The Consumer Financial Protection Bureau (CFPB) has undergone massive changes in the past month. Contrary to what many members of Congress and bureaucrats are saying, it’s great news. Reining in the CFPB means reducing uncertainty in the financial world from excessive regulation and costly regulatory agencies’ bloated budgets.

Unfortunately, the measures have been stalled in court. Reducing the CFPB’s size and scope would greatly reduce a large amount of uncertainty in financial markets that stem from regulation.

The CFPB: An Appetite for Power

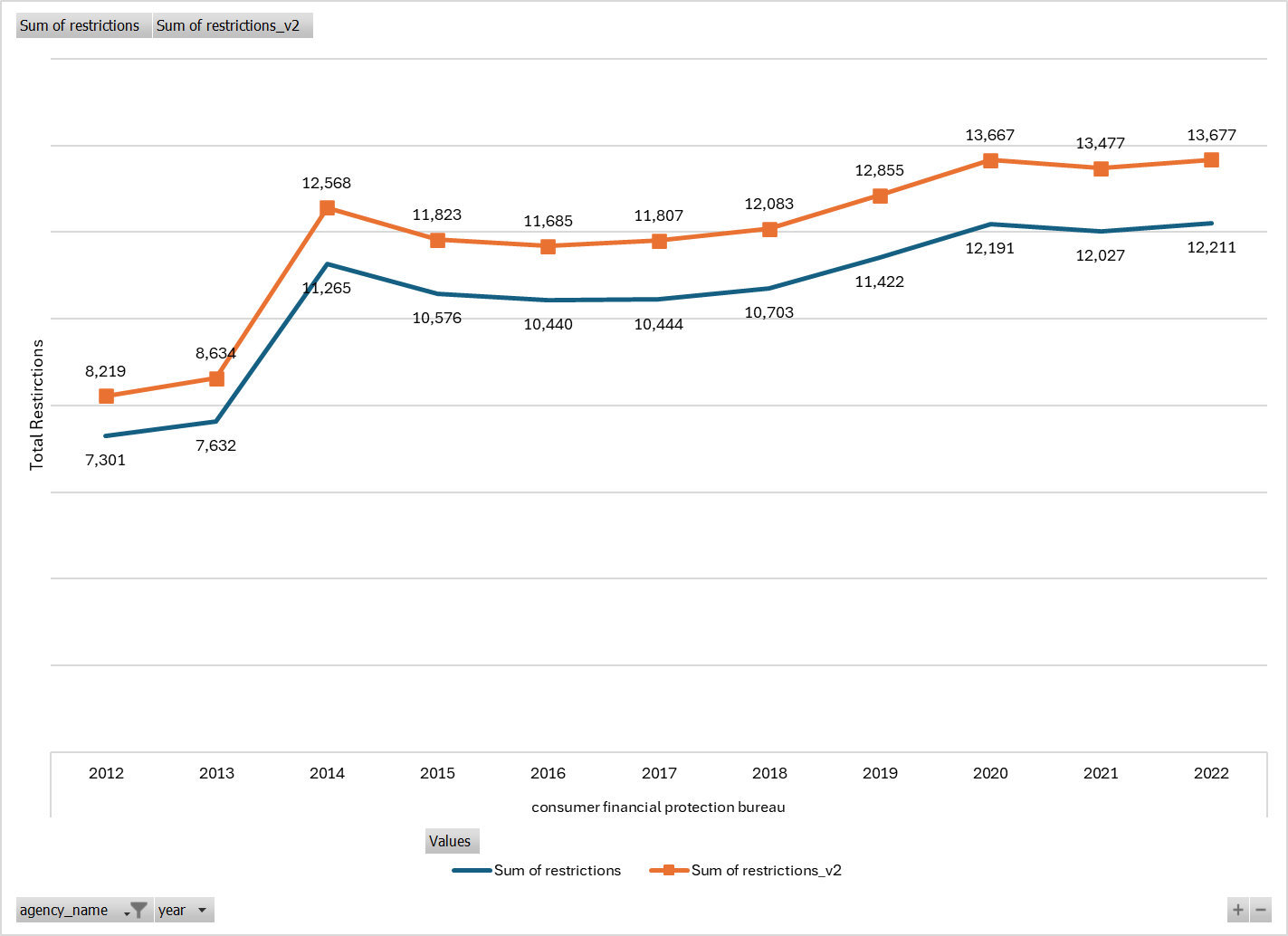

Since the CFPB began operating in July 2011, it has been eager to intervene in financial markets. QuantGov, which measures restrictions across federal agencies and industries, estimates that between 2012 and 2022 the CFPB increased its restrictions anywhere between 491-545 restrictions per year. The restrictions per year are shown in Figure 1.

Figure 1: Cumulative Restrictions for the CFPB

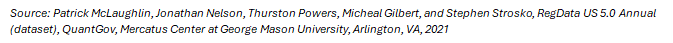

The CFPB’s own website also boasts active enforcement. Figures 2 and 3 highlight the CFPB’s enforcement actions since 2012.

