The latest Real Gross Domestic Product (GDP) release from the Bureau of Economic Analysis (BEA) shows a net decrease from Q4 2024. This net decrease “primarily reflected an increase in imports, which are a subtraction in the calculation of GDP, and a decrease in government spending…partly offset by increases in investment, consumer spending, and exports.”

The choice of phrasing can lead to some misunderstanding. Imports are subtracted from GDP as a matter of accounting, not because they hurt economic growth. Investment, consumption, and government spending already include imported goods so imports are subtracted from GDP calculations to avoid double counting.

Conversely, government spending is treated as a boon to economic growth while the cost of government spending is ignored. Government spending gets paid for through taxation, taking on debt, and/or printing money, all of which are a cost upon ordinary Americans.

It’s time our measures of economic growth reflect some hard truths: that government spending comes at a cost to our standard of living and that the economy grows despite government intervention, not because of it.

While the BEA publishes a measurement titled “Value Added by Private Industries (VAPI),” it does not get nearly as much attention as it deserves. The most recent data show that VAPI contributes to just under 89 percent of all economic growth. Despite this, GDP is still the more prominent metric, in part because the BEA treats government spending as a value added to the economy.

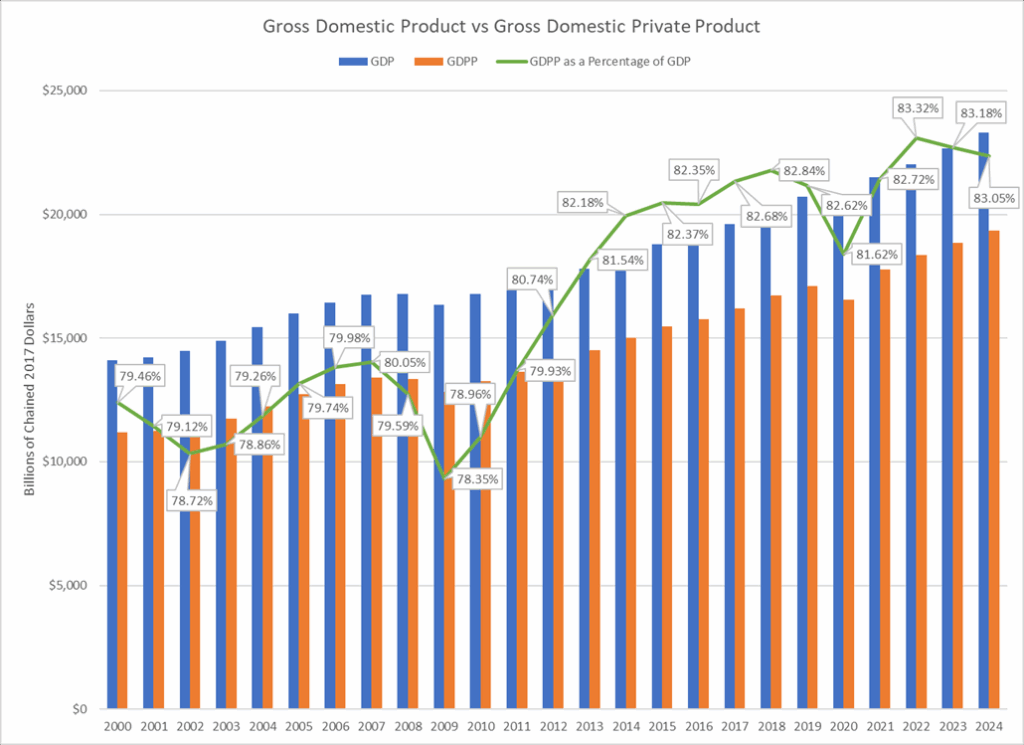

Last year, we examined GDP minus government spending, which we referred to as Gross Domestic Private Product (GDPP). Economist Murray Rothbard called this “Private Product Remaining.” Here are our latest findings.

