockwaves through markets, then quietly rolled it back —although not without consequences. This is trade policy drafted as if by people who’ve never managed a balance sheet, let alone understand the basics of margins and managerial accounting. For anyone watching, the episode was a case study: threats move markets, tariffs impose costs, and then political calculation intervenes to soften or reverse course. The volatility of the average effective tariff rates since April 2 are erratic enough to attribute to rudderless, arbitrary choices — the mark of policymakers lurching from headline to headline, not executing a coherent economic plan.

Where tariffs have been applied, the costs are temporarily hidden. Firms pre-positioned shipments before deadlines, so consumers are still buying pre-tariff goods. Many companies have “eaten” the costs, compressing margins, leaning on suppliers, or deferring investment to avoid passing price spikes directly to customers. That strategy isn’t sustainable — it’s a bill deferred, not avoided. Substitution to suppliers in Mexico, Southeast Asia, or domestic markets also mutes sticker shock, but at the price of higher costs, thinner supply chains, and creeping inefficiencies.

The broader macro backdrop has provided cover. Strong household balance sheets and a tight labor market (until now) give consumers room to absorb modest bumps. But that resilience is contingent. If growth slows or unemployment rises, tolerance for higher prices will vanish quickly, and the inflationary character of tariffs will become impossible to ignore.

The mistake of today’s triumphalists is confusing delay with disproof. Tariff damage accumulates gradually, showing up in reduced variety, fewer product lines, creeping cost pressures, deferred expansions, and foregone investment. Corporate bankruptcies are rising. These are deadweight losses — less visible at the checkout line but corrosive to long-term growth. Pretending they don’t exist because they aren’t yet dramatic is like declaring cigarettes safe after the first pack because no one coughed.

The illusion that tariffs are harmless today rests on diluted, phased rollouts, inventory buffers, margin compression, substitution, and consumer resilience — all of which are temporary palliatives. Should the effectiveness of those tactics erode, the real costs of protectionism will surface. And if that occurs, today’s mockery of economists will look as short-sighted as “Mission Accomplished” banners in 2003. The greater likelihood is that when negative effects surface, the administration will quickly withdraw its measures and claim victory. Whether the removal of whatever trade levies are in effect at that time will reverse the economic effects is anyone’s guess.

No less than US Secretary of Commerce Howard Lutnich, on March 11, 2025, acknowledged the possibility of a recession on CBS News, saying that if one occurred it would be “worth it.” Four days after the announcement of new tariffs on April 2, Treasury Secretary Scott Bessent instead commented that there was “no reason” to anticipate a recession on the basis of tariffs. Yet after initially blaming a spike in unemployment on a conspiracy within the US Bureau of Labor Statistics, Trump responded to the news of the first negative monthly net change in the total number of US employees on nonfarm payrolls since December 2020 by saying that the “real numbers” would come in a year, and that they would be “job numbers like our country has never seen before.” That is a prediction worth watching particularly closely.

The truth is that forecasts are necessarily, indeed by definition, hypothetical: they project what would happen if policies were enacted as fully and forcefully as they were promulgated at the time. When policymakers retreat from those policies — typically out of fear of exactly those consequences — that doesn’t prove the hypotheticals wrong. It proves the message got through.