The latest data from the Bureau of Labor Statistics confirm that the Federal Reserve has made a lot of progress on inflation. The Consumer Price Index (CPI) grew 2.3 percent over the past year. It has grown at an annualized rate of just 1.6 percent over the past three months. Despite this progress, however, Fed officials voted to hold the federal funds rate target range at 4.25 to 4.5 percent last week.

When will the Fed begin cutting interest rates — and how far will rates fall this year? The short answers are “not soon” and “not much.”

The Fed is currently in a holding pattern, awaiting further clarity on the fallout from President Trump’s trade war. On the one hand, lower inflation readings would seem to warrant a lower interest rate target. Recall that the real (inflation-adjusted) federal funds rate target is equal to the nominal target set by the Fed minus expected inflation.

To the extent that they coincide with lower inflation expectations, lower inflation readings result in a passive tightening of monetary policy as they push the real federal funds rate target up. To prevent policy from tightening further in the face of falling inflation, the Fed must lower its federal funds rate target.

On the other hand, Fed officials are worried that higher tariff rates introduced by the Trump administration might unanchor inflation expectations. Fed Chair Jerome Powell summarized the anticipated effects of higher tariff rates at the post-meeting press conference last week:

If the large increases in tariffs that have been announced are sustained, they’re likely to generate a rise in inflation, a slowdown in economic growth, and an increase in unemployment. The effects on inflation could be short-lived, reflecting a one-time shift in the price level. It is also possible that the inflationary effects could instead be more persistent. Avoiding that outcome will depend on the size of the tariff effects, on how long it takes for them to pass through fully into prices, and ultimately on keeping longer term inflation expectations well-anchored.

Powell made it clear that the Fed’s “obligation is to keep longer term inflation expectations well anchored and to prevent a one-time increase in the price level from becoming an ongoing inflation problem.”

The tariffs are, in effect, an adverse supply shock, similar to the adverse supply shock caused by COVID-19 in 2020. The Fed could not prevent the disease from spreading or rescind stay-at-home orders in 2020. It cannot repair supply chains disrupted by higher tariff rates today. The best it can do is look through the adverse supply shock and keep nominal spending on a stable trajectory. Its failure to do this beginning in 2021 resulted in above-target inflation. The Fed does not want to repeat that mistake.

Here’s the problem: although disinflation warrants reducing the federal funds rate target, that move could be misconstrued as an attempt to offset the decline in economic growth associated with the higher tariff rates. If the public expects the Fed to deliver an expansionary monetary policy in response to the adverse supply shock, inflation expectations will rise and potentially become unanchored. To avoid that, the Fed is holding its federal funds rate target steady for now and assuring the public that it will not attempt to offset a tariff-induced contraction.

How long will the Fed maintain its holding pattern? Prior to last week’s meeting (and Powell’s commentary), markets expected the Fed would likely cut its federal funds rate target in July. On May 6, 2025, the CME Group reported futures markets were pricing in a 77.7 percent chance that the federal funds rate target would be at or below 4.25 percent following the July meeting.

Now, it reports the odds at just 36.8 percent.

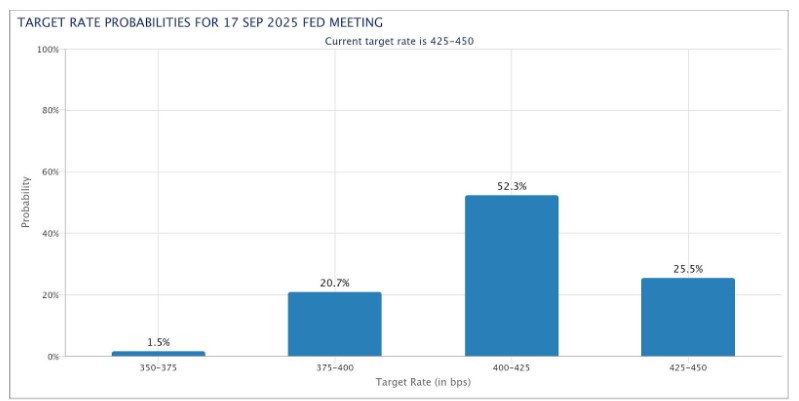

More likely, the Fed will begin cutting interest rates in September. The CME Group now reports 74.5 percent odds that the federal funds rate target will be lower following the September meeting.

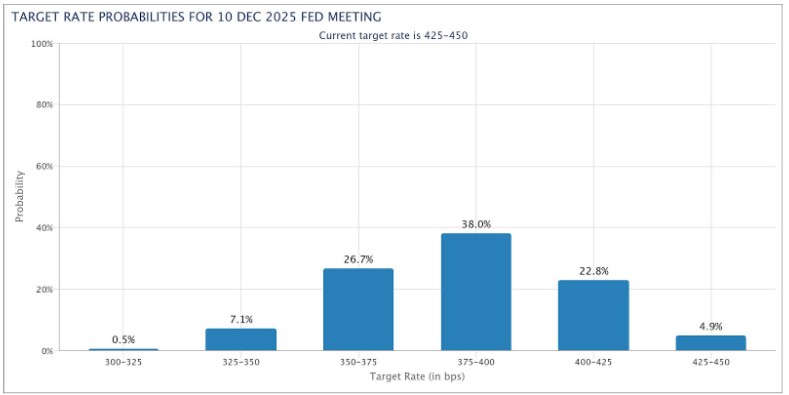

Back in March, the median Federal Open Market Committee member projected that the federal funds rate would fall 50 basis points by the end of this year. That still looks likely.

According to the CME Group, there is currently a 22.8 percent chance that the federal funds rate target is 25 basis points lower following the December meeting; a 38.0 percent chance it is 50 basis points lower; and a 26.7 percent chance it is 75 basis points lower. All told, the futures market is pricing in a 72.3 percent chance the Fed’s target rate is lower by at least 50 basis points by the end of the year. FOMC members will submit revised projections in June.

Ultimately, the Fed’s interest rate decisions will depend on the incoming data — and the clarity those data bring.

“For the time being,” Powell said last week, the Fed is “well positioned to wait for greater clarity before considering any adjustments to our policy stance.”