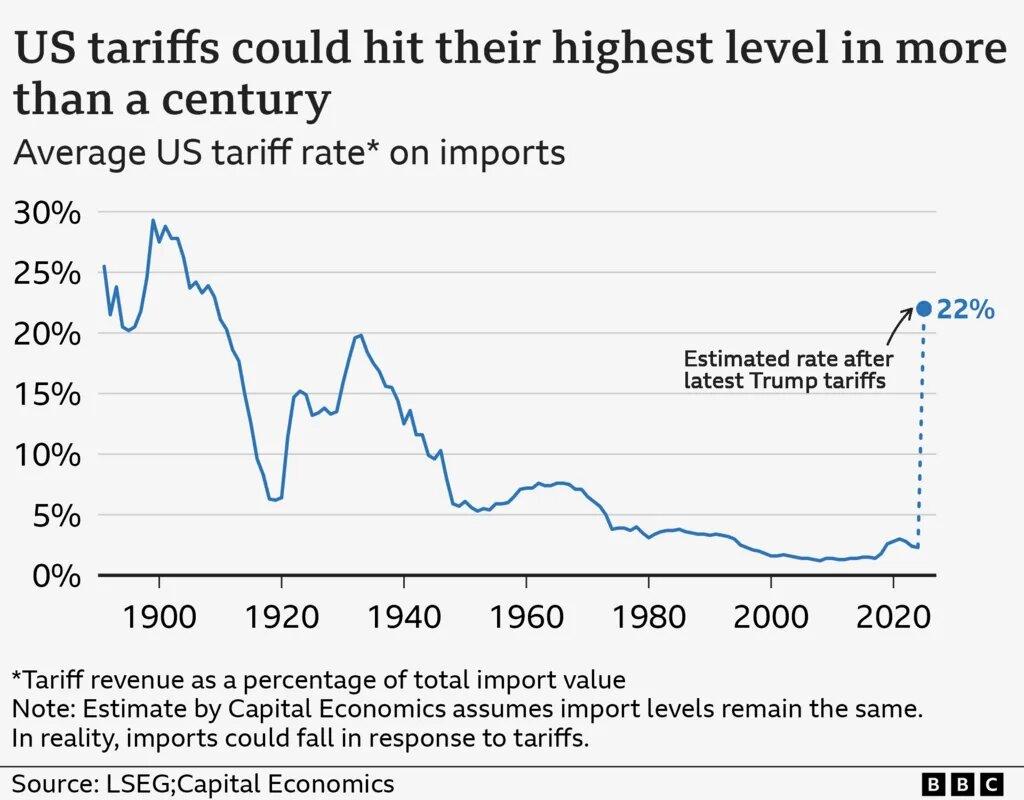

On April 2, President Donald Trump made a sweeping declaration that could reshape the global economic landscape for years. Deemed “Liberation Day,” his announcement of reciprocal tariffs on nearly every major trading partner marked the most dramatic shift in American trade policy levels not seen in a century since the infamous Smoot-Hawley Tariff Act of the 1930s, which triggered a global trade war and worsened the Great Depression.

Trump’s protectionist agenda includes a blanket 10-percent tariff on all imported goods, with some rates climbing to 49 percent for select countries — and a staggering 145 percent on Chinese imports. In response, China imposed a 125 percent tariff on US goods, setting the stage for a full-scale trade war. Trump claims the goal is to reduce trade deficits and revive domestic manufacturing. But the risks are severe: rising consumer prices, retaliatory tariffs, and the looming threat of a global economic slowdown.

Markets reacted sharply. The S&P 500 shed a staggering $2.4 trillion in market value, marking its worst single-day plunge since the onset of the COVID-19 pandemic in March 2020. This is not just market volatility; it’s a warning sign of the broader economic fallout that protectionism can trigger. In the wake of the financial chaos, the White House softened its stance, scaling back the harsher tariffs to a uniform 10 percent for 90 days — excluding China — to buy time for negotiations.

