On May 16, Moody’s Ratings downgraded the US government’s long-term issuer and senior unsecured ratings from Aaa (the highest possible rating) to Aa1 and revised the outlook to stable from negative. The rating agency cited the likelihood of “persistent, large fiscal deficits [that] will drive the government’s debt and interest burden higher” due to deficits driven by increasing entitlement spending and plateauing tax revenues.

Moody’s, however, was late to the party. S&P Global ratings downgraded the US government’s credit rating in 2011, and Fitch Ratings issued a downgrade in 2023. Both cited similar concerns over growing budget deficits and doubts about the ability to pay them.

Unfortunately, when the US cannot keep its finances in order, American families will feel the squeeze through higher borrowing costs, higher taxes, a more aggressive tax collection regime, and a weaker dollar.

Government Debt Hurts Private Borrowers

At a basic level, the yield curve (a visual representation of how much it costs the Treasury to borrow money for different periods of time) serves as a benchmark for market interest rates, including corporate bonds and mortgage rates. Much like when a credit score downgrade results in higher personal borrowing costs, the US credit downgrade will mean higher borrowing costs to offset the increased risk of lending. These higher borrowing costs will be reflected on the yield curve and prompt private creditors to raise interest rates to firms and individuals as well.

Nobel Prize-winning economist James Buchanan noted that when private investors purchase government debt, they forgo the next-highest valued use of their capital. As Buchanan put it, spending that is funded by debt is “in effect chopping up the apple trees for firewood, thereby reducing the yield of the orchard forever.”

Government borrowing diverts capital from more productive private sector uses (i.e. research, innovation, and/or business expansion) that could help improve the standard of living for everyday Americans.

Furthermore, the government’s growing demand for loanable funds puts upward pressure on interest rates (the price of borrowing). Lenders will demand higher returns, and individual borrowers will need to offer more competitive terms to access credit. This means higher interest rates on mortgages, credit cards, and personal loans.

Government Debt Hurts Taxpayers

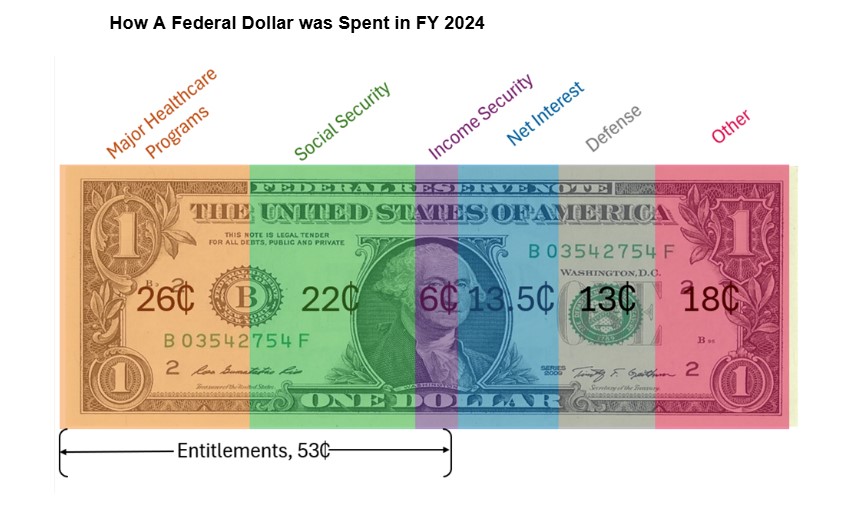

As the US government faces higher borrowing costs, net interest payments (the interest the government must pay on its debt, offset by interest income) will dramatically increase. The image below comes from the AIER Explainer “Financing the Federal Government: How Government Takes & Spends Your Money”; it depicts a breakdown of how the federal government spent each dollar in FY 2024, which ended on October 1, 2024, long before the Moody’s downgrade.

Note that 13.5 cents of every dollar went to net interest payments. As borrowing costs increase, more spending is dedicated to net interest payments, which then crowds out funding for other federal programs. My former colleague Brooklyn Roberts and I discussed this after the Fitch Rating downgrade in August 2023, noting that cuts to transfer payments (particularly Medicaid) to state and local governments would be seen by federal policymakers as more politically viable than addressing bloated federal programs.

So far, the federal government has spent $578.7 billion on net interest payments out of the $4.16 trillion spent this fiscal year. In other words, 14 cents of every dollar this fiscal year is going to net interest payments, which is likely to increase by the end of FY 2025.

Buchanan also noted that debt-financed spending shifts tax burdens from present to future generations. While bond investors trust that their loan will be paid back with interest, future generations will bear the cost of the government spending undertaken today.

A Declining Dollar Hurts Everyone

The credit downgrade, along with uncertainty in monetary policy, has hurt the dollar. The US Dollar Index (DXY) fell following the credit downgrade announcement and continues to decline. Analysts also note that the decline in demand for Treasury notes also led to a decline in demand for dollars.

As the demand for the dollar decreases, a sell-off of dollar assets could increase the supply of dollars in the foreign exchange market, leading to further depreciation in the dollar’s value. This depreciation is likely to lead to reduced living standards, weaker economic growth, and higher inflation.

Ultimately, policymakers in Washington are only hurting themselves. As my colleague Pete Earle aptly put it:

“The greatest threat to the soundness and utility of the US dollar, and in turn to the financial health and prosperity of American civil and commercial life, comes not from shadowy figures in faraway lands, but from unremarkable apparatchiks carrying out the edicts of US officialdom.”

As the US loses its status as the world’s reserve currency, politicians and bureaucrats in Washington have no one to blame but themselves.

Can Washington Course Correct?

Earle notes that there is still time to correct course through “economically coherent, consistently applied policies.” Ultimately, this must come from serious spending reform and (particularly) spending reduction.

My colleague Ryan Yonk and I lay out several options for spending reform in the AIER Explainer “Understanding Public Debt.” While the Department of Government Efficiency (DOGE) seemed to get off to a promising start in January, it failed to tackle the primary driver of spending growth: entitlements. Worse, members of Congress have thus far failed to make the few cuts DOGE recommended permanent. Now, DOGE Director Elon Musk is stepping down.

After the news of Musk’s DOGE exit broke, a headline from The Babylon Bee quipped “Elon Musk Leaves Job Of Making Government More Efficient For Much Easier Job Of Sending Humans To Mars.”

Reversing course is possible, but it will demand political courage and coordination to overcome the incentives millions in the federal government have to maintain “business as usual.” Let’s hope such a transformation is still possible.