This updated chart also shows the percentage of GDP made up by GDPP. Note that these percentages differ slightly from VAPI estimates. This is because VAPI includes private outputs that are purchased by government (i.e. a defense contractor) while GDPP treats those purchases as part of “Government Consumption and Gross Investment.”

A cursory glance at the BEA’s description of government assumes that all levels of government “contribute to the nation’s economy when they provide services to the public and when they invest in capital. They also provide social benefits, such as Social Security and Medicare, to households.”

The description also notes that the government gets its revenue taxes, transfers, and fines, as well as rent and royalties. It fails to mention, however, that government receipts come at a cost. That cost, what economists call opportunity cost, is the next-highest valued use of that money.

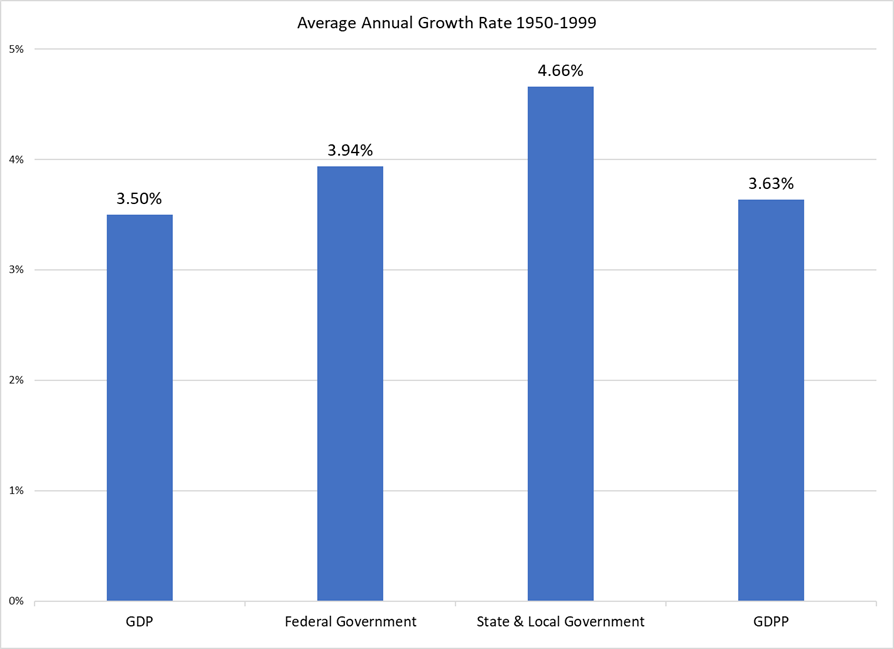

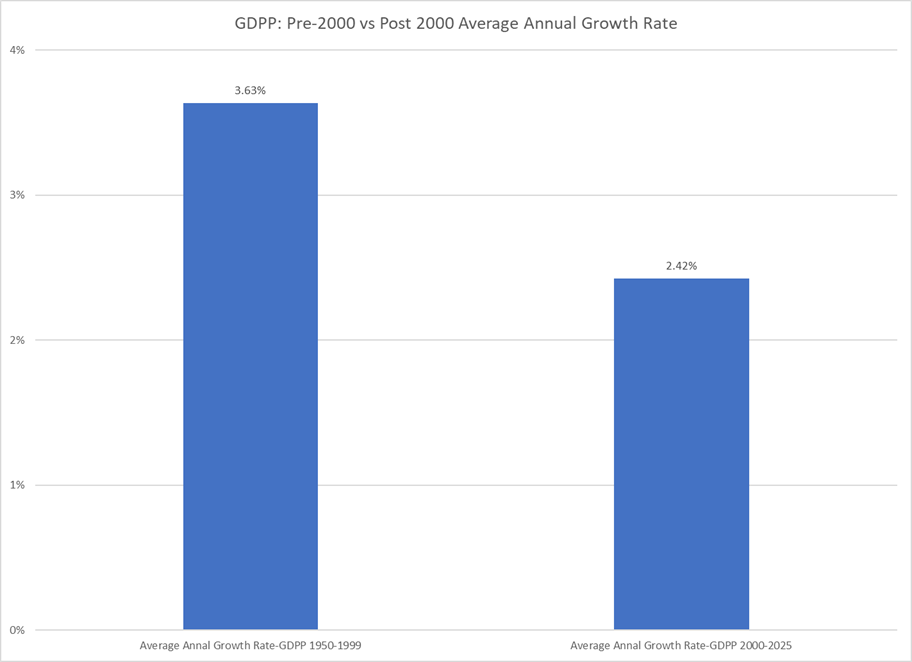

We can see this effect reflected in the BEA’s own data. When examining the growth of government and the private sector both before and after 2000 in our analysis published last year, government growth (both federal as well as state and local) outpaced that of the private sector. Below is an updated analysis of last year’s findings. Note that the same still holds true: Government outpaces the growth of the private sector, especially state and local governments.

Furthermore, we find that the private sector has grown 33 percent slower per year since the start of the new millennium. It is also important to remember that transfer payments, such as Social Security or unemployment insurance, are excluded from GDP estimates of government spending because those transfers are counted toward private spending.

As many Americans filed their income taxes earlier this year, their W-2 forms highlight how much money they hand over to the federal, state, and local governments. When they look at those amounts, they may be shocked to see how much was withheld and consider what they would have otherwise done with that money. Maybe it would be put toward groceries and gas, maybe it would be put toward car repairs or medical treatments, or maybe it would be set aside for a rainy day.

The same could be said for the government taking on debt. When any level of government issues debt, it takes private capital away from other projects in which private investors might have otherwise invested or provided financing for. Debt-financed spending also shifts tax burdens from the present to the future. While bond investors trust that their loans will be paid back with interest, future generations will bear the cost of government spending undertaken today.