Now, Trump faces a serious legal reckoning. On Monday, the nonpartisan Liberty Justice Center filed a lawsuit in the US Court of International Trade, arguing that the president overstepped his constitutional authority by unilaterally imposing tariffs meant for national security emergencies and that the sweeping measures — based on what the suit calls “dubious calculations of foreign trade barriers” — are inflicting serious harm on small American businesses.

Unchecked Presidential Power: Can Congress Rein in the President’s Tariff Powers?

President Donald Trump’s trade policies have sparked a growing backlash, not only from his usual political opponents but also from within his own party. In a rare instance of bipartisan defiance, a group of Senate Republicans voted 51-48 to block Trump’s tariffs on Canadian imports, signaling a shift in the political climate regarding his aggressive trade agenda. While limited, that Republican rebellion highlights concern over the president’s protectionist policies and their economic fallout.

What’s at stake isn’t just bad policy. It’s constitutional overreach.

The Constitution gives Congress — not the president — the power to impose tariffs. Article I, Section 8 clearly states that lawmakers have the authority “to lay and collect Taxes, Duties, Imposts and Excises.” For much of American history, this was a core congressional prerogative. But over the past century — especially after the economic catastrophe of the 1930 Smoot-Hawley Tariff Act — Congress began steadily ceding this power to the executive branch, hoping presidents would take a broader, less protectionist view. For decades, that arrangement held. But this uneasy balance shifted sharply with Trump’s election in 2016.

According to the Congressional Research Service, six major statutes currently allow the president to impose tariffs — often unilaterally and without prior investigation. The main ones are the International Emergency Economic Powers Act (IEEPA) and Section 232 of the Trade Expansion Act of 1962. These provisions grant sweeping authority to impose tariffs under the pretext of national security or economic emergencies, with little transparency and almost no accountability.

In an historic first, Trump invoked the IEEPA in 2025 to declare a national emergency and levy punitive tariffs on Canada, Mexico, and China — measures Congress has not sanctioned and cannot easily undo. The emergency can only be ended by the president himself or through a joint resolution of Congress.

Congress has tried to push back, but with little success. Speaker Mike Johnson has blocked House votes to end the emergency declarations that underpin Trump’s tariffs on Canada. Bills to restore congressional oversight have stalled. Any serious effort would likely face a Trump veto, leaving lawmakers paralyzed and the executive unchecked.

This stalemate points to a broader constitutional crisis: the steady erosion of congressional authority in favor of unchecked presidential power. What began as a practical delegation to simplify trade negotiations has become a blank check for protectionism. And the fallout isn’t just legal — it’s economic.

Tariffs imposed without oversight drive up prices on everything from electronics to clothing, burdening American consumers and businesses. They rattle investors, disrupt global supply chains, and strain ties with key allies already on edge.

Congress Must Reclaim Its Constitutional Authority Over Trade

If Congress continues to cede ground on trade policy, it risks cementing a dangerous precedent. Allowing the president to wield emergency powers for economic purposes undermines the separation of powers that the Constitution was designed to protect. Left unchecked, any future president could bypass Congress and unilaterally impose tariffs, centralizing trade control in the executive branch. The consequences extend beyond domestic governance: trade wars, diplomatic rifts, and instability in global markets become far more likely. The longer Congress remains passive, the harder it will be to undo the damage.

To prevent further damage to the constitutional framework and restore balance between the branches of government, Congress must act to reclaim its authority over trade policy. Bills like those introduced by Senator Rand Paul seek to limit the president’s ability to impose tariffs without Congressional approval. Although enacting such reforms will be challenging, particularly in the current hyper-partisan environment, they are essential to safeguarding the US economy and maintaining the separation of powers.

To preserve the integrity of US democracy and trade policy, Congress must reassert its constitutional role before the damage becomes irreversible. Unless those laws change — or enough Republicans are willing to break publicly with Trump — the president’s protectionist agenda will remain effectively immune from challenge.

The time to act is now — before the growing, unchecked power of the executive branch leads the nation down an even more precarious path.