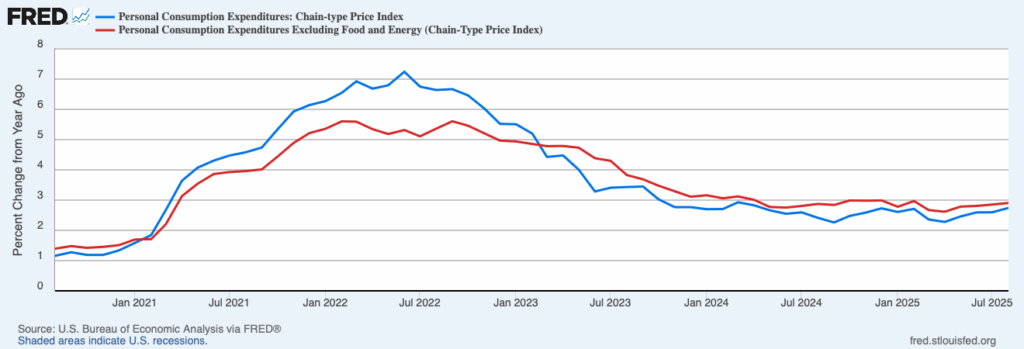

Prices rose faster last month, according to new data from the Bureau of Economic Analysis. The Personal Consumption Expenditures Price Index (PCEPI), which is the Federal Reserve’s preferred measure of inflation, grew at an annualized rate of 3.2 percent in August 2025, up from 2.0 percent in the prior month. It has averaged 2.2 percent over the last six months and 2.7 percent over the last year.

Core inflation, which excludes volatile food and energy prices but also places more weight on housing services prices, declined. According to the BEA, core PCEPI grew at an annualized rate of 2.8 percent in August 2025, down from 2.9 percent in July. It has averaged 2.5 percent over the last six months and 2.9 percent over the last year.

Inflation appears to be closer to the Fed’s two-percent target when imputed — or, estimated — prices are excluded. Some prices, like those for owner-occupied housing and financial services furnished without payment (e.g., free checking accounts), are not directly observed and must be estimated for inclusion in the PCEPI. But there is some debate about the quality of such estimates. Market-based PCE, which is a supplemental measure offered by the BEA based on household expenditures for which there are observable prices, grew at an annualized rate of 2.5 percent in August 2025. It has averaged 2.0 percent over the last six months and 2.4 percent over the last year.

Market-based core PCE, which removes food and energy prices in addition to most imputed prices, grew 1.9 percent in August 2025. It has averaged 2.3 percent over the last six months and 2.6 percent over the last year.

Fed officials seem inclined to attribute the recent uptick in inflation to higher tariffs imposed by the Trump administration, something monetary policymakers should ignore. Last week, the Federal Open Market Committee voted to lower the federal funds rate target range by 25 basis points, marking the first cut since December 2024. FOMC members also signaled that additional rate cuts would soon follow. The median FOMC member projected the midpoint of the federal funds rate target range would decline another 50 basis points this year. That approach is sensible if one expects tariffs will have a temporary effect on inflation, and little-to-no effect on inflation expectations.

“Goods prices, after falling last year, are driving the pickup in inflation,” Fed Chair Jerome Powell said earlier this week. “Incoming data and surveys suggest that those price increases largely reflect higher tariffs rather than broader price pressures.” He noted that prices for services continued to grow more slowly.

Powell also indicated that inflation expectations appear to be well anchored. Although inflation expectations for the next year “have moved up, on balance, over the course of this year on news about tariffs,” Powell said, “most measures of longer-term expectations remain consistent with our two-percent inflation goal.”

At the same time, Fed officials seem worried that tight monetary policy may be causing the economy to grow more slowly than it should. Powell said the “moderation in growth” observed in the first half of 2025 “largely reflects a slowdown in consumer spending.” He also said the labor market had become “less dynamic and somewhat softer,” with higher downside risks to employment.

All of this suggests the Fed will proceed with its plans to cut rates further this year, despite higher inflation. The CME Group reports the implied odds of an October rate cut at 89.8 percent. It reports a 97.2 percent chance that the federal funds rate will be at least 25 basis points lower following the December meeting, and a 65.0 percent chance the federal funds rate will be 50 basis points lower.