President Trump is not happy with Federal Reserve Chair Jerome Powell. With the economy likely to slow under the weight of the administration’s tariffs and corresponding uncertainty, the president thinks the Fed should be cutting rates preemptively. Powell, in contrast, prefers a wait-and-see approach, at least partially out of fear that inflation will resurge if the Fed cuts rates too soon.

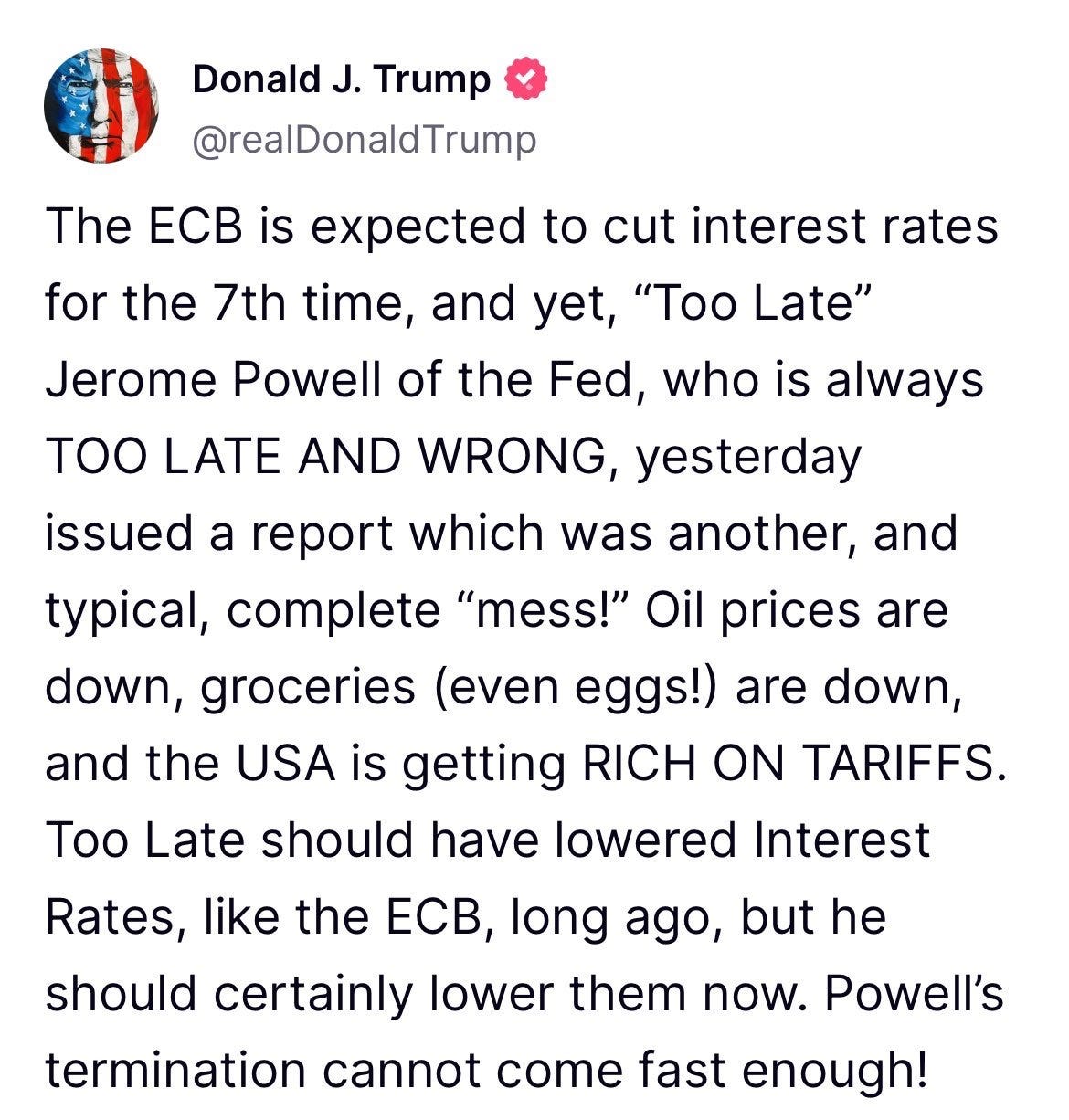

In a Truth Social post last week, the president wrote that “Powell’s termination cannot come fast enough!”

Figure 1. Trump blasts Powell on Truth Social, April 17, 2025

Powell’s four-year term as chair will end on May 15, 2026. Even then, he could stay on the Board as a governor until January 31, 2028. President Trump had considered getting rid of Powell even sooner, but then more recently said he had ‘no intention’ of firing the chair.

