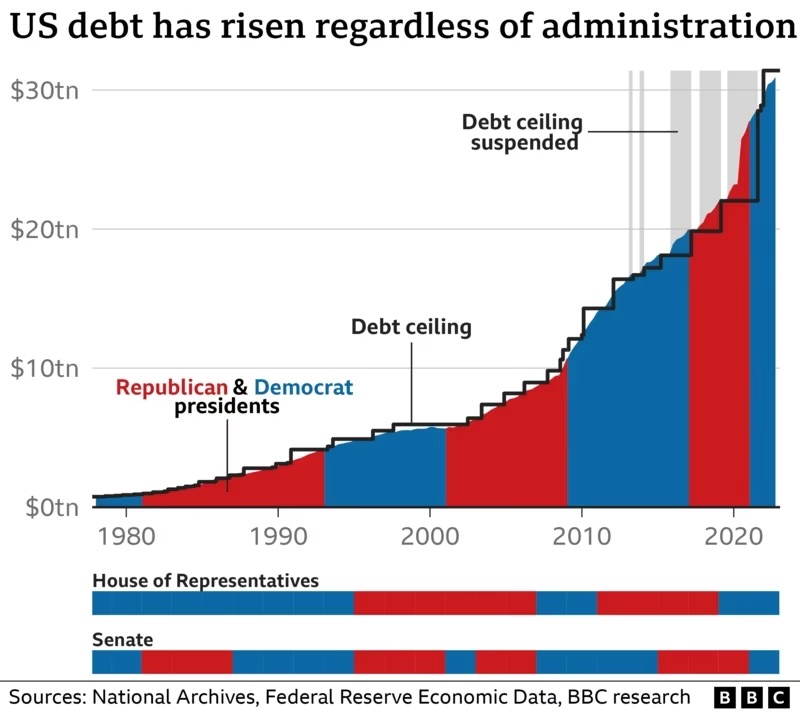

Larry Summers recently claimed on X that Republican tax policies — specifically the One Big Beautiful Bill (OBBB) pushed by Trump and congressional Republicans — are a major reason why the US is headed toward a debt crisis. He even revived his favorite 40-year claim that “the economy performs better under Democratic presidents.”

Let’s be blunt: that’s nonsense. Summers is ignoring the actual root of the crisis — runaway spending by both major parties — while defending the very policies that got us into this mess.

The real danger isn’t pro-growth tax reform, which the OBBB could improve. It’s the $2.5 trillion in overspending annually since COVID and the elevated trajectory that no one in Washington seems willing to reverse.

America’s federal budget has exploded from $4.5 trillion in FY 2019 to a projected $7 trillion in FY 2025. That’s a 56 percent increase in just six years, with much of that needlessly baked into permanent baselines. This isn’t fiscal policy — it’s economic malpractice.

And yes, the original surge began under Trump and Congress in 2020, when emergency COVID aid was rushed out with no spending offsets or accountability. But rather than rolling back those levels, President Biden and Congress doubled down, institutionalizing new programs, inflating the bureaucracy, and racking up debt faster than ever. Both parties lit the fuse.

Trump’s Promises vs. Washington’s Results

To his credit, Trump often says the right things:

“We’re going to eliminate waste, fraud, and abuse.”

“We want a simpler, better tax code.”

“We need to cut spending.”

But as I explained in The Daily Economy, his execution — the “art of the deal” — often failed to deliver. Rather than shrinking the state, Trump too often negotiated up — signing trillion-dollar spending deals, boosting the defense and border budgets, and giving Democrats massive domestic wins. Fiscal hawks were sidelined. The swamp stayed full.

That said, there’s still time to learn from those mistakes — and build the policy package this country needs.

What Should Trump and Congress Do Now?

1. Return federal spending to FY 2019 levels.

This simple move could save $2.5 trillion per year without touching entitlements. Most of the post-COVID increase went to temporary programs, pandemic-era expansions, and bureaucratic growth. Roll it back. If families can tighten their belts, so can Washington.

2. Cap spending growth with a rule like TABOR.

Colorado’s Taxpayers’ Bill of Rights (TABOR) ties spending to population growth plus inflation. It works even with a Democrat trifecta — and could work federally. Even the Budget Control Act of 2011, passed by Congress during Obama’s presidency, temporarily restrained spending. We need a permanent version.

3. Improve the 2017 Trump tax cuts.

The Tax Cuts and Jobs Act helped working families and boosted investment — but it didn’t go far enough:

- Eliminate or lower the corporate income tax. Businesses don’t pay taxes — people do through higher prices, lower wages, lost jobs, and lower shareholder returns.

- Flatten and lower individual tax rates with fewer carveouts, no SALT handouts, and no gimmicks like “tax-free tips,” “no tax on social security,” and “no tax on overtime.” When will we finally have “no tax on income”?

- Make full expensing permanent to boost investment and productivity.

4. Slash wasteful subsidies and spending, starting with healthcare.

As Dr. Deane Waldman and I have shown in Empower Patients, healthcare is Washington’s most expensive disaster — and it’s not because of patients or providers.

It’s the $2 trillion in annual regulatory waste, bureaucratic duplication, and command-and-control mandates that inflate costs and undermine care.

We should:

- Empower patients with universal access to competitive healthcare options

- Eliminate distortive third-party payment systems, replace them with no-limit HSAs.

- Cut the red tape that traps doctors and nurses in compliance quicksand.

Fix healthcare, and we fix the largest part of the budget.

What Summers Gets Wrong — and Why It Matters

Summers argues that Democratic presidents manage the economy better. But this analysis ignores what’s actually driving economic performance: institutional stability, sound money, capital investment, and economic freedom.

None of that comes from growing government. All of it comes from unleashing the private sector.

Summers supports more taxes, more spending, and more central planning. But this only magnifies the uncertainty that has businesses holding back investment and families losing hope. As I’ve said before:

“Progressives expand the welfare state in the name of equity.

National conservatives expand the corporate welfare state in the name of industrial policy.

Either way, it’s economic socialism — and it’s bankrupting America.”

What Really Works? Econ 101.

We don’t need Summers-style spin. We need Econ 101 — the foundational principles politicians keep ignoring.

Here are just a few:

- Nothing is free – Every government dollar is taken from someone else.

- Trade creates value – Voluntary exchange beats tariffs and “Buy America” mandates.

- Profits and losses matter – Bailouts and subsidies distort incentives and reward failure.

- Inflation comes from the Fed – Not “greedy corporations” or external shocks.

- Stop the broken window fallacy – Rebuilding what was destroyed isn’t economic growth.

- Let people prosper – Washington doesn’t create wealth. People do.

This is the real playbook for economic renewal — not more top-down tinkering from elites.

A North Star for Real Reform

Many say bold reform is politically impossible. But as Milton Friedman reminded us:

Only a crisis — actual or perceived — produces real change. When that crisis occurs, the actions that are taken depend on the ideas that are lying around.

Let’s make sure the right ideas are lying around.

Yes, politics is hard. Yes, the status quo has inertia. But truth doesn’t change — and economic reality doesn’t care about party platforms. If we want a future of opportunity and prosperity, we need policies that reflect that truth.

Cut spending. Flatten and reduce taxes. End subsidies. Fix healthcare. Unleash markets. Empower people. This is how we get back on track.

And we must act now — not because it’s easy politically, but because it’s essential morally and economically. America can’t afford another decade of delay, dysfunction, or disinformation from failed ideas recently expressed by Summers.