When asked why Donald Trump won the presidency last November, most people point to inflation. That’s understandable. Prices soared under the Biden administration. In the run up to the election, voters cited inflation as a top concern — and most thought Trump would do a better job bringing inflation back down. “Nothing did more to deliver the White House to Donald Trump than inflation,” Greg Ip recently wrote in The Wall Street Journal.

It looks like an open and shut case. But I am not convinced. High inflation was salient. However, voters continued to cite high inflation even after their wages caught up and inflation declined. I suspect voters were actually disappointed in the slow real wage growth they experienced under the Biden administration. This slower real wage growth was not entirely attributable to higher inflation: real wages continued to grow more slowly than they had in the pre-pandemic period even after inflation began to fall and workers renegotiated their wages to account for the excess inflation.

To make my case, let me start by taking on what I believe is the best evidence against my position: people say they voted for Trump because of high inflation. Why not take them at their word?

People often point to the most salient factor when they are disappointed, even when that factor is not the primary reason for their disappointment. For example, my wife might complain when I forget to take the trash out to the curb for pick up. How bothered could she possibly be about that? (The garbage truck comes twice per week and our garbage can is almost never full.) More likely, she is upset about my general inattentiveness when it comes to such tasks. She is using this specific — and highly salient — failure to remind me that I should care more about the small things that affect her. But she does not say that. Instead, she says: I can’t believe you forgot to take out the trash again!

Similarly, people might point to high inflation when they are really bothered by slower real wage growth. They recognize that goods and services are harder to afford than they expected they would be at this point. But they do not say that. Instead, they say: Inflation is too high!

I do not mean to overstate the point. Certainly, inflation was too high. And, since the high inflation was unanticipated, it initially reduced real wages. But that effect was temporary. Workers eventually renegotiated their wages. By February 2023, the average real wage was higher than it had been in January 2020, just prior to the pandemic.

Why, then, were people still upset? There are at least two reasons. First, workers did not generally receive additional compensation to make up for the reduced real wages they had experienced. Inflation temporarily reduced real wages, but it permanently reduced their wealth.

Second, although real wages eventually caught up to their pre-pandemic level, they have not caught up to the level one would have expected to prevail given the pre-pandemic growth in real wages. Instead, real wages appear to be on a lower growth path.