Let’s not forget printing money. If the federal government finances spending with newly printed money, the resulting inflation destroys the purchasing power of the dollar, making everyday goods and services more expensive.

State and local governments also heavily rely on transfers from the federal government. These transfer payments allow policymakers at the state and local level to increase spending at the cost of federal taxpayers who live in other states.

Whether or not the benefits of government spending outweigh the costs is a debate worth having, but official metrics must more clearly communicate that government is a cost in the first place.

Consider Social Security payroll taxes, which the BEA claims, “employer and employee contributions to government social insurance.” If these contributions are not made, however, employers and employees could face penalties—including jail time. The sad truth is that employers and employees could have earned a better return on investment if they had put their payroll tax money in the S&P 500 instead of the required Social Security tax.

A recent review of the academic literature on government stimulus in the economy finds that government stimulus makes, at best, modest, short-term contributions to economic activity. In the long-term, however, the review finds that government stimulus effects “often diminish or turn negative due to reduced private investment and consumption, emphasizing the role of anticipatory effects and private-sector responses.”

Economists, both past and present, have argued that calculating government contributions to the economy is more complicated than official GDP calculations claim. Economist Patrick Newman notes Nobel Prize-Winning Economist Simon Kuznets’s own objections that government was treated as “an ultimate consumer” on par with private consumers regardless of whether private citizens valued government consumption and investment. Newman takes Kuznets’s concerns further and argues that such positive treatment of government in economic growth calculations opened the door to the flawed views of Modern Monetary Theory.

Alternatively, economists Vincent Geloso and Chandler S. Reilly examine government consumption and investment minus defense spending, called “Defense-Adjusted National Accounts”. The result is a much lower level of GDP, but the clear lesson “that wars do not improve living standards.” These challenges to the status quo of economic growth calculations help, in the words of Geloso and Reilly, “bridge the gap between official economic data and the perceptions of the American public.”

If the average American can see the opportunity cost of the money the government takes from them, there’s no reason the economics profession or government officials cannot reflect and communicate those costs in economic growth measurements as well.