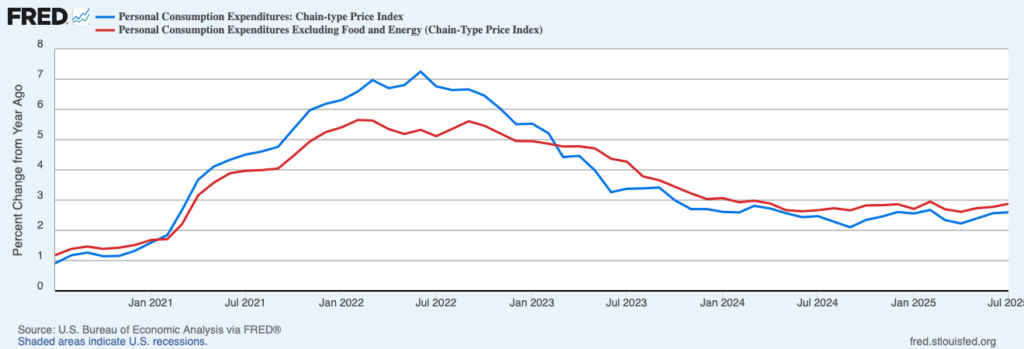

New data from the Bureau of Economic Analysis show that inflation ticked down in July. The Personal Consumption Expenditures Price Index (PCEPI), which is the Federal Reserve’s preferred measure of inflation, grew at an annualized rate of 2.4 percent in July, down from 3.5 percent in the prior month. It has averaged 2.5 percent over the last six months and 2.6 percent over the last year.

Core inflation, which excludes volatile food and energy prices but also places more weight on housing services prices, edged up. According to the BEA, core PCEPI grew 3.3 percent in July, up from 3.2 percent in June. It has averaged 3.0 percent over the last six months and 2.9 percent over the last year.

The decline in inflation is even larger when imputed prices are excluded. Market-based PCE, which is a supplemental measure offered by the BEA based on household expenditures for which there are observable prices, grew at an annualized rate of just 1.1 percent in July, down from 4.1 percent in the prior month. It has averaged 2.2 percent over the last six months and 2.3 percent over the last year.

Market-based core PCE, which removes food and energy prices in addition to most imputed prices, grew 2.1 percent in July after having grown 3.8 percent in June. It has averaged 2.8 percent over the last six months and 2.6 percent over the last year.

Taken together, the latest release reaffirms the view that inflation is on a path back to its 2-percent inflation target—and that the Fed should start cutting its federal funds rate target.

Fed Governor Christopher Waller, who was one of two dissenting votes at the Federal Open Market Committee’s July meeting, has been making the case for rate cuts. Speaking to the Economic Club of Miami on Thursday, he said the more recent “economic data have reinforced” his “view of the outlook and my judgment that the time has come to ease monetary policy and move it to a more neutral stance.”

Federal Reserve Chair Jerome Powell, in contrast, has preferred a wait-and-see approach. However, in his remarks at the annual Jackson Hole Economic Symposium, he appeared to suggest a rate cut could be coming soon. He still believes the “risks to inflation are tilted to the upside,” but his “baseline outlook and the shifting balance of risks may warrant adjusting our policy stance.”

Markets certainly expect the Fed to cut its federal funds rate target soon. The CME Group currently puts the implied odds of a 25 basis point rate cut in September at 87.1 percent, up from 63.3 percent one month ago.

Interestingly, markets also suggest a September cut could be the first in a series of cuts. According to the CME Group, there is currently a 46.5 percent chance that the federal funds rate target is 50 basis points lower following the October meeting and a 38.8 percent chance that it is 75 basis points lower following the December meeting. That would put the federal funds rate between 3.5 and 3.75 percent by the end of the year.

Waller appeared to endorse a series of rate cuts in Miami:

I believe the data on economic activity, the labor market, and inflation support moving policy toward a neutral setting. Based on the median of FOMC participants’ estimates of the longer-run value of the federal funds rate, neutral is 125 to 150 basis points lower than the current setting. While I believe we should have cut in July, I am still hopeful that easing monetary policy at our next meeting can keep the labor market from deteriorating while returning inflation to the FOMC’s goal of 2 percent. So, let’s get on with it.

He said “there is a growing consensus that monetary policy needs to be more accommodative, and even some recognition that it would have been wise to begin this process in July.” Waller said he anticipates “additional cuts over the next three to six months, and the pace of rate cuts will be driven by the incoming data.”

Whether other Fed officials have come around to Waller’s view or continue to believe a slow path back toward neutral is preferable remains to be seen. But the tides are turning.