Figure 2: CFPB Enforcement Actions by Year

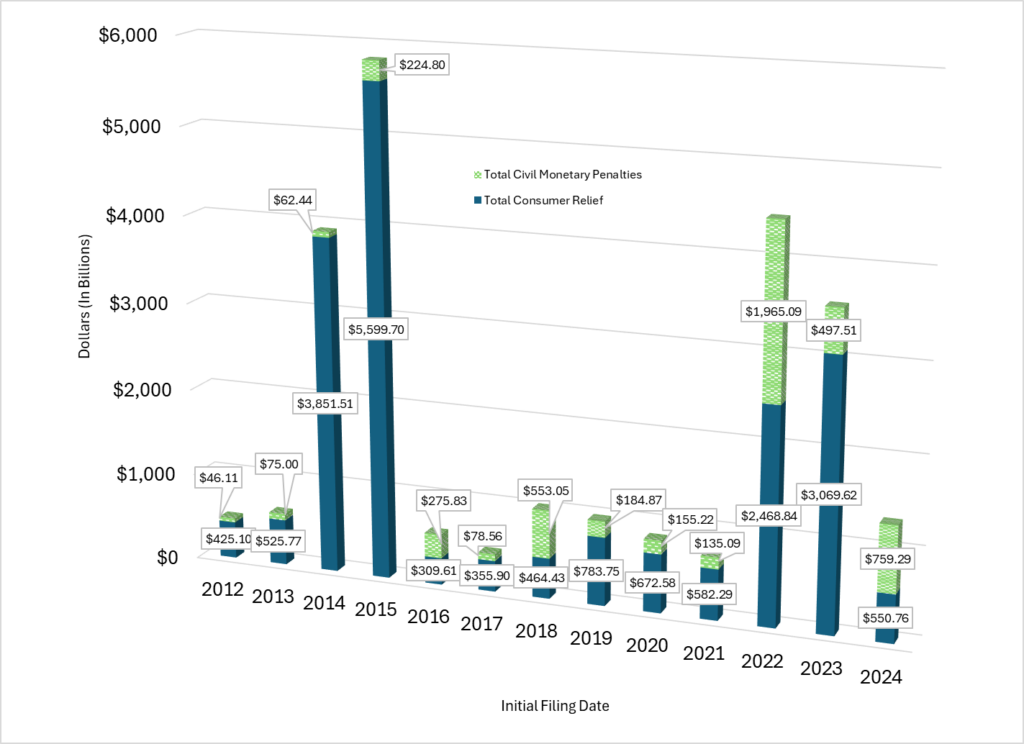

While those numbers may appear modest, the CFPB has managed to get enforcement targets to shell out billions of dollars. These payouts come in the form of “consumer relief,” which is compensation paid directly to consumers and “civil penalties,” which are fines that the government issues for legal violations. These payments are shown in Figure 3.

Figure 3: CFPB Penalties Issued by Type and Year

While that data may appear as government fighting for the everyman, the results of regulation and enforcement tell a different story.

The CFPB has a long history of abuse of power. Hester Peirce (appointed SEC Commissioner in 2018) noted in 2017 that “business as usual” for the CFPB meant limiting consumer options, threatening privacy through its expansive credit card database, as well as finding ways around legal constraints (including basic due process by ignoring statutes of limitation).

The CFPB’s eagerness for intervention means that those in the financial sector must always be looking over their shoulder. The threat of regulation, hanging like the Sword of Damocles over them, leaves providers of financial services hesitant to engage in commerce or work with various groups of Americans lest they come under attack. Furthermore, financial service providers must devote time, talent, and resources toward legal compliance that would have otherwise gone toward expanding financial services and finding ways to offer those services at a lower price. The value of all the forgone opportunities that resulted from the CFPB’s existence is difficult to quantify.

As we outlined in a public comment to the CFPB and in a recent Reason article, the CFPB’s various regulations from payday lenders to mortgage servicing and “junk fees” inevitably result in one outcome: limiting consumer access to credit, especially for the poorest Americans.

Nevertheless, the Bureau now seems adamant about regulating how medical debt is reported on credit reports.

Where the CFPB Stands Now

On January 20, 2025, President Trump issued an Executive Order (EO) freezing all regulations pending a review and approval by the respective agency head. This 60-day freeze halted a Consumer Financial Protection Bureau (CFPB) rule requiring medical debts to be removed from credit reports.

On February 7, 2025, President Trump appointed Russell Vought to head the CFPB (who was also serving as the head of the Office of Management and Budget). Shortly after, Acting Director Vought announced on X that he notified the Federal Reserve that the CFPB will not take unappropriated funding from them. “This spigot, long contributing to CFPB’s unaccountability,” Vought commented, “is now being turned off.” That did not stop the CFPB from sending letters to various state legislatures urging policymakers to pass laws that enacted their desired policy wishes. As in years past, the CFPB sees constraints as obstacles to be circumvented, not rules to be followed.

These actions, however, were halted by a federal judge, while the finalized rule prohibiting medical debt from appearing on credit reports was delayed until June by a different Federal Court.

President Trump has now nominated Jonathan McKernan as Director of the CFPB to replace Vought. It seems McKernan, if confirmed, would continue the work of reining in the agency. A key legal showdown began on March 3, as a federal judge began to hear arguments on whether the CFPB may resume its mandated activities—setting the stage for a pivotal ruling on the agency’s authority, obligations, and perhaps its very future. The trial is ongoing.