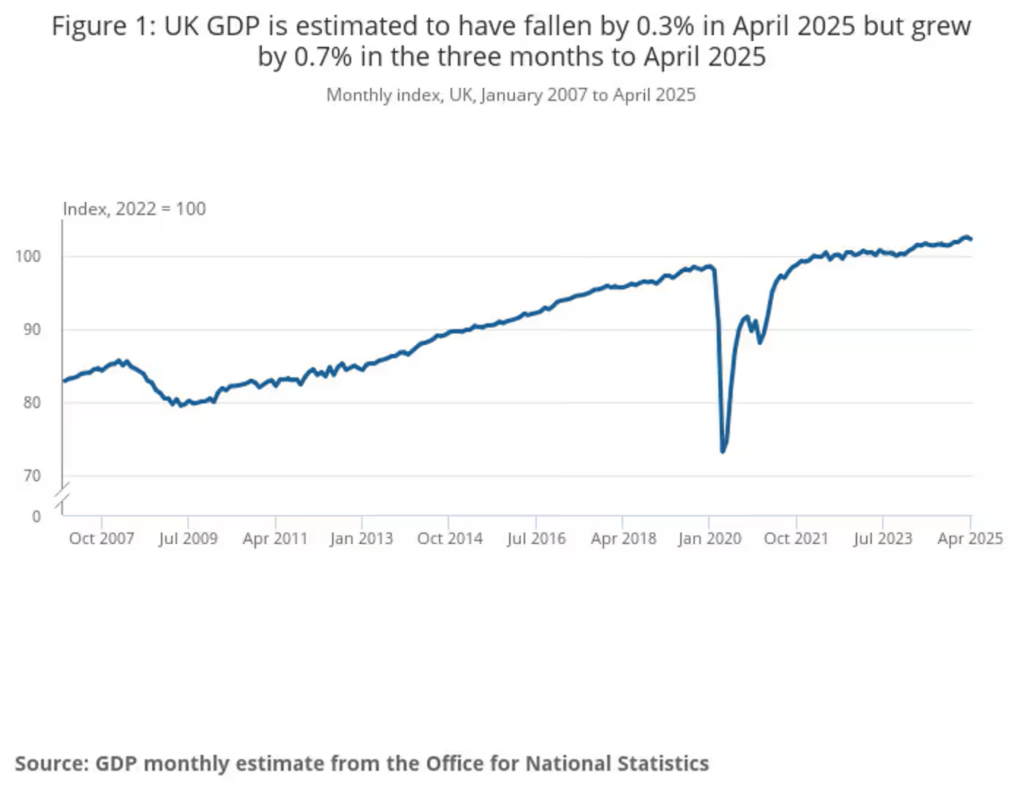

The UK economy shrank by 0.3% in April, a sharper-than-expected decline that has raised fresh concerns about the fragility of the recovery and the growing pressure on both households and businesses.

Figures released by the Office for National Statistics (ONS) on Tuesday showed that the fall in gross domestic product (GDP) was driven by a 0.4% drop in the services sector — the largest contributor to the overall contraction.

Production output also declined by 0.6%, while construction output offered a rare bright spot with a 0.9% increase.

The latest data underscores the challenges facing Prime Minister Keir Starmer’s Labour government, which took office after a landslide election victory last summer.

The April decline marked the sharpest monthly fall in GDP since October 2023 and the worst performance since Labour came to power.

Economists surveyed by Bloomberg had predicted only a 0.1% decline in GDP for April. The larger contraction may complicate the government’s fiscal plans ahead of the autumn Budget.

Chancellor of the Exchequer Rachel Reeves told Sky News:

“We know that April was a challenging month.”

“There was a huge uncertainty about tariffs, and one of the things, if you dig into those GDP numbers today, is exports weakening and also production weakening because of that uncertainty in the world around tariffs.”

She added that the figures for April were “disappointing, but also perhaps not entirely unexpected”, given global economic uncertainty.

Source: The Guardian

Exports fall by £2 billion amid Trump tariffs, pulling growth down

A significant drag on growth came from the collapse in exports to the United States, which fell by £2 billion in April.

The ONS said this was the largest monthly drop in US-bound goods exports since records began in 1997.

The decline followed President Donald Trump’s announcement on April 2 of a blanket 10% tariff on imports from the UK, part of a wider effort to reshape global trade.

The impact was felt across several sectors, with notable declines in car shipments, non-ferrous metals, and chemical exports.

While UK officials have since negotiated a new trade agreement with the US, the tariffs still applied during April and were cited as a major factor in the economic downturn.

“After increasing for each of the four preceding months, April saw the largest monthly fall on record in goods exports to the United States with decreases seen across most types of goods, following the recent introduction of tariffs,” said Liz McKeown, Director of Economic Statistics at the ONS.

Tax pressures, weak demand weigh on output

Domestically, the economic landscape in April was shaped by higher energy bills, increases to payroll taxes and the national minimum wage, and an overall tightening of household finances.

Retail sales fell as consumers pulled back after stronger spending earlier in the year.

Real estate and legal services experienced a sharp drop in activity, reflecting a slowdown in home sales amid tax-related transaction changes.

The latest figures contrast sharply with the stronger-than-expected performance in the first quarter, which Labour had touted as evidence that the UK economy was turning a corner.

However, economists have warned that much of that strength was driven by temporary factors, including a rush by exporters to ship goods ahead of anticipated tariffs.

“Weaker growth is a headache for the chancellor as it makes generating the revenue government needs to support its sizable spending plans more difficult, increasing the chances of further tax rises in the autumn Budget,” said Suren Thiru, economics director at the Institute of Chartered Accountants in England and Wales in a Bloomberg report.

Outlook dims for second quarter

The outlook for the second quarter remains muted.

Most analysts now expect growth of just 0.1% between April and June, significantly below earlier forecasts.

The fragile trajectory of the economy is further clouded by Trump’s escalating trade measures and ongoing global uncertainty.

While April’s construction growth offered a glimmer of resilience, the broader picture remains troubling for policymakers, businesses and consumers alike.

With mounting job losses and tighter financial conditions, the challenge of sustaining growth in the face of global headwinds and domestic constraints continues to loom large.

The post UK GDP falls by 0.3% in April as services slump and US tariffs bite appeared first on Invezz