US Energy Secretary Chris Wright recently summed up the new federal approach: “We are unabashedly pursuing a policy of more American energy production and infrastructure, not less.” That’s a welcome shift after four years of Washington micromanaging energy markets, imposing costly regulations, and forcing unreliable sources into the grid.

But as someone who lives near Austin, Texas, I’ve seen firsthand that avoiding federal overreach is only part of the solution. States must also resist the temptation to control energy markets — something Texas is starting to get wrong.

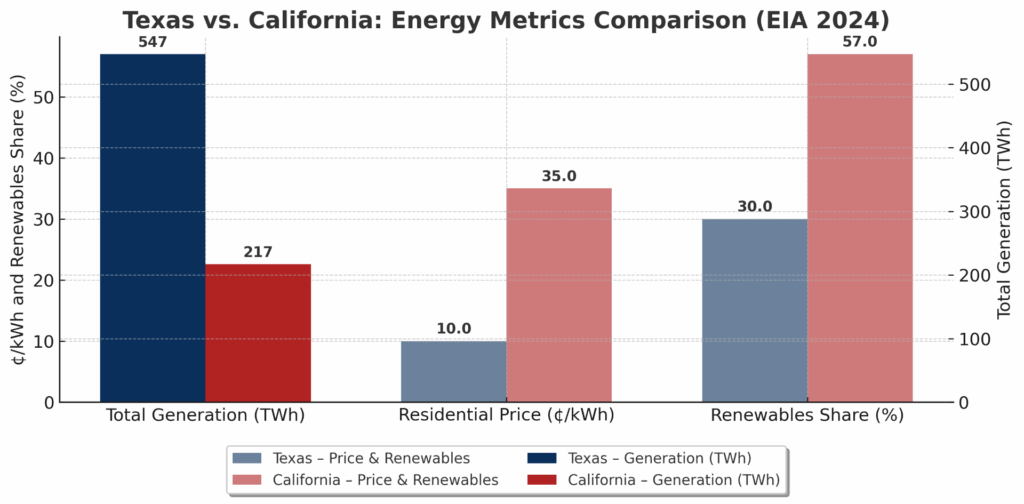

Texas and California are the two largest US states by population and economic output. Their energy policies have produced starkly different outcomes.

- California has some of the highest residential electricity rates in the country, averaging 31.8 cents per kilowatt-hour, compared to 15.5 cents in Texas.

- Texas produced 512 terawatt-hours of electricity in 2023 — more than a quarter of US generation — while California generated 194 terawatt-hours.

- California’s renewable share is 57 percent, compared to Texas’s 31 percent.

But being more “green” doesn’t necessarily mean better. California’s grid is fragile and prone to blackouts, overreliant on intermittent sources. Texans benefit from lower prices and higher output, but Texas now leads the nation in wind generation — a title earned through decades of subsidies, not pure market forces.

That chart tells the story: Texas still delivers more energy for less money, but the policy gap is closing — in the wrong direction. Texas is in danger of losing its competitive edge by repeating California’s mistakes.

Texas Risks Becoming California

The Texas blackout during 2021’s Winter Storm Uri was a wake-up call. As energy economist Rob Bradley, policy expert Bill Peacock, and others have reported, frozen wind turbines and iced-over solar panels were unable to meet demand. Natural gas plants underperformed due to poor weatherization, and the state’s overreliance on intermittent sources magnified the crisis.

Texas’s electricity market is not as “free” as many believe. While Texans can choose their electricity providers in a competitive retail market under the Electric Reliability Council of Texas (ERCOT), the generation side is riddled with subsidies and political interference.

For years, Texas’s Chapter 313 property tax abatement program was heavily favored by wind and solar projects, distorting investment decisions. But that program expired in December 2022. In 2023, the legislature passed another version of property tax abatements in Chapter 403, and voters approved a new constitutionally dedicated Texas Energy Fund, with $5 billion in low-interest, taxpayer-funded loans for new natural gas plants. This year, the legislature passed another $5 billion in subsidized loans and could soon subsidize nuclear power.

This is still political favoritism — only the fuel source changes, leaving a flawed policy intact.

Subsidies Distort Energy Markets

Subsidies heavily distort Texas’s power generation market. Federal production tax credits and Inflation Reduction Act subsidies for wind and solar drive massive overbuilding, even when those sources couldn’t meet demand during peak stress.

Now, Texas is repeating its errors with dispatchable generation — bolstering natural gas with state-backed loans rather than allowing higher market prices to attract private investment. As AIER research has shown, markets allocate resources more efficiently when prices reflect actual costs and risks. When the government guarantees a return, investors chase subsidies rather than consumer demand.

Gabriella Hoffman, director of the Center for Energy and Conservation at the Independent Women’s Forum and a recent guest on my “Let People Prosper” show, makes this point clearly: conservation and market-based energy policy can coexist, but only if the government stops trying to pick winners. Europe’s energy crisis serves as a warning about what happens when political goals take precedence over reliability and affordability.

Energy Freedom Drives Prosperity

Energy is a foundational component of economic growth. It powers manufacturing, health care, technology, and every part of modern life. Energy policy must be grounded in cost-benefit analysis and market principles — not central planning and political favors.

Secretary Wright is correct to warn that Europe’s “net zero” strategy has made energy more expensive and less reliable. The US should not follow suit, and neither should Texas. Instead, lawmakers should remove barriers to pipelines, LNG terminals, and power plants, while eliminating taxes and fees on oil and natural gas production that fund unnecessary government growth.

Living near Austin, I see every day how energy costs shape business decisions and family budgets. People continue to move here from California for lower costs and greater opportunities. But if Texas continues to copy California’s interventionist approach, that advantage will erode.

Power for the Future

Texas’s energy sector still outproduces California’s, delivering lower prices and greater reliability. But government meddling — whether for wind, solar, gas, or nuclear — threatens to undo many of these benefits. The path forward is clear:

- End all tax preferences and subsidies for every energy source.

- Let ERCOT’s price signals work without political interference.

- Approve infrastructure quickly, but without taxpayer guarantees.

- Let consumers and suppliers, not politicians or regulators, decide the energy mix.

If Texas allows people in the market to navigate freely, the state can remain the energy leader that California isn’t. This would also ensure families and businesses continue to move here for the freedom and prosperity they can’t find elsewhere. If not, Texas could find itself with California’s prices, reliability problems, and dependence on politics to keep the lights on.

Chart references:

- US Energy Information Administration (EIA). Net Generation by State (2023).

- EIA – State Electricity Profiles: Texas (2023).

- EIA – State Electricity Profiles: California (2023).

- EIA – Electric Power Monthly, Table 5.6.A: Average Retail Price of Electricity to Ultimate Customers by End-Use Sector, by State (May 2025).

- EIA – California State Energy Profile (includes Renewables Share).

- *EIA – Texas State Energy Profile (includes Renewables Share).