US tariffs on steel and aluminum were doubled, but the metal markets appear to have quickly absorbed the impact.

Aluminum prices on the LME have already fully rebounded to approximately $2,440 per ton after a brief dip.

“The market therefore does not currently seem to expect any major impact on the global supply situation for the raw materials affected,” Thu Lan Nguyen, head of FX and commodity research at Commerzbank AG, said in a report.

However, the consequences are more far-reaching than they appear at first glance.

Nguyen said:

It can be assumed that the tariffs will have an impact on other segments of the metal market on the one hand and on the foreign trade policies of other nations on the other.

Demand shift

According to experts, tariffs usually lead to a shift in demand to other substitutes.

An immediate increase in US production capacities for aluminum and steel is improbable, given their typically slow response times. Therefore, this trend is expected to be even more pronounced for these materials, according to Commerzbank.

The US steel market is, fortunately, not excessively tight.

US steel mills demonstrated strong capacity utilisation last year, operating at 72-78% during the first eight months. This high domestic output largely met consumption needs, evidenced by imports constituting a mere 13% of apparent consumption.

USGS data indicated that US aluminium smelters operated at only 50% capacity utilisation in 2024, suggesting potential for expansion.

Even at full production capacity, only approximately 30% of consumption would be met, Nguyen noted.

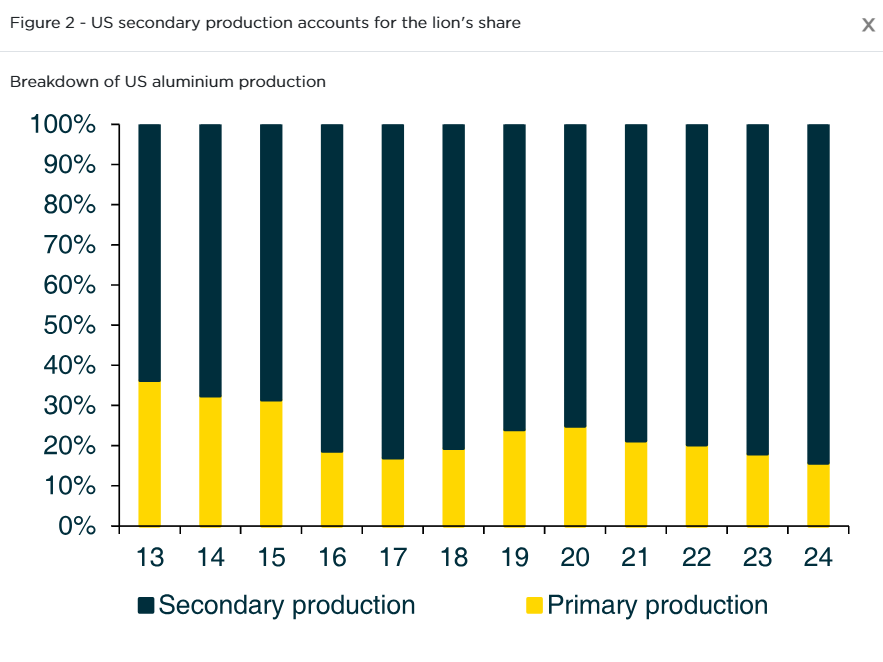

Given that secondary production, specifically the recycling of aluminum scrap, already constitutes approximately 80% of US aluminum output, the aluminum industry is poised to increasingly prioritise this sector, Commerzbank said.

This focus is expected to further invigorate secondary production.

Secondary aluminium production

The recycling of aluminium scrap in the US is likely to have consequences for secondary production outside the US.

According to European Aluminium, the recent dramatic acceleration of EU metal scrap exports to the US is undoubtedly linked to aluminium tariffs.

These tariffs are causing a shift in US demand from primary to secondary aluminium.

Beyond the US, aluminum scrap prices are expected to decline in the medium to long term.

This is largely due to the increased availability of primary aluminum.

US companies have ceased importing primary aluminum due to prohibitive tariffs, which could make exporting to the US more appealing, Nguyen added.

Divergence in EU and US prices to continue

“One could argue that demand outside the US will likewise shift from secondary to primary production, meaning that the supply situation would remain more or less unchanged, at least from a global perspective,” Nguyen said.

Nevertheless, this is probably unsuitable for the EU, given its commitment to boosting its domestic supply of crucial minerals and metals.

EU also aims to increase secondary production for sustainability, as it is less energy and resource-intensive than primary production.

Due to the recent US tariff increase, the introduction of restrictions on scrap metal exports is now highly probable and under consideration in the EU.

“Restricting these exports would lead to a higher supply of scrap metal on the EU market and put pressure on prices there, which were already expected to come under pressure due to a higher supply of primary aluminium,” Nguyen said.

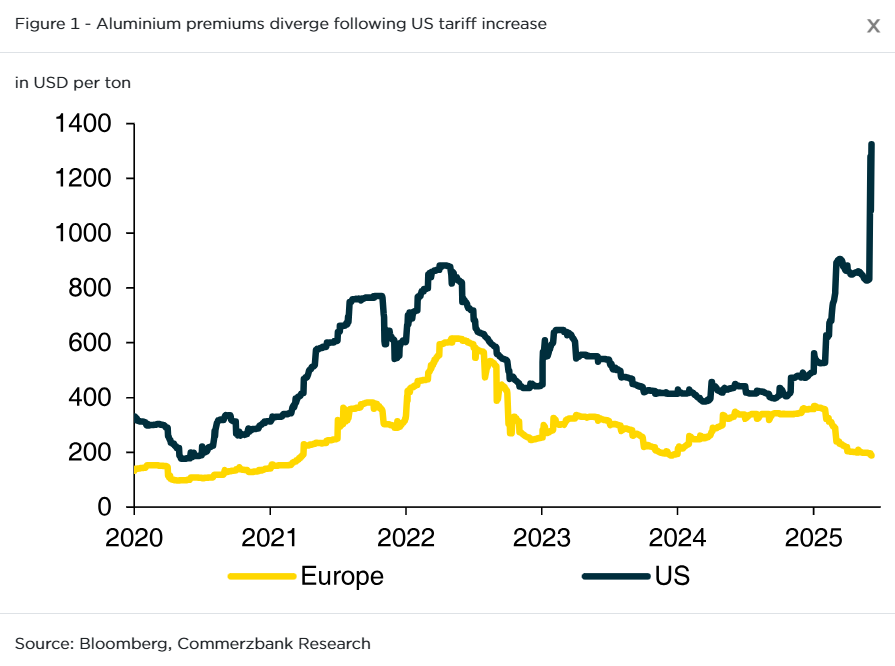

The divergence in aluminium prices between the US and Europe is therefore likely to continue.

The post Aluminum and steel tariffs spark rise in secondary production, price divergence appeared first on Invezz