The Federal Reserve Act permits the president to remove a governor “for cause.” (Powell would not be able to continue to serve as chair if he were removed as a governor.) It is widely accepted, however, that cause does not include mere policy disputes. That is certainly Powell’s view. When asked whether the president has the power to fire or demote the Fed chair back in November, Powell said it was “Not permitted under the law.” Just last week, he said the Fed’s “independence is a matter of law.”

President Trump disagrees. “If I want him out, he’ll be out of there real fast, believe me,” he said last week.

Earlier this year, then-Vice Chair for Supervision Michael Barr opted to step down before President Trump could attempt to fire or demote him, which seemed likely. Barr did not believe the president had the authority to do so, but did not “want to spend the next couple of years fighting about that” in court and thought “it would be a serious distraction from” the Fed’s “ability to serve our mission.”

Whether intentional or not, Barr’s decision has almost certainly improved the odds that Powell will serve out his term as chair. Since Barr was very unpopular among Republican lawmakers, President Trump would not have experienced much opposition from the home team for firing or demoting him. And, if Barr had fought the decision in court and lost, Trump could point to the precedent when dealing with Powell. By stepping down, Barr prevented such a precedent from being established.

Unlike Barr, Powell is very popular among Republican lawmakers. That puts the president in a much more difficult position. If he moves to fire or demote Powell, he will face opposition from some Republican lawmakers — and, since the decision might be overturned by the Courts anyway, it could be all cost and no benefit for the president.

When asked on Tuesday, President Trump said he has “no intention of firing” Powell. When reminded that, just a few days prior, National Economic Council Director Kevin Hassett indicated the president and people in the White House were studying the issue, President Trump denied that he had any plans to oust Powell. “None whatsoever. Never did,” the president said.

The press runs away with things. No, I have no intention of firing him. I would like to see him be a little more active in terms of his idea to lower interest rates. This is a perfect time to lower interest rates. If he doesn’t, is it the end? No, it’s not. But it would be good timing. It could have taken place earlier. But, no, I have no intention to fire him.

That would seem to put an end to the question.

If President Trump does not intend to fire Powell, how will he respond in the likely event that the Fed continues to delay cutting its federal funds rate target? (The CME Group currently puts the odds of a May rate cut at just 8.3 percent.)

Last year, now-Treasury Secretary Scott Bessent suggested Trump could appoint a “shadow Fed chair” prior to the end of Powell’s term. The shadow Fed chair would initially be appointed as a governor, with a credible commitment from the president that he or she would be elevated to chair once Powell’s term ends. The shadow Fed chair could then make speeches indicating how he or she would conduct policy in the future, which would move expectations — and markets — today.

There are at least three problems with Bessent’s suggestion, however. First, the Federal Open Market Committee conducts policy by majority vote. The Fed chair usually has an outsized voice in the process, but there is no guarantee that the remaining members of the FOMC would go along with the president’s new appointment when the time comes. The most recent Summary of Economic Projections and statements from FOMC members suggest there is broad support for Powell’s wait-and-see approach. If other FOMC members were to publicly oppose the future chair’s stated policy path, it would hamper his or her ability to move expectations as shadow chair.

Second, the president can only appoint a governor when a position becomes available. Barring a resignation or firing, the next opening will come in January 2026 when the balance of Adriana Kugler’s partial term ends. (Although she would then be eligible for reappointment, it is difficult to imagine President Trump extending the term of his predecessor’s pick.) Hence, a shadow chair would be left waiting in the wings until January — making any statements before then less credible than they would be if he or she were already on the Board.

Third, the shadow chair scheme risks significantly narrowing the pool of potential applicants. The power and independence of the Fed is part of the position’s appeal. I suspect few of those qualified and interested in the top spot would remain interested if they thought the shenanigans surrounding their appointment would significantly weaken the institution. The Wall Street Journal reports that Kevin Warsh, who is widely believed to be a frontrunner for the position, “has advised against firing Powell and has argued that he should let the Fed chair complete his term without interference.” If a chair-in-waiting were to appear complicit in a scheme to undermine the power and independence of the Fed, it would not merely damage the reputation of the Fed. It would damage the reputation of the chair-in-waiting, as well.

Given the constraints, it is easy to understand why President Trump now says he will not fire the Fed chair and, indeed, never intended to do so. As for appointing a shadow Fed chair, that seems unlikely, too. Most likely, the president will reluctantly let Powell serve out his term as chair while continuing to badger and berate him from the bully pulpit. Whether pressure from the president will be effective, ineffective, or counter-effective remains to be seen.