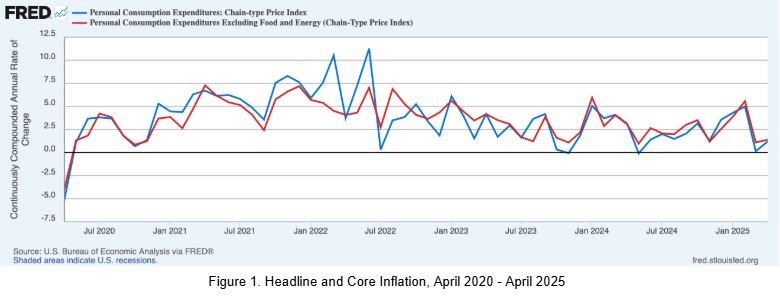

Will the Federal Reserve undershoot its inflation target this year? The Personal Consumption Expenditures Price Index (PCEPI) grew at an annualized rate of 1.2 percent in April 2025, marking the second consecutive month of below-target inflation. PCEPI inflation has averaged 2.1 percent over the last three months and 2.6 percent over the last six months.

Core inflation, which excludes volatile food and energy prices, also remained low. Core PCEPI grew at an annualized rate of 1.4 percent in April 2025, after growing just 1.1 percent in the prior month. Core PCEPI inflation has averaged 2.7 percent over the last three months and 2.6 percent over the past six months.

The Fed has generally overshot its inflation target over the last four years. Headline PCEPI has averaged 4.0 percent per year since April 2020, whereas core PCEPI has averaged 3.9 percent. However, inflation has declined since July 2022, with fits and starts, as the Fed tightened and then maintained tight monetary policy. If the Fed continues to hold its federal funds rate target above the neutral rate, inflation will fall further still.

The Federal Open Market Committee voted to hold its federal funds rate target at 4.25 to 4.5 percent earlier this month.

Recall that the nominal federal funds rate target is equal to the real federal funds rate target plus expected inflation. Suppose the public expects this month’s 2.1 percent inflation will persist. That would imply a real federal funds rate target range around 2.15 to 2.4 percent.

For comparison, the New York Fed estimates the natural rate was 0.80 percent 2024:Q4 using the Holston-Laubach-Williams method and 1.31 percent using the Laubach-Williams method. The Richmond Fed estimates the natural rate was 1.86 percent in 2024:Q4. All three measures of the natural rate fall well below the implied real federal funds rate target range estimated above. Hence, monetary policy remains tight.

Furthermore, monetary policy will likely remain tight through much (and perhaps all) of 2025. Back in March, the median Federal Open Market Committee (FOMC) member projected the federal funds rate target range would decline to just 3.75 to 4.0 percent by the end of the year. According to the CME Group, the futures market currently expects the first 25 basis point cut will come in September and the second 25 basis point cut to follow in December.

Assuming the Fed’s rate cuts come as expected and the public continues to expect 2.1 percent inflation, the implied real federal funds rate target range would fall to 1.9 to 2.15 percent in September and 1.65 to 1.9 percent in December. The former exceeds all three estimates of the natural rate presented above, whereas the latter exceeds two of the three. Hence, monetary policy currently looks likely to remain tight through September and possibly through December.

Finally, consider the potential dynamics of tight monetary policy. If monetary policy remains tight, inflation will likely decline. As inflation declines, inflation expectations will likely decline as well. All else equal, declining inflation expectations raise the implied real federal funds rate target, further tightening monetary policy. Hence, monetary policy will likely be even tighter than the back-of-the-envelope calculations above suggest, unless the Fed changes course. Correspondingly, inflation would fall further than those estimates suggest.

After years of above-target inflation, below-target inflation may seem like a welcome relief. I can certainly understand the sentiment. I am generally in favor of a monetary policy rule that makes up for above-target inflation with below-target inflation, and have criticized the asymmetric make-up policy the Fed introduced in August 2020. I am also in favor of reducing the 2-percent inflation target by at least a full percentage point, which I think is more in line with the academic literature on the optimal rate of inflation. But none of that necessarily implies that below-target inflation is ideal in the current context.

Had the Fed announced in advance that it would symmetrically target inflation at 2.0 percent (or, some lower rate), there would be little cause for concern. But the Fed has not done that. Instead, it has consistently said that it would merely bring inflation back down to 2.0 percent; it would not try to make up for above-target inflation. Consequently, the public has come to expect that the Fed would merely bring inflation back down to 2.0 percent.

Undershooting its target after clearly articulating that it would not do so risks surprising the public and could result in a recession. If people believe the dollars on offer are (or soon will be) worth less than they actually are (or soon will be), they will be less inclined to accept them in exchange. Correspondingly, production may slump and unemployment may rise. That’s undesirable and totally avoidable: the Fed just needs to deliver the inflation it said it would, as people have come to expect.

In March, the median FOMC member projected 2.7 percent inflation this year. If offered an over-under wager, I would not hesitate to take the under. Moreover, I would not be surprised at all to see FOMC members revise down their projections for inflation when they meet again in June. Unless they also revise down their projections for the federal funds rate target path, which seems much less likely, monetary policy will remain tight, and inflation will continue to fall this year. It may very well come in below the Fed’s 2-percent target.

If the public is caught off guard, we may find ourselves in a recession.