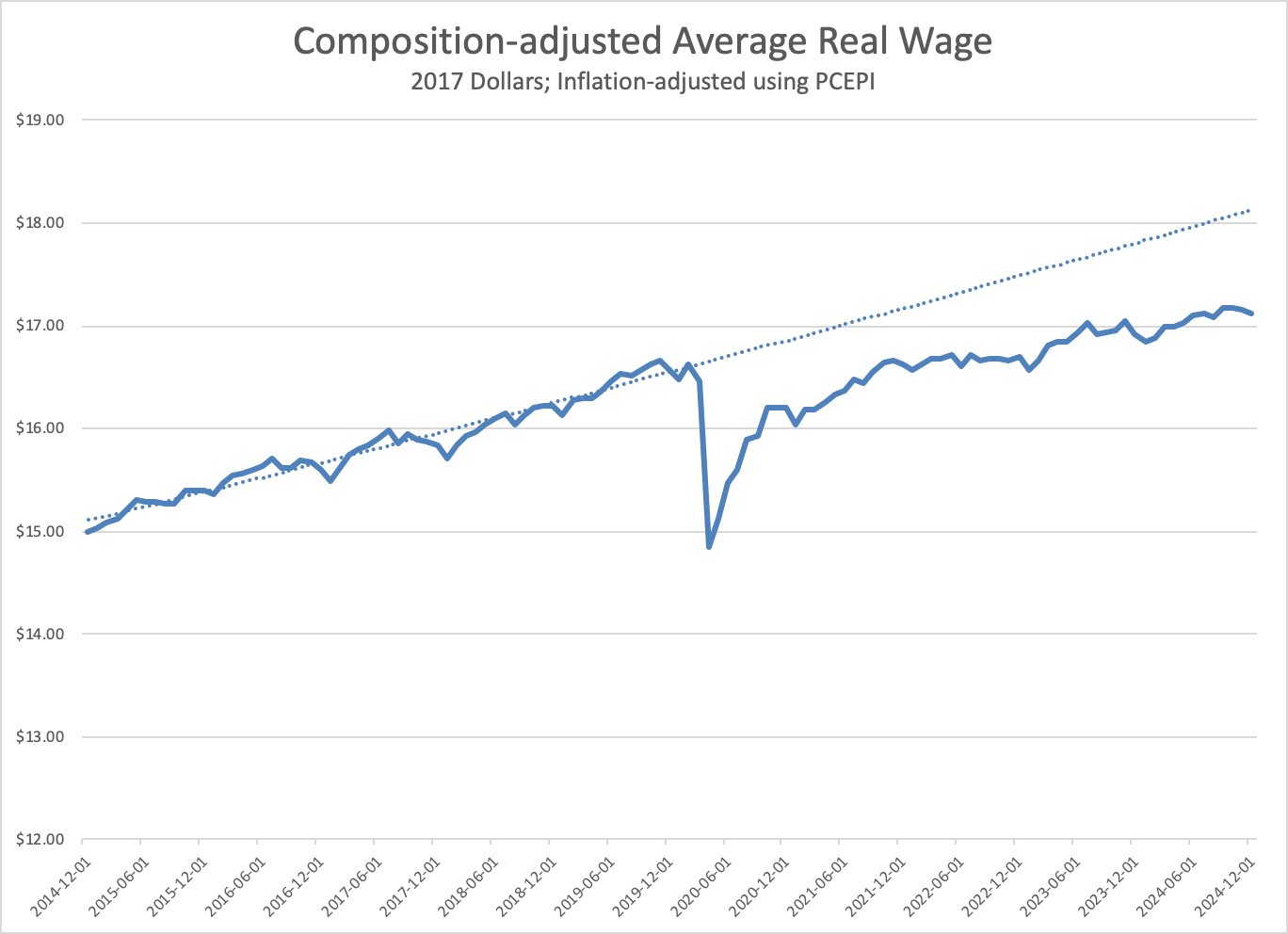

Consider the composition-adjusted average real wage series presented in Figure 1. As I have explained at greater length before, this series adjusts nominal wages for inflation and also accounts for the changing composition of employment over time. Whereas the conventional average hourly earnings measure drops those who move from employment to unemployment and then includes them again when they move from unemployment to employment, my composition-adjusted real wage preserves the sample over time by assuming those not working earn a wage of $0. For this reason, my alternative measure more closely resembles the microdata.

Figure 1. Composition-adjusted Average Real Wage, December 2014 – December 2024

From December 2014 to December 2019, just prior to the pandemic, the composition-adjusted average real wage grew at a continuously-compounded annualized rate of 2.0 percent. Since then, it has grown much slower, at just 0.7 percent per year. Of course, the slow growth in the latter period is partly due to the pandemic in 2020 and inflationary surprise in 2021. But, as noted above and observable in Figure 1, real wages had caught up to their pre-pandemic level by February 2023. From February 2023 to December 2024, the composition-adjusted average real wage grew at a continuously-compounded annualized rate of just 1.5 percent. In other words, the level of real wages had not returned to the pre-pandemic growth path. Indeed, since real wages have been growing more slowly than they did in the pre-pandemic period, the gap between the level of real wages and the pre-pandemic growth path has increased since February 2023.

Is the more recent slow real wage growth due to inflation? No. Standard economic theory maintains that inflation only lowers real wages to the extent that it is unexpected — and, even then, only until real wages adjust. Inflation remains a bit above the Fed’s 2-percent target. But that’s no longer a surprise. People were initially fooled, but they have come to expect above-target inflation (at least for the near term) and renegotiated their wages with those expectations in mind. If that were not the case, and there was still scope for further renegotiations to make up for high inflation, we would expect to see real wages rising faster than they did in the pre-pandemic period as they catch up to where they would have been in the absence of the unexpected inflation. That’s not what we see. Instead, real wages appear to have converged on a lower, slower growth path.

With this in mind, it is not difficult to understand why people might say groceries are too expensive, clothes cost too much, or takeout is much pricier than it used to be — even though higher real wages have made those things easier to afford. The typical worker is better off today than they were prior to the pandemic. But they are not as well off as they expected to be. That’s disappointing.

It is also understandable that they would see President Trump as a potential solution to this problem. During his first term, the economy soared. And real wages soared along with it.

Voters may not understand how anti-growth policies hindered production and real wages under the Biden administration. But they experienced it. And they recognized that their real wages had grown faster under the prior Trump administration.

They cast their votes. Let’s hope he delivers.