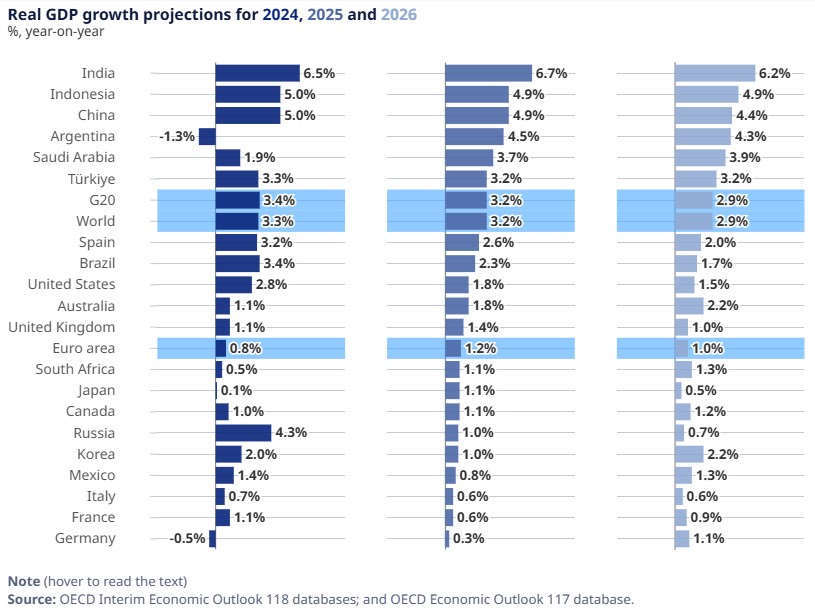

The Organization for Economic Co-operation and Development’s (OECD) latest economic outlook should serve as a wake-up call for Washington. While the organization upgraded global growth to 3.2 percent in 2025 after surprising resilience in the first half of the year, the US economy is still forecast to slow sharply — from 2.8 percent growth in 2024 to just 1.8 percent in 2025, before sliding to 1.5 percent in 2026. That’s barely half our historic post-war average of 3.5 percent. At that pace, America’s economy will take more than three decades to double in size — condemning a generation to slower wage gains, fewer opportunities, and diminished prosperity.

According to the Wall Street Journal, the OECD now believes the US will “slow less sharply” in the near term, but warns that tariffs will hit hard in 2026 as protectionist measures take full effect. And as CNBC reports, global growth was bolstered by emerging markets like Brazil, Indonesia, and India, along with AI-driven investment in the US and heavy fiscal stimulus in China. But these are temporary boosts. The real risks — soaring tariffs, policy uncertainty, and Washington’s fiscal excesses — remain firmly in place.

A Short-Term Lift, a Long-Term Drag

The OECD noted that “global growth was more resilient than anticipated in the first half of 2025,” partly because companies rushed production and trade ahead of the August tariff hikes. In the US, investment tied to artificial intelligence delivered a short-term bump, just as Beijing’s stimulus propped up Chinese output. But these front-loaded gains do not change the trajectory. As the OECD warned, “the full effects of tariff increases have yet to be felt” and are already becoming visible in consumer spending, labor markets, and prices.

The numbers confirm it. Effective US tariff rates jumped to 19.5 percent by August, the highest since 1933. That level of trade restriction is not just a policy tweak; it is a historic reversal of America’s pro-growth, pro-trade legacy. For now, firms are absorbing some of the added costs in margins, but the OECD expects the price impacts to cascade into higher consumer costs and tighter labor markets. Even with a small downward revision in the inflation forecast — US prices are now projected to rise 2.7 percent in 2025, down from the prior 3.2 percent — the warning is clear: tariffs are an inflationary tax that hurts both households and businesses.

Why This Matters for Families

For ordinary Americans, these projections are not just numbers on a page. A 1.5 percent growth economy means real wages stagnate, homeownership drifts further out of reach, and retirement savings erode in value. It means college graduates take longer to find stable, good-paying jobs. It means debt loads grow heavier as Washington’s national debt passes $37 trillion with fewer resources left to sustain it. Slow growth is the silent thief of the American dream.

Washington’s Hand in the Slowdown

The OECD’s language about “weak productivity growth” is a polite way of saying America’s government is strangling its own economy. Federal outlays have soared 88 percent since 2015, growing more than three times faster than the combined pace of population and inflation. That kind of fiscal explosion crowds out private investment and leaves fewer resources for innovators and families.

At the same time, regulation has piled up in every corner of the economy. From energy permitting delays to healthcare mandates to financial compliance, the bureaucratic state has made it harder to start businesses, expand production, or hire workers.

And then there’s industrial policy. Programs like the CHIPS Act pour billions into companies already investing heavily, distorting markets and rewarding political connections rather than productivity. The OECD cautions that these interventions may further weaken long-run growth prospects, and history agrees. Cronyism doesn’t create prosperity; it squanders it.

The Free-Market Path Forward

The solutions are not complicated, but they require political courage. Federal spending must be cut, then capped to grow less than population growth plus inflation — called sustainable budgeting. Tax policy should reward work and savings by flattening the code to eliminate distortions. Red tape should be slashed so that entrepreneurs can innovate without years of bureaucratic delay. And the Federal Reserve’s $6.6 trillion balance sheet should be reduced to restore honest price signals and control inflation.

Other nations prove this works. Ireland, Estonia, and Singapore consistently outperform larger economies by keeping taxes low, regulation light, and markets open. Their success is not an accident — it is the fruit of freedom. America can lead again, but not by doubling down on the failed policies of big spending and protectionism.

Conclusion: A Warning, Not Destiny

The OECD’s projections are a flashing red light, not a prophecy. America’s growth slowdown is not inevitable; it is the direct result of choices made in Washington. Tariffs, runaway spending, and regulatory excess are self-inflicted wounds. If left unchecked, they will make 1.5 percent growth the new normal, robbing a generation of prosperity.

But it doesn’t have to be this way. The fix is clear: spend less, regulate less, and trust people more. That’s how America doubled its economy in 20 years during its golden decades of growth, and it’s how it can do so again. The OECD has raised the alarm. Now it’s up to us to change course — before decline becomes destiny.