Africa is poised to take a central role in the global gas industry’s future, according to recent projections from Rystad Energy.

A substantial surge in global liquefied natural gas (LNG) production capacity, anticipated to climb from 486 million tons per annum (Mtpa) last year to 755 Mtpa by 2030, underpins this shift.

The anticipated significant expansion of LNG capacity will be driven by increasing gas demand in areas lacking sufficient domestic production or pipeline access.

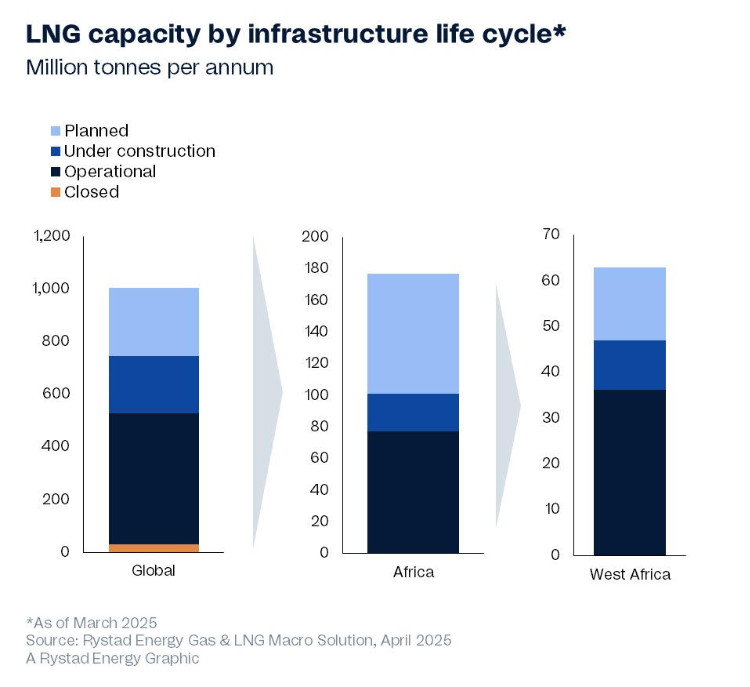

Globally, approximately 477 Mtpa of LNG capacity is in the pipeline, with Africa accounting for about 20% of this total, or around 93 Mtpa.

Nigeria’s dominance and challenges in African LNG

This African portion includes projects that are under construction, have received a final investment decision (FID), or are in the pre-FID stage.

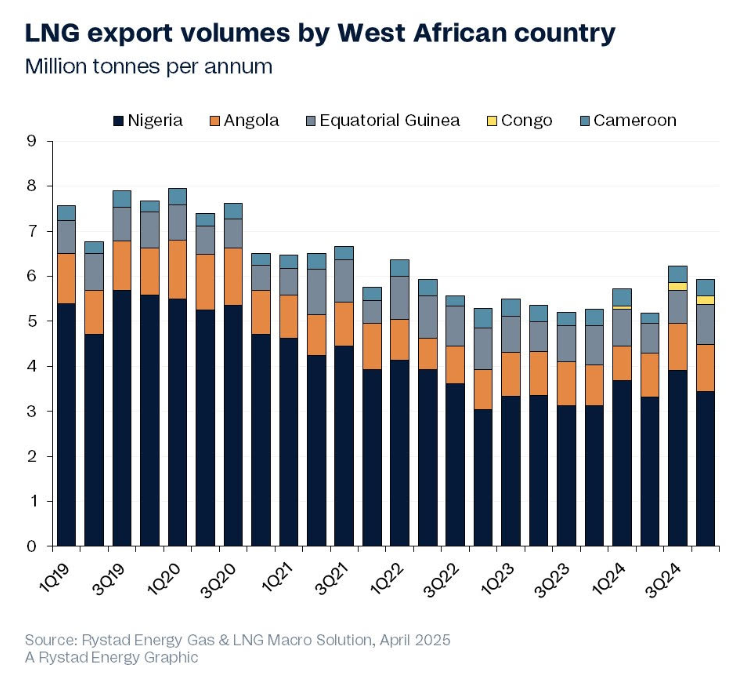

Nigeria spearheads LNG production in Western Africa, contributing almost half of the continent’s total.

Rystad Energy predicts a significant increase in Nigeria’s LNG exports, projecting a rise of 20 million tonnes (Mt) by 2030.

To fully leverage its gas reserves and satisfy both international and local needs, Nigeria might consider alternative strategies like floating LNG (FLNG) and smaller mini-LNG ventures, the energy intelligence company said.

