Peter C. Earle

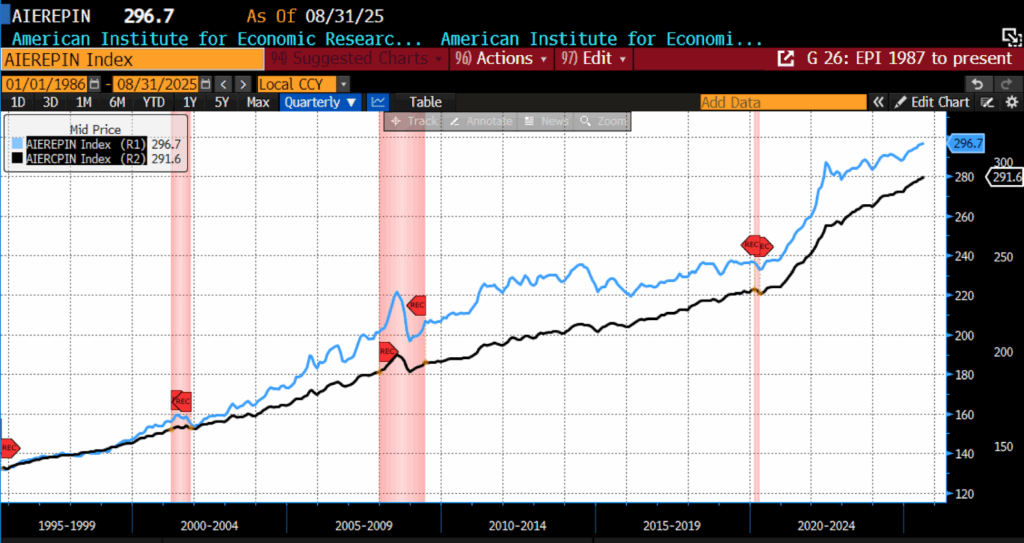

The AIER Everyday Price Index (EPI) rose 0.21 percent to 296.7 in August 2025. Our proprietary inflation index is up 2.9 percent since January 2025, and this increase marks its ninth consecutive monthly rise. Among the 24 price categories, thirteen saw price increases, two were unchanged, and nine saw declines in August. The largest price increases occurred in internet services and electronic information providers, tobacco and smoking products, and recreational reading materials, with the top three price declines seen in nonprescription drugs; admission to movies, theatres, and concerts; and purchase, subscription, and rental of videos.

AIER Everyday Price Index vs. US Consumer Price Index (NSA, 1987 = 100)

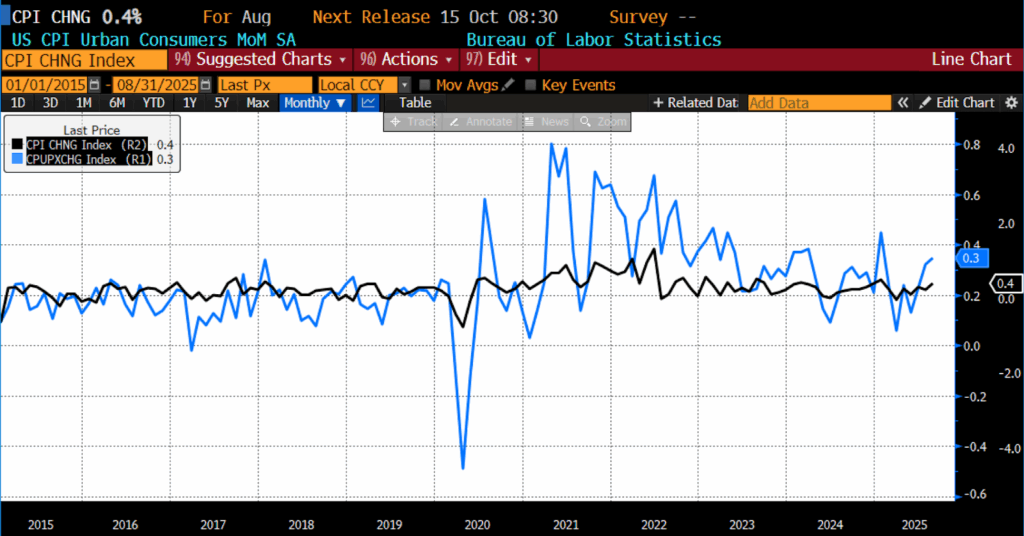

On September 11, 2025, the US Bureau of Labor Statistics (BLS) released its August 2025 Consumer Price Index (CPI) data. The month-to-month headline CPI rose 0.4 percent (missing forecasts of a 0.3 percent increase) while the core month-to-month CPI number increased by 0.3 percent, which met expectations.

August 2025 US CPI headline and core month-over-month (2015–present)

The food index rose 0.5 percent in August after being unchanged in July. Food at home increased 0.6 percent, with all six grocery categories higher. Fruits and vegetables climbed 1.6 percent, led by tomatoes up 4.5 percent and apples up 3.5 percent. Meats, poultry, fish, and eggs gained 1.0 percent, with beef rising 2.7 percent. Nonalcoholic beverages increased 0.6 percent, while both dairy products and cereals and bakery products edged up 0.1 percent. Other food at home also rose 0.1 percent. Food away from home advanced 0.3 percent, with full-service meals up 0.4 percent and limited-service meals up 0.1 percent.