Nigeria’s LNG liquefaction rates have significantly declined from a 90% average in 2018 to 60% last year due to production problems and vandalism, despite increasing global demand.

This substantial drop in output highlights the severity of the disruptions and underscores the urgent requirement for measures to leverage Nigeria’s competitive advantage.

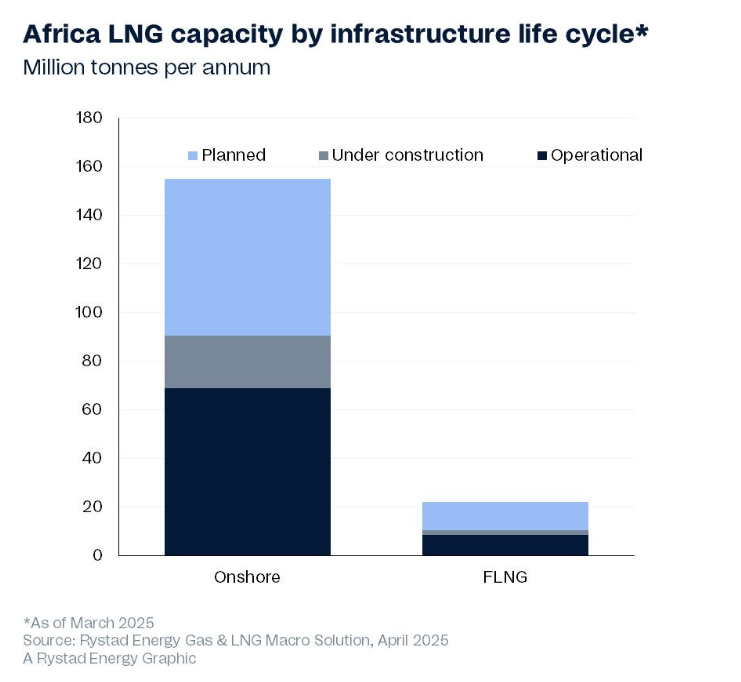

Africa is home to the highest concentration of FLNG infrastructure in the world, underscoring its growing importance in the global gas market.

West Africa’s growing LNG aspirations

The continent currently possesses about 14% of the world’s onshore LNG production capacity, which translates to roughly 70 Mtpa.

Producing over half of Sub-Saharan Africa’s LNG last year, West Africa is the region’s leading producer and aims for a 50% production increase by 2030.

Nigeria is central to this expansion, generating almost two-thirds of West Africa’s LNG production and more than a third of the entire continent’s.

This solidifies its crucial position in Africa’s global LNG aspirations.

Antonia Syn, commodity markets analyst at Rystad Energy, said in an emailed commentary:

Nigeria has consistently ranked among the top LNG producers globally, despite export volumes being much smaller than those of the US, Australia and Qatar.

Located outside the US tariff conflict, Nigeria LNG provides key flexibility for Asian and European purchasers.

Advantage over US LNG

Its strategic position and reduced shipping durations offer an advantage over US LNG exports, according to Syn.

However, Nigeria’s potential to benefit fully from its resources remains hampered by persistent issues of pipeline vandalism and oil theft.

Syn added:

While we expect Nigeria’s LNG exports to recover, they are unlikely to place the country among the top five global exporters in the near future.

Nigeria’s falling LNG output has been a key factor in the recent decrease in West African LNG exports, according to analysis from Rystad Energy.

Despite this, over 60% of Africa’s LNG exports, totaling 22.7 million tons, originated from the region last year.

Onshore projects in Nigeria and Gabon, along with various floating LNG (FLNG) ventures anticipated to commence within the next ten years, are projected to elevate the region’s capacity to 50.6 Mtpa by 2035, Rystad said.

Offshore potential

Approximately 65% of West Africa’s gas reserves are located offshore, with the remaining 35% situated onshore.

The onshore gas sector is more advanced, with over two-thirds currently producing or under development.

In contrast, approximately two-thirds of the offshore gas reserves, totaling around 16 billion barrels of oil equivalent, are yet to be developed.

“These resources are ideal for FLNG technology, being less dependent on vulnerable pipeline infrastructure,” the agency said.

West Africa currently possesses roughly 20% of the global FLNG capacity.

There is a possibility for this share to increase through the development of more gas resources intended for LNG export.

The post Africa to drive 20% of global LNG growth by 2030, Rystad says appeared first on Invezz