The energy index increased 0.7 percent, reversing a 1.1 percent July decline, with gasoline up 1.9 percent, electricity up 0.2 percent, and natural gas down 1.6 percent. Excluding food and energy, the core index rose 0.3 percent, matching July. Shelter advanced 0.4 percent, including owners’ equivalent rent up 0.4 percent, rent up 0.3 percent, and lodging away from home up 2.3 percent. Airline fares jumped 5.9 percent after a 4.0 percent rise in July. Used cars and trucks gained 1.0 percent, apparel rose 0.5 percent, new vehicles increased 0.3 percent, and household furnishings advanced 0.2 percent, while recreation and communication both slipped 0.1 percent. Medical care declined 0.2 percent, following a July increase of 0.7 percent, as dental services fell 0.7 percent and prescription drugs dropped 0.2 percent; physicians’ services rose 0.3 percent and hospital services were unchanged.

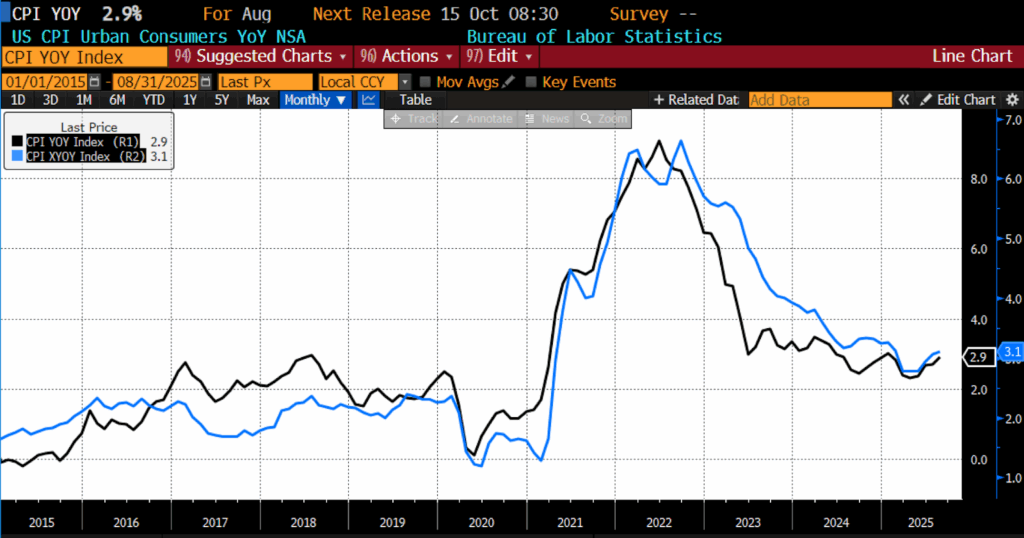

The headline Consumer Price Index rose 2.9 percent between August 2024 and August 2025, which was in line with the forecast. Surveys predicted a 3.1 percent increase in the year-over-year core CPI measure, which it did.

August 2025 US CPI headline and core year-over-year (2015 – present)

The food at home index rose 2.7 percent over the year ending in August. Meats, poultry, fish, and eggs climbed 5.6 percent, while nonalcoholic beverages advanced 4.6 percent and other food at home increased 1.5 percent. Fruits and vegetables rose 1.9 percent, cereals and bakery products gained 1.1 percent, and dairy and related products edged up 1.3 percent. Food away from home increased 3.9 percent, with full-service meals up 4.6 percent and limited-service meals up 3.2 percent.

The energy index rose 0.2 percent over the year. Gasoline fell 6.6 percent and fuel oil declined 0.5 percent, while electricity increased 6.2 percent and natural gas surged 13.8 percent. Excluding food and energy, the core index gained 3.1 percent, led by shelter up 3.6 percent. Additional increases were seen in medical care at 3.4 percent, household furnishings and operations at 3.9 percent, used cars and trucks at 6.0 percent, and motor vehicle insurance at 4.7 percent.

Core consumer prices accelerated in August 2025, rising 0.3 percent on the month and 3.1 percent year-over-year, with the headline index up 0.4 percent, the fastest since January. Goods inflation firmed to 0.3 percent, matching the strongest pace since mid-2023, as categories like new and used vehicles, apparel, and appliances advanced. Analysts debated the role of tariffs, noting increases in beef and tomatoes but also outright declines in tariff-exposed categories such as appliances and personal computers. Services inflation proved stickier, with airfares up 5.9 percent and lodging 2.3 percent, while shelter costs added 0.4 percent, their largest monthly gain this year.

Tariff pass-through appears to be plateauing. Estimates suggest the coefficient of tariff shocks to CPI fell to 0.03 in August from 0.23 in July, consistent with recent price drops in categories such as furnishings, sporting goods, and electronics. Firms that raised prices earlier in the year appear to be moderating amid consumer resistance, though average inflation across tariffed goods still rose slightly — a worrisome sign that opportunistic pricing may be creeping in. Diffusion indexes reinforce that price pressures remain broad: nearly half of core CPI components are still rising at an annualized rate above 4 percent, although the share of categories posting outright declines climbed to 36 percent, up from 27 percent last month.

Labor market data adds complexity to the inflation backdrop. Initial jobless claims surged to their highest level in nearly four years, reinforcing concerns that unemployment is trending higher after earlier payroll revisions cut growth estimates sharply. Real wages edged up just 0.7 percent from a year earlier, the weakest in over twelve months, underscoring that household purchasing power remains strained. While surges in discretionary categories like airfares and hotels point to still-resilient demand, the persistence of high shelter costs alongside rising claims suggests a softer labor market may be colliding with entrenched service-sector inflation.

Market reaction captured the tension. Fed funds futures now price about 27 basis points of easing at next week’s FOMC meeting, with expectations for roughly 72 basis points of cuts by year-end. Policymakers are likely to deliver an initial 25 basis point reduction, but today’s firmer inflation print complicates the trajectory for subsequent meetings. If core inflation continues to run at August’s pace, the probability of multiple cuts diminishes, leaving the Fed to balance labor-market softness against risks that tariff dynamics, shelter inflation, and opportunistic price increases could keep underlying inflation elevated well into the autumn.